Hello Traders! After many weeks of daily active trading on my part, I’ve hit a bit of a quiet period in which I’m still getting good trades off, however they aren’t the 2-3 per day I was getting on occasion. This is in part due to the recent spike in vol we have seen on the back of market jitters based on rising global yields. Market conditions just haven’t suited my way of trading. So during this period I was reflecting on what the best thing(s) to do are when you hit these inevitable periods where you cant seem to find ‘that

Hello Traders, Weekend thoughts on this weeks action:Crazy week full of ups and downs…. !! The word on everyone’s lips from seasoned market pros to the novice investor seems to be ‘Yields’ this week. The Bond Markets are playing a game of chicken with the FED at the moment, almost daring them to take action…. be that in the form of negative rates or yield curve control, seeing them start to put their foot on the long end by buying longer duration bonds. A risky proposition either way…. I personally think that they won’t tolerate a big steeping of the curve

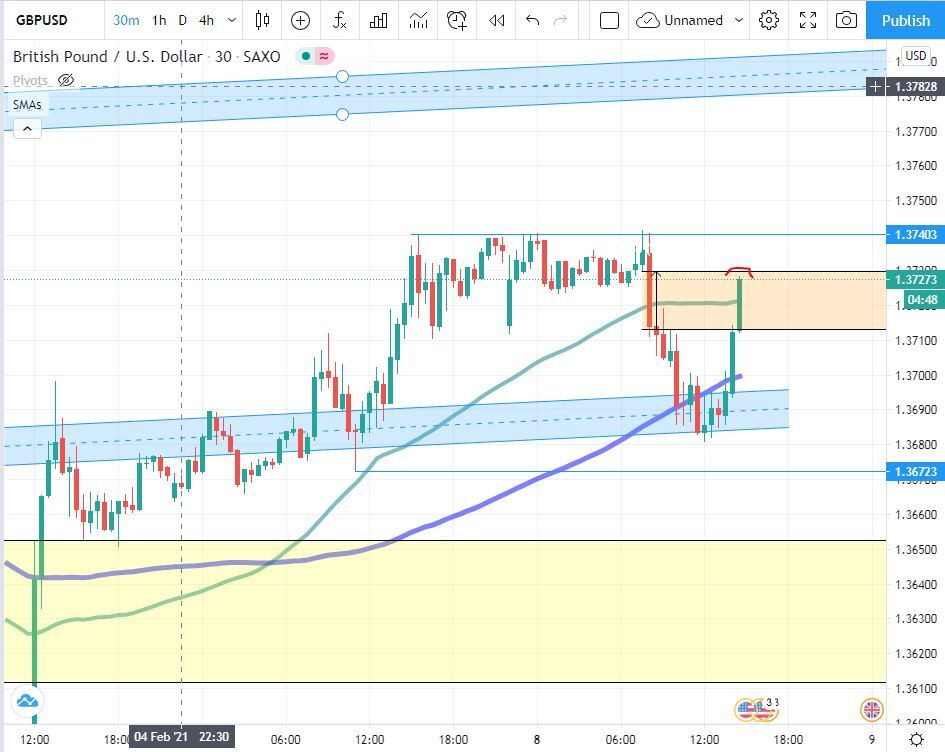

Hello Traders!A great Long trade in GBPUSD to report this week which netted 90 pips! As usual this was shared in the SentiFX chat room under trade ideas – current members check it out, else if you’re not a member, you know what to do.Check out the lifetime membership option.Ok, onto the trade analysis and outcome. On the 17th (per below screenshot) I shared with the SentiFX Slack Chat group a chart giving my long entry conditions for Cable. The trade was based on a horizontal (Liquidity Gap – LG) Zone and trendline/wedge pattern forming on the 1hr chart. Add

