To Sentiment or Not to Sentiment?

That’s a dumb question.

Imagine this ~

A speeding train is headed towards you as you leap back and forth in front of the track.

You could grab on for the ride when it gets slightly past you.

If you wait too long, you’ll miss it….. But if you keep hopping back and forth trying to dodge it – you’re going to get run over.

That’s what happened this week to those who chose Not to Sentiment.

USDJPY

USDJPY was that Train, and if you were hopping back and forth trying to long it when a clear Sentiment SHIFT had occurred, you would have gotten run over.

One guy wrote me and said “I haven’t tried your tool yet but I use sentiment from a website and retail was heavily shorting so I was buying expecting the move to continue upward. How did you know that the move was going to start going down?”

I replied “Those sites don’t track changes in Sentiment order flow, which is the MOST important element of trading sentiment. That’s why we can confidently board the fast moving train in the direction of the train and go with the MMs and not get run over. Retail started shifting their bias to Buy and we saw a Market Structure clue that told us that the shift in sentiment and change in Market Structure was a Sell.”

If you were just following sentiment on those other sites – you would have gotten run over.

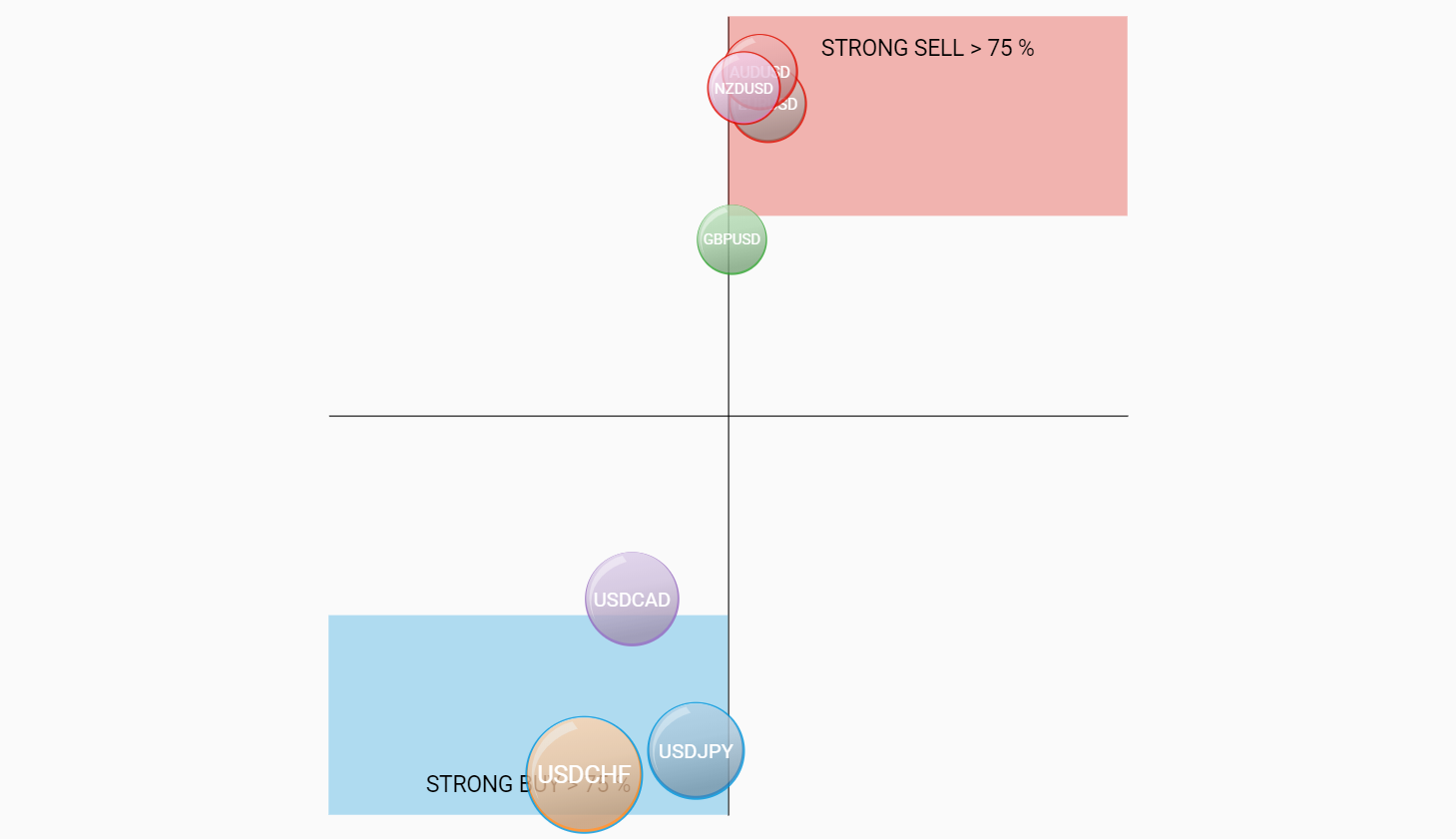

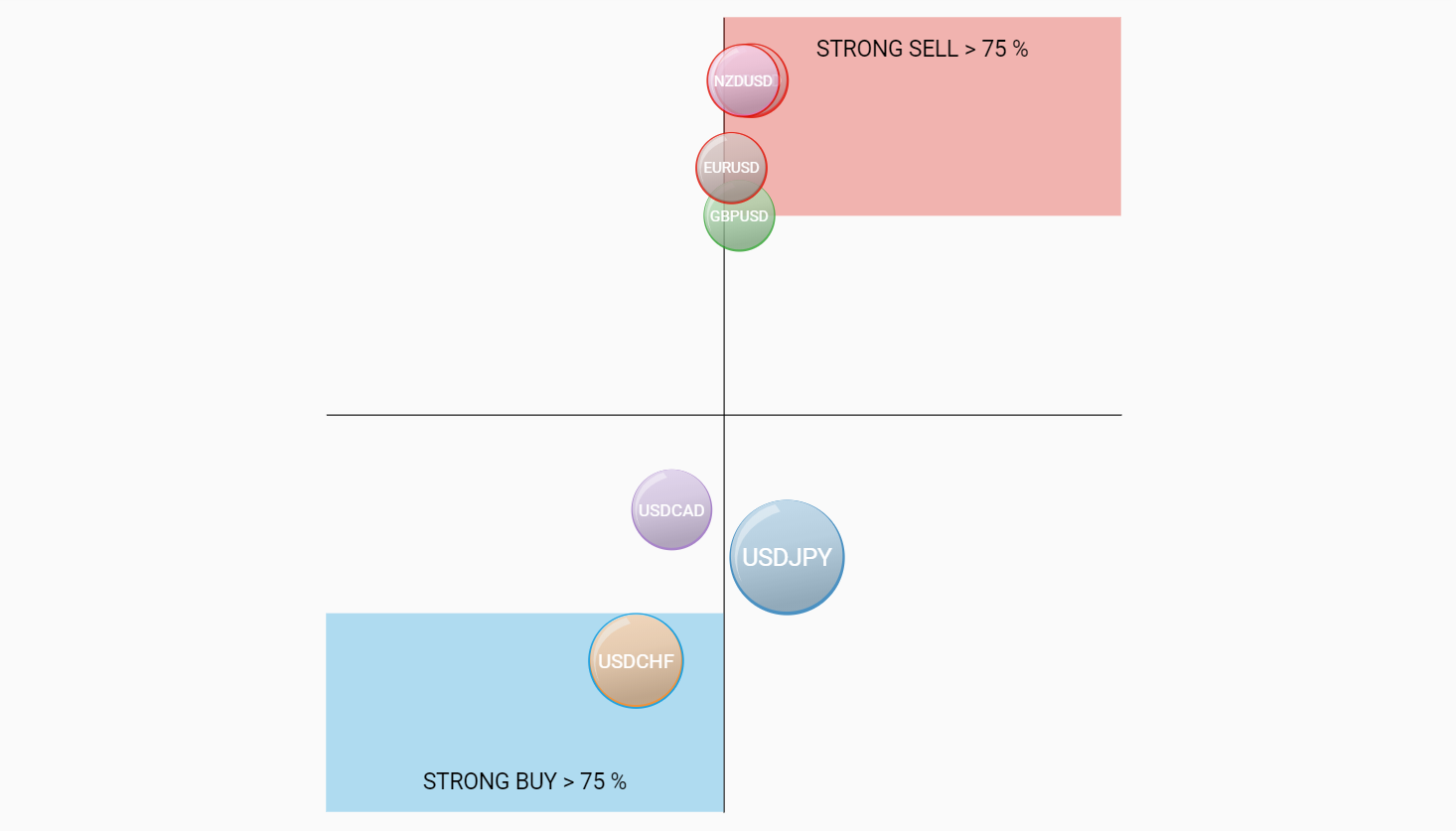

I had told members on Monday – watch for USDJPY to shift and then pounce on it. We saw a shift across the Y axis, then the X axis – It was a kill shot before anyone knew what hit them.

A few people messaged me and asked why the liquidity gap didn’t fill.

My answer: It will at some point. But going against the Sentiment shift was very high risk.

