FOCUS ON CORONA VIRUS

The major headwind in the markets is still the corona virus.

When volatility is this high, a good money management strategy is to lower your position size to account for the added risk.

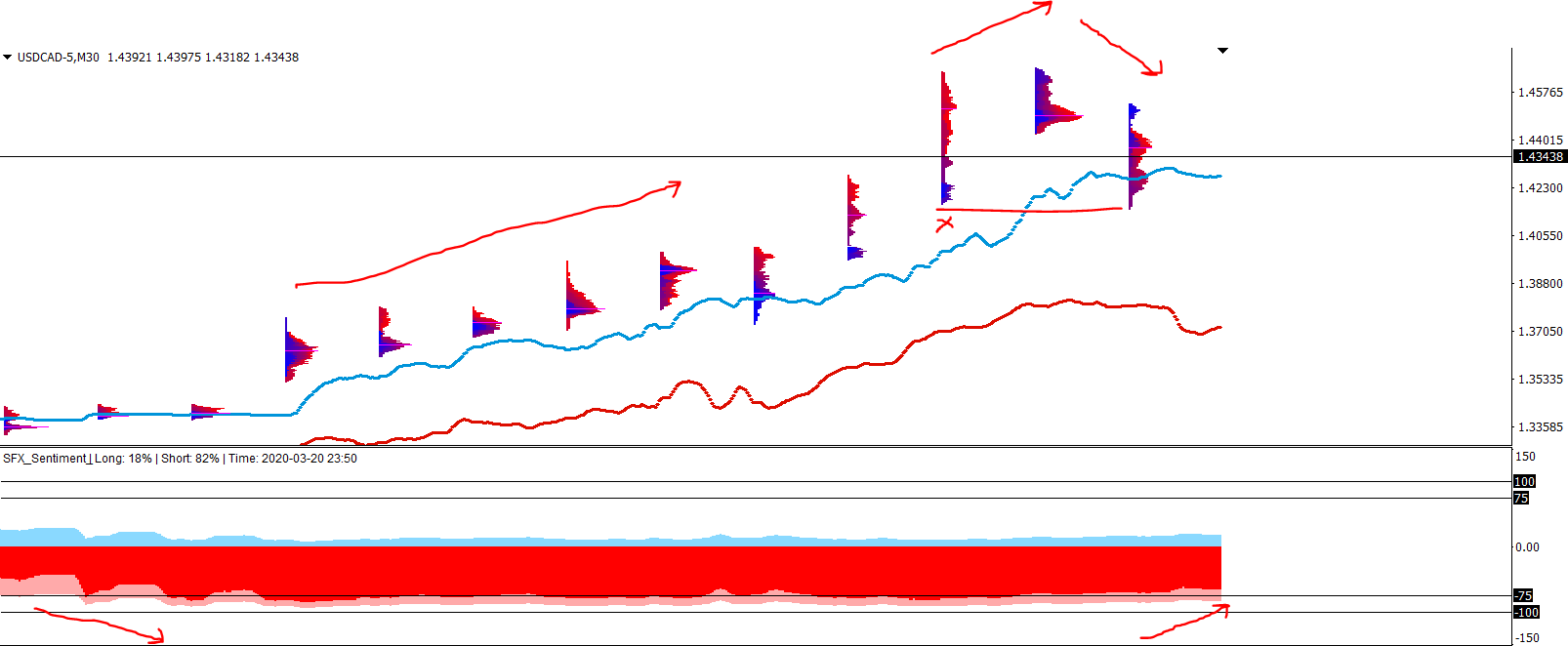

USDCAD

With DXY (US Dollar Index) at near 19 year highs... I couldn't help but get the feeling that the juice may be running out - at least for now.

Take a look at USDCAD above. As retail became more and more short and entered the extreme zone between -75 and -100, look how price continued to move upward. On Friday price started moving downward and appears to have found value lower than on Thursday.

Price took out stops from 2 days prior. Also notice that retail sentiment is shifting (retail is less short than before and appears to be moving upward). Combine this with the market structure shift above and we may have the begging of a nice short move for USDCAD.

Watching the shift in retail positioning and market structure gives us the best possible chance to sell near the tops and buy near the bottoms. In this case, we may bank some pips on a short USDCAD move.

It's important to wait for a signal to get in the trade and monitor DXY.

The target is in the scope. Get ready to strike should the opportunity present itself.

***UPDATE*****

Price action at the open does not confirm this move. See below.

An IMPULSE MOVE (IM) upward suggests that price is aiming to take out stops above.

The Trapped Traders (TT) below are going to be in pain and their stops are above the highs. Price more likely now to continue upward than to follow the original plan.

This is a good example why it's important to be patient in your analysis and trade entries.

