Monitor the Sheep

The Most Powerful Sentiment Shifting Analysis Indicator for MT4

SentiFX Relative Sentiment Indicator MT4

Catch the Beginning of Moves

The earliest signs of a move come from retail being overly positioned either long or short and then they begin to shift their positions. The herd then start to follow the other retail traders.

Market Makers take this opportunity to run price the opposite the new herd direction and the retail sheep start piling in on the wrong side of the trade again and again.

Catch the Beginning of Moves

The earliest signs of a move come from retail being overly positioned either long or short and then they begin to shift their positions. The herd then start to follow the other retail traders.

Market Makers take this opportunity to run price the opposite the new herd direction and the retail sheep start piling in on the wrong side of the trade again and again.

Target the Biggest Edge in FX

By targeting changes in Sentiment, you have the highest probability of getting in on a move before the real move begins.

Now that's a leading indicator.

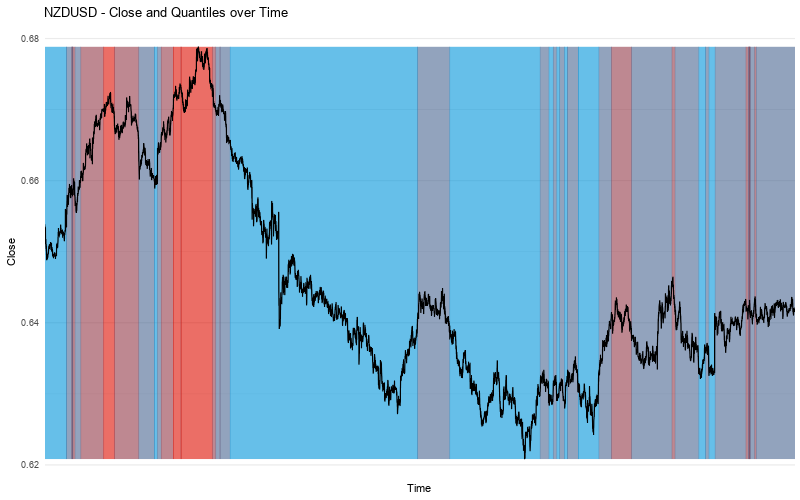

Proven Edge by Quantitative Analysis

We did a deep dive using quantitative analysis to see if Sentiment Trading had edge. The results were in line with what we expected.

The Results? Price moves opposite to the retail herd.

Look at the image to the right - it doesn't take a rocket scientist to see that when retail was Shorting (red background) price moved up and when retail was going Long (blue background) price moved down.

Proven Edge by Quantitative Analysis

We did a deep dive using quantitative analysis to see if Sentiment Trading had edge. The results were in line with what we expected.

The Results? Price moves opposite to the retail herd.

Quantitative Analysis done using the statistical analysis environment R

Look at the image above - it doesn't take a rocket scientist to see that when retail was Shorting (red background) price moved up and when retail was going Long (blue background) price moved down.

Who is Sentiment Trading for?

Traders who believe the Market is Manipulated and want to be on the side of the Market Manipulators.

Traders who know that most retail lose and want to take trades opposite of the retail herd.

Traders who want more confidence taking their trades and holding on longer for bigger profit.