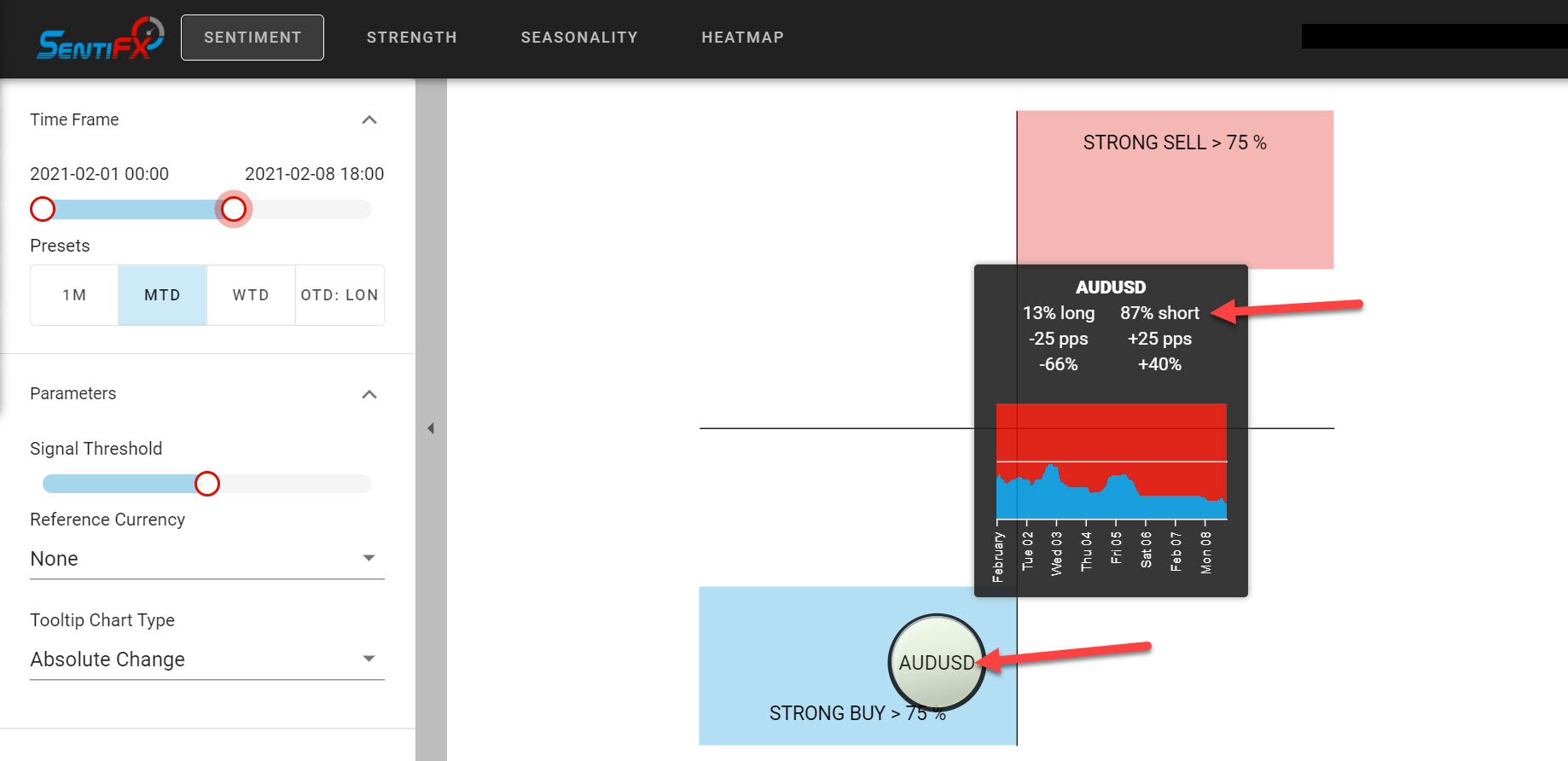

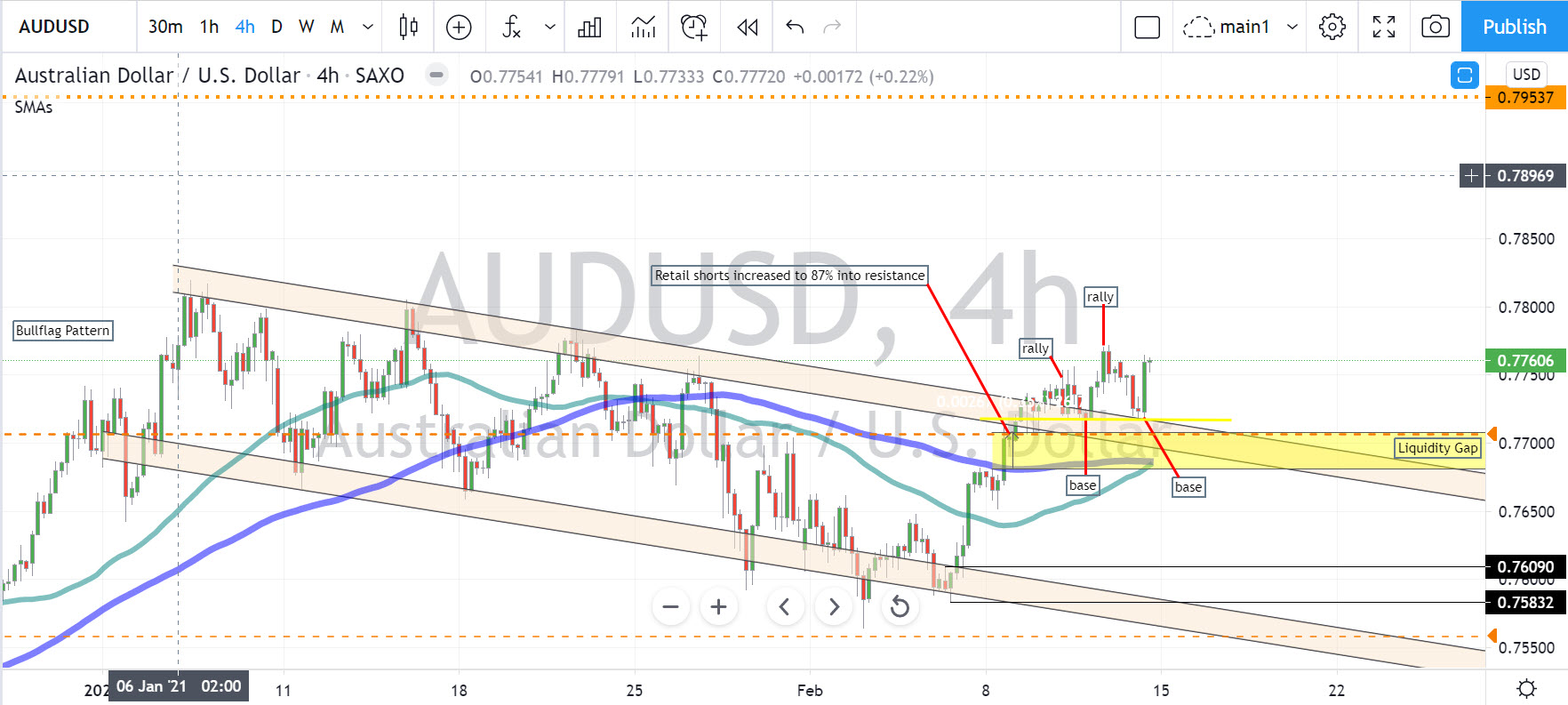

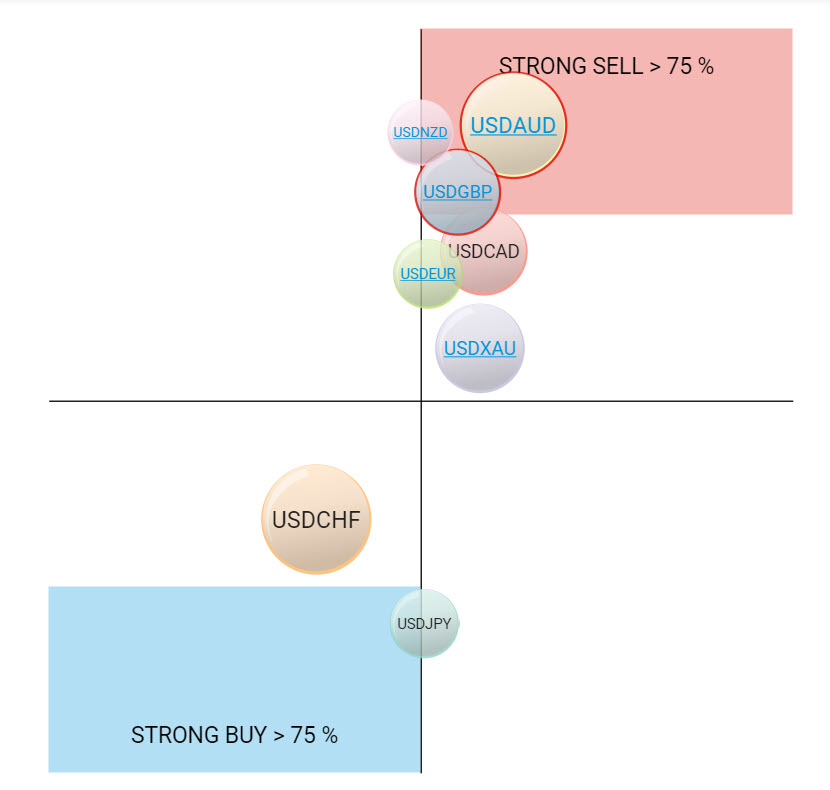

Another pips positive week behind us for those with access to the SentiFX sentiment indicators…. Here are some more examples of successful trades in the past week, taking the other side of retail positions. As always they were communicated to the Sentifx slack chat community forum under ‘Trade Ideas’. Lets start with AUDUSD – per my recent blog on the 7th Feb, I was bullish the pair and had advised buying dips into unfilled Liquidity gaps for an expected upmove, firstly into the upper channel zone of the potential bull flag pattern that had been identified and then trade any breakout in

