Here is an example of an intra day scalp trade taken on Monday the 8th Feb and which was shared with SentiFX members in the Slack workspace in the Trading ideas section.

On the channel you will find daily trade ideas from not only myself but Charles also, who shares his trade setups for members to consider. All setup ideas are conceived and executed with the sentiment data provided by the SentiFX indicators at the heart of the analysis. These indicators are on the website or MT4 for those that prefer that platform.

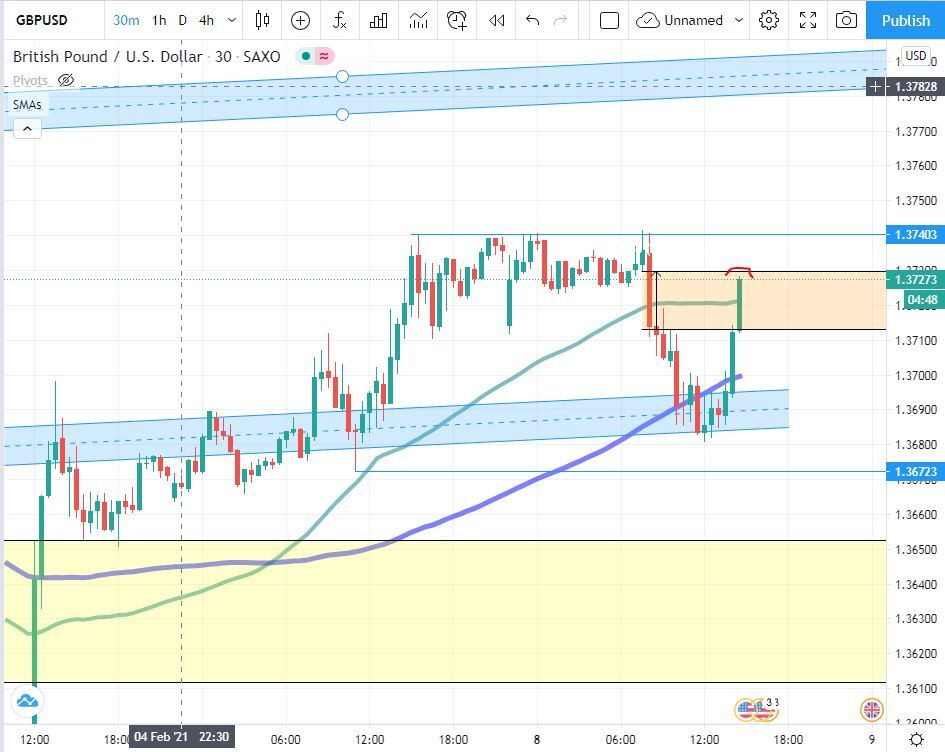

Todays example of how to best utilize the sentiment data is a long trade in the GBPUSD (or #cable). Per the below screenshot, the pair made a swing low into a Liquidity Gap (LG - explained on the SentiFX website for members) which was in confluence with a trendline/zone of interest. At this time the Sentiment indicators were showing a reading of retail 72% short and in the 'Strong Buy' zone of the sentiment indicator - basket analysis also was pointing to potential GBP strength. The number of retail shorts had grown over the past 2 days prior as the USD ran out of steam in its short term bullish move. Also as another confidence (probability booster) the 50 and 100DMA's were providing dynamic support here and were in a bullish formation. With all these factors in place it was an easy Long trade to pull the trigger on.

Below this chart I will give the exit explanation.

GBPUSD Long Entry 8th Feb 2021

Prior to pulling the trigger on the long entry I identified the nearest LG to the upside per below screenshot. I switched down to the next timeframe to get a more clinical exit target - in this case the top of the highlighted LG. This was to be the target, and as you can see the target was met netting approx 40pips in the process. The Pair went on to rally much harder however taking bite size profits out the market on a daily basis in this manner will give long term account growth and a smoother returns curve when coupled with low leverage.

gbpusd long exit 8th Feb 2021

I don't use 'Hard stops' but prefer to manage each trade. If I scale into a position at LG's in anticipation of a move against retail but the trade moves against me at the same time retail sentiment pivots the other way, then at that point i will likely close out the trade and consider taking new positions into LG's against retail in the new direction. Rinse repeat and profit!! Good luck. Talk again soon.

GMG

Leave A Comment