End of Week Analyses using Sentiment and Market Structure in Forex

DXY

The Dollar is currently in a range between 99.63 and 100.30.

We want to see a clean break up or down as shown by the arrows before we get too excited for either direction here.

Structurally, DXY is more likely to make higher highs and take out stops above. However, when looking at other pairs there is cause for concern.

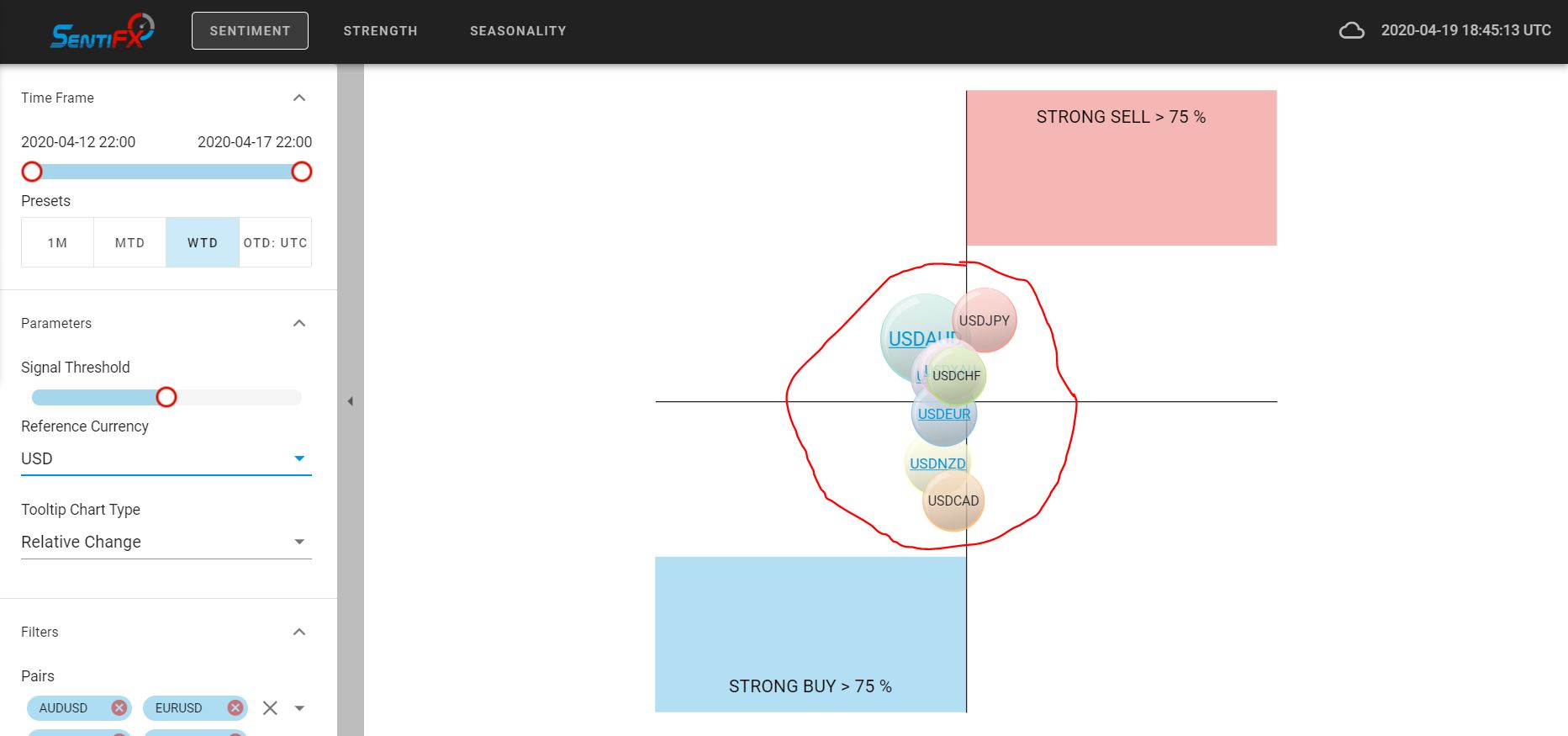