DXY

The Dollar is approaching 19 year highs. Notice that price tried to push up again and couldn't break the highs there and hold ( M ) shape. If price trades below the LITS (Line in the Sand) then I would expect to see movement down to the bottom red line there.

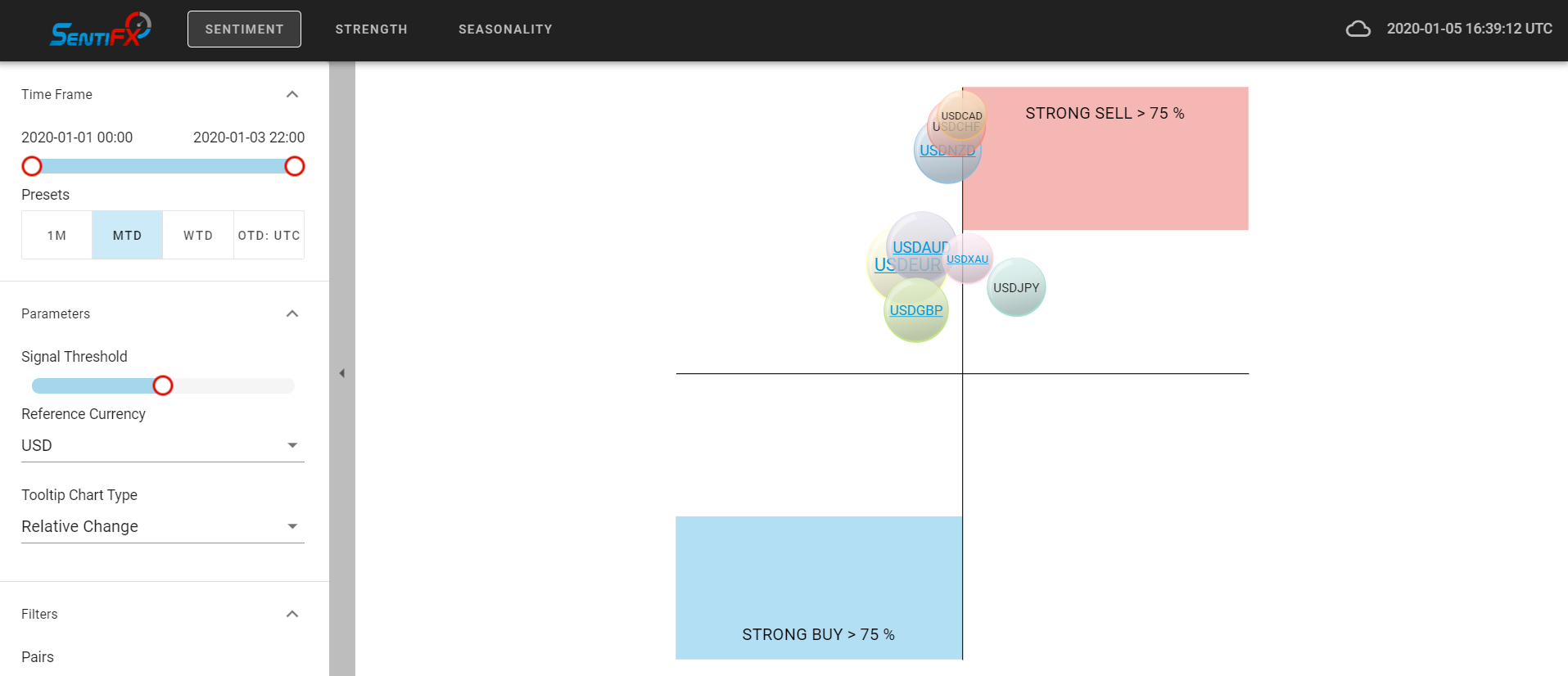

Directional Bias

Retail Sentiment gives us a directional bias for our trades - regardless of your trading style.

We want to trade against retail as we know retail lose over the long term. This is the best way to win more trades and make more profit.

Where to get the Sentiment Edge?

The MT4 Sentiment Indicator and the MT4 Relative Sentiment Indicator provide you with an incredible directional bias that you can use to trade against the retail sheep. Use these week after week to extract money from the Forex market.

The Sentiment Analysis Tool (SAT) combines Sentiment Positioning and Relative Sentiment in an independent platform. The (SAT) also provides the ability to easily perform basket analysis, currency strength analysis, and seasonality analysis to add additional edge to your existing trading style.

Retail Sentiment is the biggest edge in FX. If you aren't using it along with your trading style - you are missing out on having the additional confidence and confirmation to get in the profitable trades and hold them longer.

Trade with Edge, Trade Well -

Charles

Leave A Comment