Massively Short

If you live in the United States, surely you've been to a Gamestop before.... either for yourself or for your kids...

I have visited and purchased from Gamestop plenty of times in my life. In fact, I actually purchased a Nintendo Switch from Gamestop and really enjoy it as a family friendly console. But I digress...

The problem with Gamestop, is that it's possible they are repeating the patterns of Blockbuster video. Blockbuster had physical videos that were over priced with short rental periods and late fees for not rewinding the tapes. Blockbuster was stuck in the physical product world. Blockbuster failed.

It was a good business model - until Redbox and Netflix streaming came along.

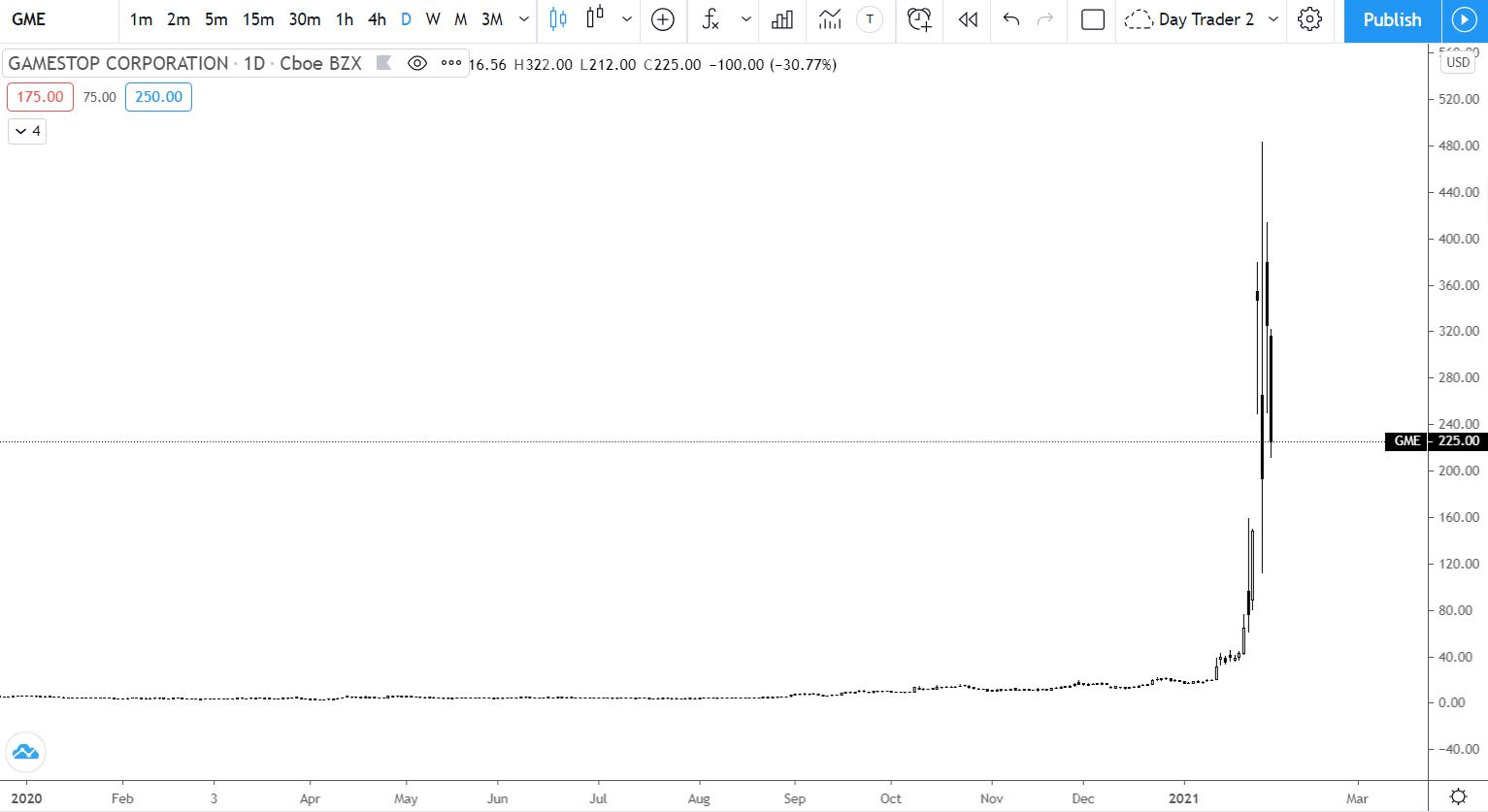

Gamestop being a primarily physical game/console company may be just like Blockbuster in an ever streaming world. Most consoles now allow you to purchase games directly from their marketplaces. Pre-corona virus Gamestop was on a massive decline and rightfully so in a business model that is prehistoric. Hedgefund(s) knew this and shorted the stock heavily. So much so - that the % Shorted (Adj. Float) = 112.3%

They forgot, The Majority Lose

We know that most retail traders lose money. In fact, over 90% of retail fail to succeed in the markets. At SentiFX, we have built our entire trading strategies on trading against the flow of retail traders. Why? Because the majority lose. When retail is positioning heavily to one side - they have to take the opposite side of the trade to exit for profit or loss. Usually a loss!

If either the buyers or the sellers are overweight (imbalanced to one side) then the market tends to move the opposite direction to clear liquidity created by the imbalance. Think - taking stops and putting things back into balance.

Who knew the market was Zen like?

What does this have to do with the tea in China?

Well, retail doesn't always lose. In the case of GME... the mistake of the hedgefund(s) were that they were short to such an extreme that the path to least resistance (and profit) was to push the hedgefunds into closing their short positions (which become buy orders..... which drive up price).

Wait what? Retail taking Hedgefund stops? Yes. You heard that right.

The edge here was in a massive group of retail traders pushing up price to the point where the hedgefunds would have to liquidate their short positions. Thus driving up price even further.

Talk about edge.

You can read more about the first post and due diligence that was done 4 months ago. Some traders saw an opportunity for the short squeeze of the century (check it here) and took positions. By trading the path of least resistance... those traders became millionaires.

When it comes to FX trading, we have tools available to see which side is overloaded so that you can trade against the majority of retail flow and take their stops. This is what the Market Makers do every day.

If you're interested in knowing more, check out some of the tools we have available:

Leave A Comment