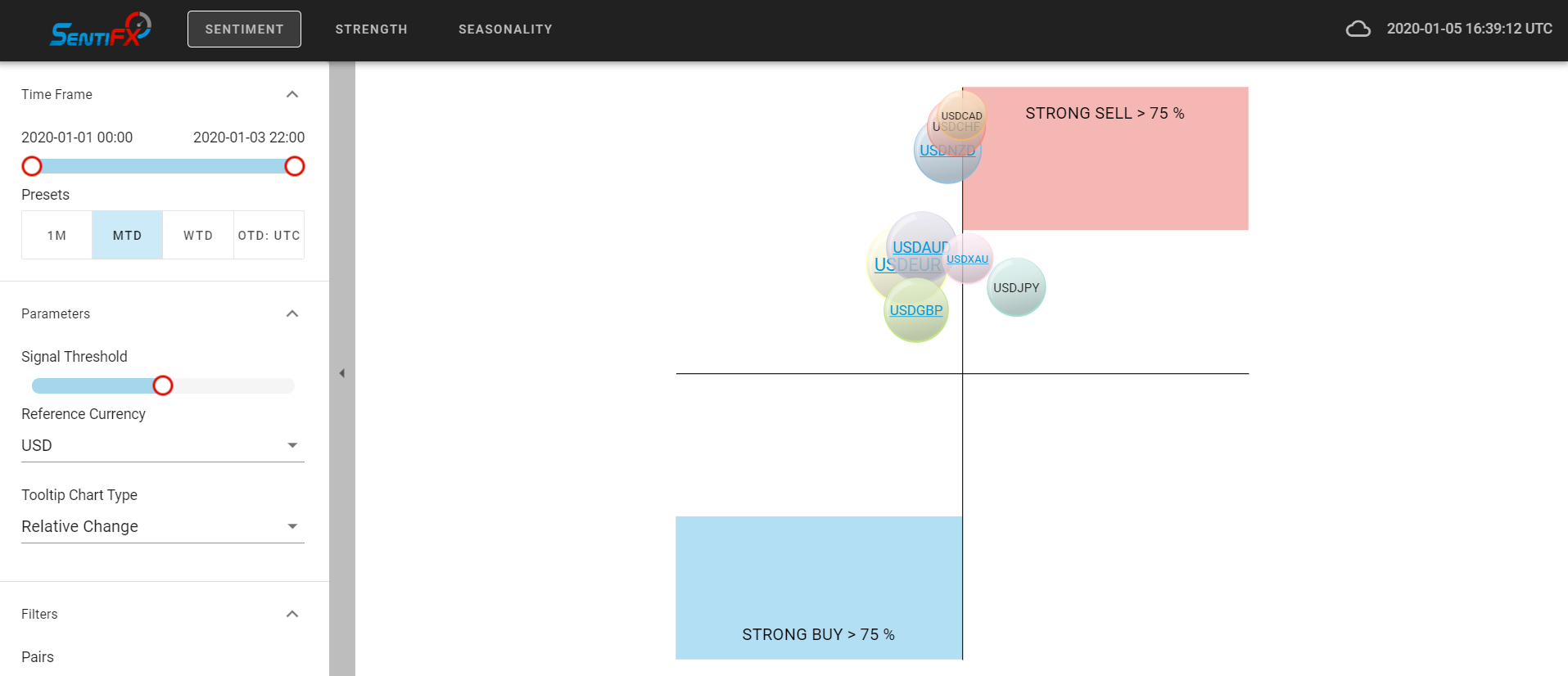

Sentiment Readings using Basket Analysis shows that all of the pairs are clustered in the center of the quadrants. This is a clear sign of indecision of directional bias for the Dollar as far as Sentiment is Concerned.

EURUSD

EU responded at structure and took out stops below marked X. But then Price pushed up and made a New Structure High.

Since sentiment is mixed at this time, I would follow the clues from Market Structure.