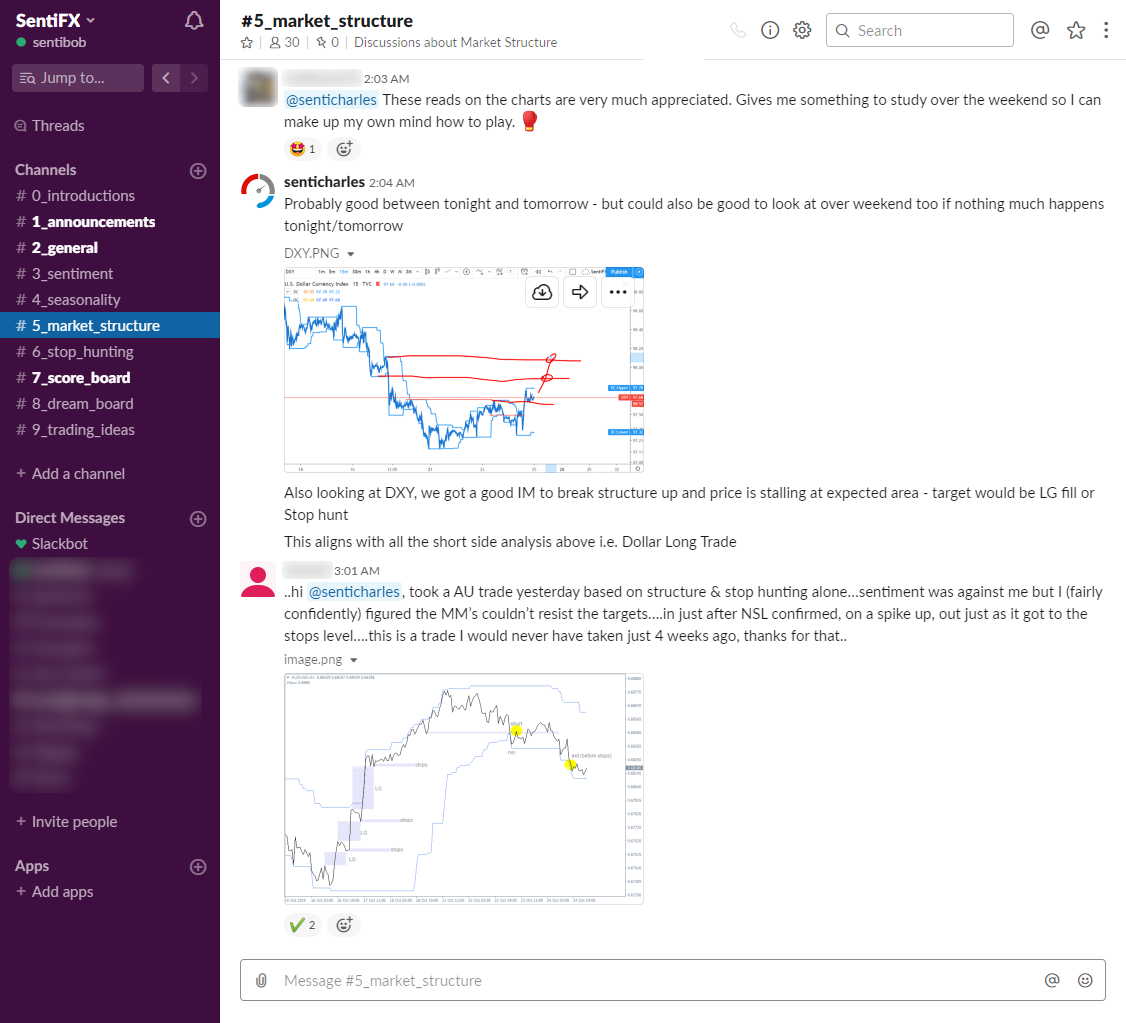

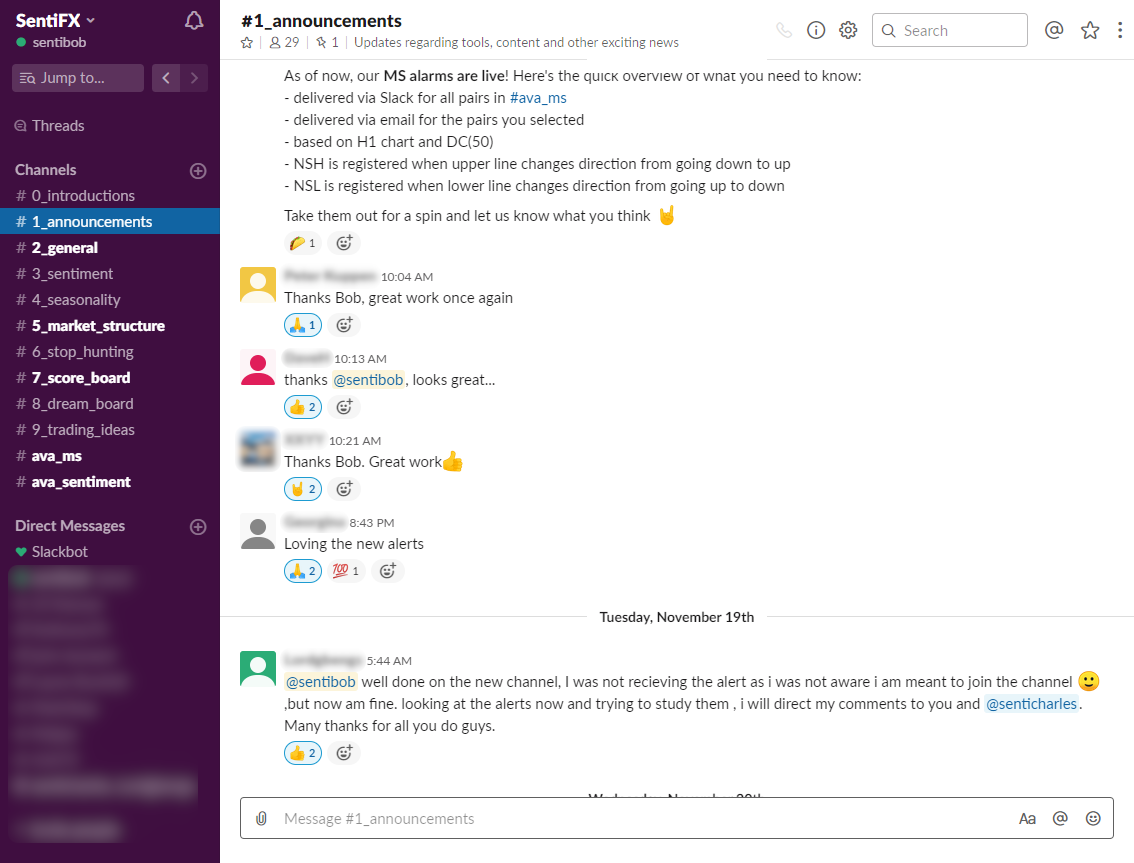

Access a Trading Community

You get more than the Powerful Sentiment Analysis Tools, Indicators, and Education.

You also get access to other Traders who

use the Edge of Sentiment every day on Slack.

Get the Edge You Need

Relative Sentiment MT4 Indicator

Lifetime License

$197 $127

lifetime access - single installment