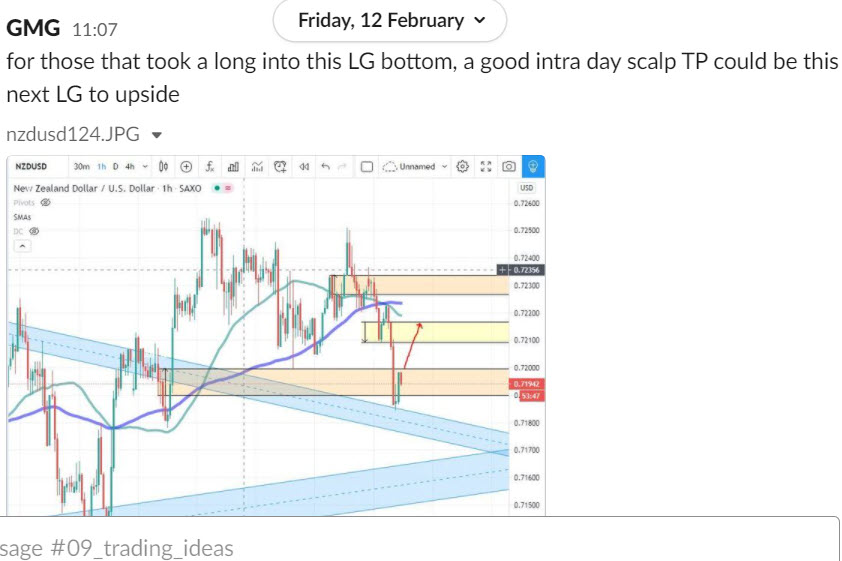

Here is an example of an intra day scalp trade taken on Monday the 8th Feb and which was shared with SentiFX members in the Slack workspace in the Trading ideas section. On the channel you will find daily trade ideas from not only myself but Charles also, who shares his trade setups for members to consider. All setup ideas are conceived and executed with the sentiment data provided by the SentiFX indicators at the heart of the analysis. These indicators are on the website or MT4 for those that prefer that platform. Todays example of how to best utilize the

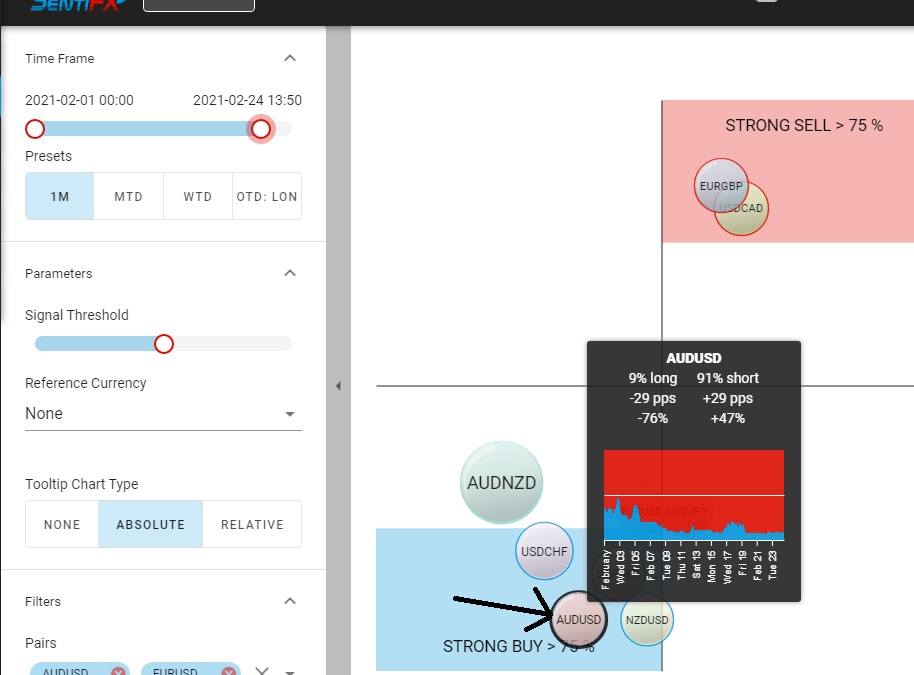

This is my analysis of the AUDUSD pair using SentiFX tools to understand how retail is currently positioned and how we may exploit this positioning to effectively take the other side of the 90%+ losing retail traders and bank some pips in the process. Starting with the Daily Chart you will see that the pair is in a very strong uptrend making consistent higher highs whilst retail have been trapped and adding to shorts for the whole ride up. Note that the 50 and 100 DMA’s are in a very wide bullish formation indicating a persistent trend. Recently the pair has taken