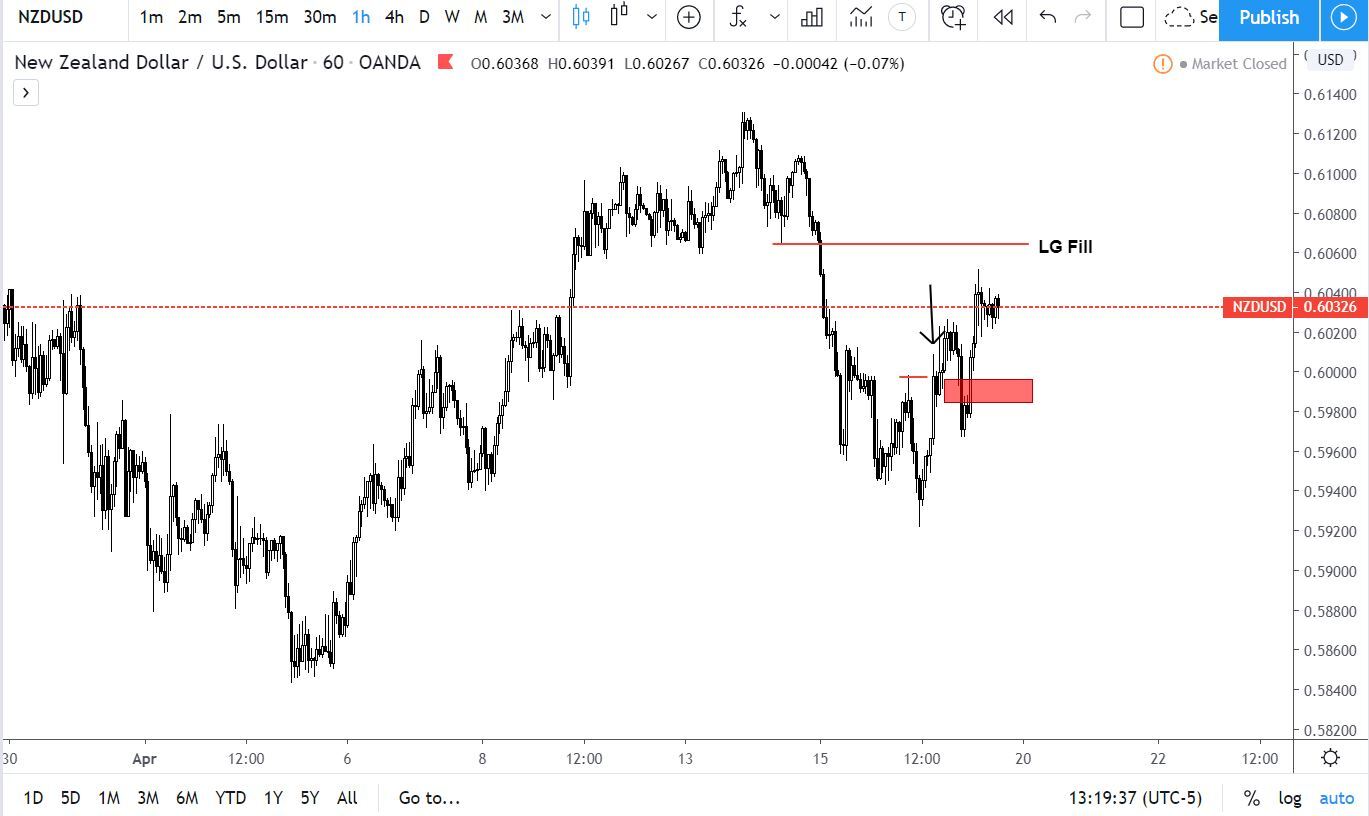

NZDUSD

NZDUSD had a clear Structural Break to the upside as well and has also made a Higher High.

The expectation is for NU to at least fill the Liquidity Gap above.

USDJPY

UJ has made a short term New Structure Low here. I would expect price to bounce around at that value area near the red line and then continue to push lower to take out stops

Whats New?

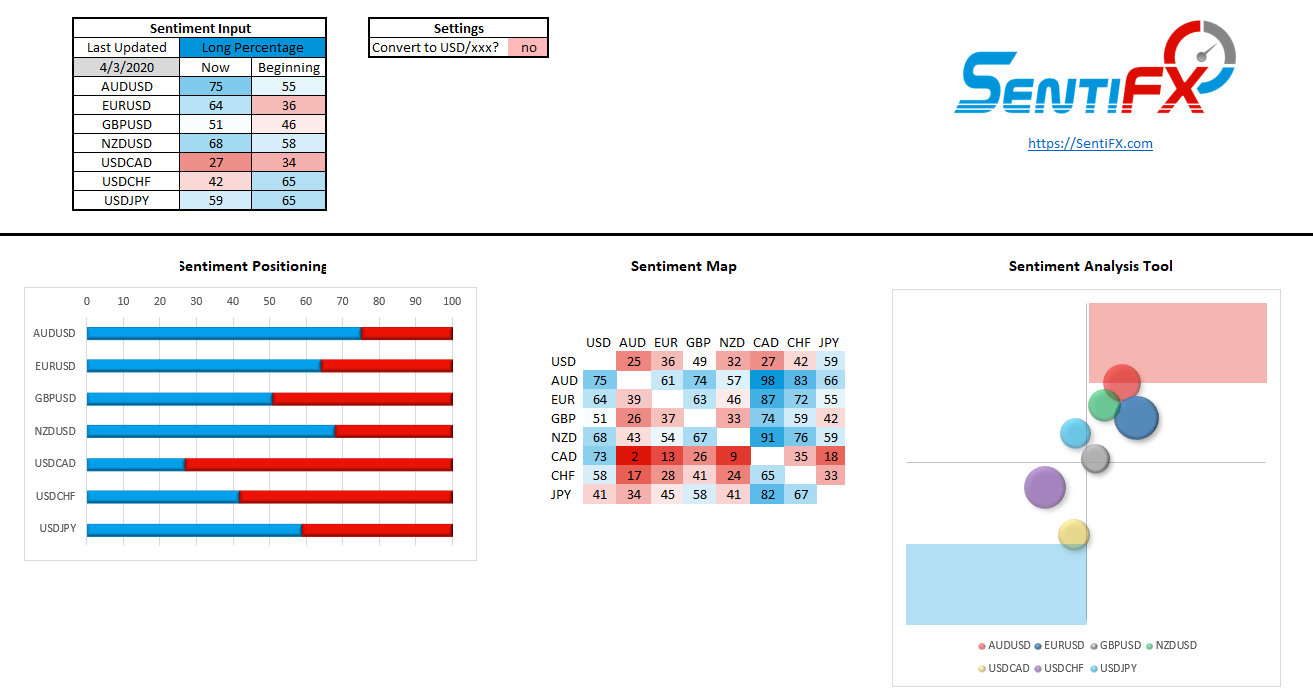

We had some requests for an inexpensive way to traders to track Sentiment themselves.

So we created the Sentiment Analysis Excel Spreadsheet (very similar to the one I used to profit in the FX Market for years ). You can use it to quickly track retail sentiment and changes in positioning. You simply just have to type in the positions and everything is calculated for you.

We even included a simple version of the Sentiment Analysis Tool that will give you Buy and Sell signals and can also do Basket Analysis for the Majors.

Get the Sentiment Analysis Excel Spreadsheet

for just $57 $7.

P.S. It even includes a Sentiment Heat Map and a How to Use Video!

You can't beat it if you don't own our other indicators.

Directional Bias

Retail Sentiment + Market Structure gives us a directional bias for our trades - regardless of your trading style.

We want to trade against retail as we know retail lose over the long term. This is the best way to win more trades and make more profit.

Where to get the Sentiment Edge?

The MT4 Sentiment Indicator and the MT4 Relative Sentiment Indicator provide you with an incredible directional bias that you can use to trade against the retail sheep. Use these week after week to extract money from the Forex market.

The Sentiment Analysis Tool (SAT) combines Sentiment Positioning and Relative Sentiment in an independent platform. The (SAT) also provides the ability to easily perform basket analysis, currency strength analysis, and seasonality analysis to add additional edge to your existing trading style.

Retail Sentiment is the biggest edge in FX. If you aren't using it along with your trading style - you are missing out on having the additional confidence and confirmation to get in the profitable trades and hold them longer.

Trade with Edge, Trade Well -

Charles

Leave A Comment