Those who tried, well – they were hopping across the track and when they weren’t paying attention – they got ran over.

Let’s now take a look at how I traded USDJPY and why.

HOW I TRADED USDJPY

There was a clear structural break to the downside circled. I immediately sold when price pulled back to structure without hesitation – targeting stops. Shortly after – the target was hit.

It’s worth studying why this was a good trade and why the probabilities were on our side.

- Sentiment was in our favor (retail on wrong side of the trade)

- Order Flow was Sell Side

- The market tipped it’s hand by breaking strongly down and pulling back

EURUSD

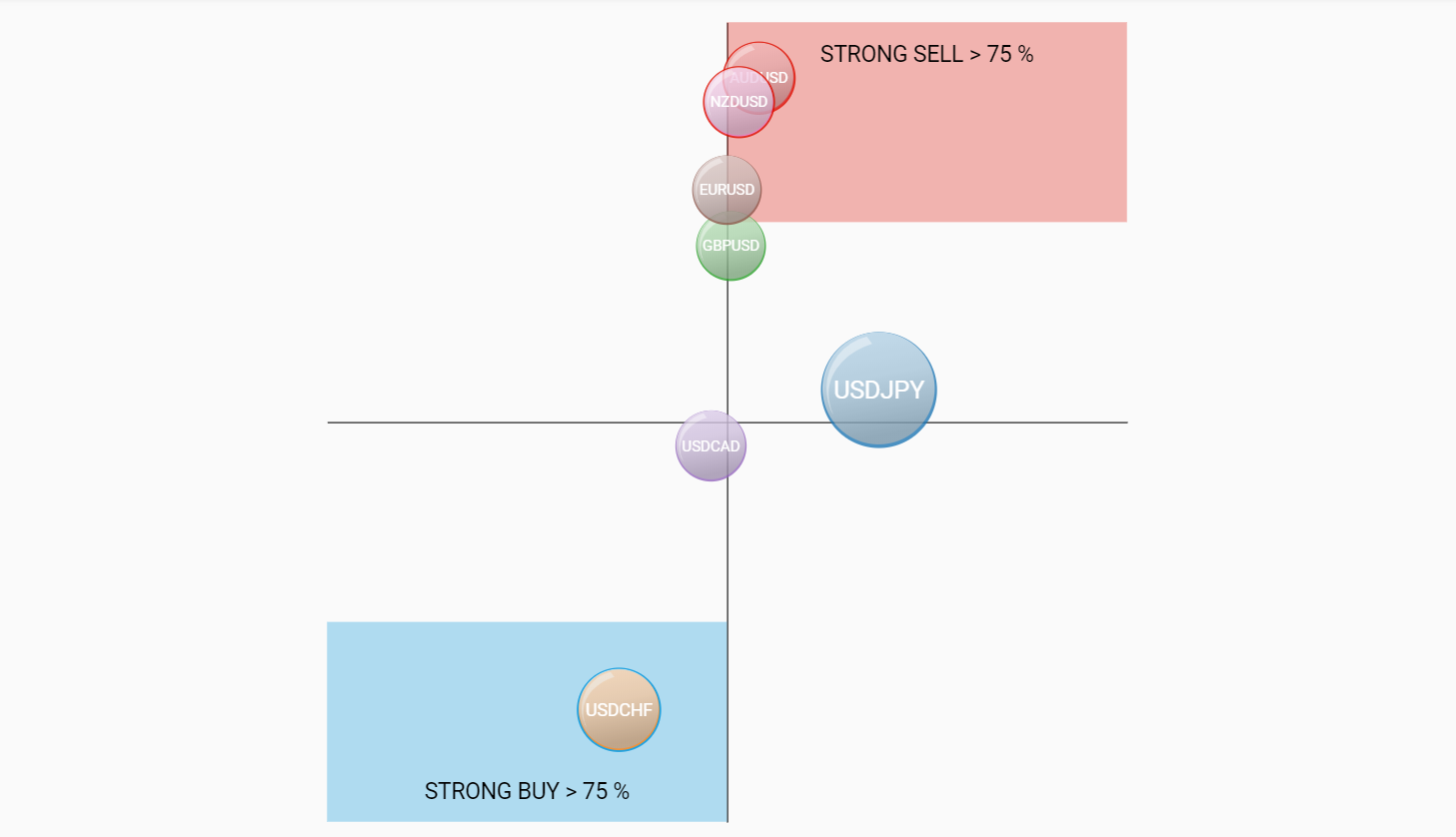

EURUSD was in a Down Trend – and most people weren’t even paying attention. Including myself.

The bubble was small on the Sentiment Analysis Tool and I was focused on other pairs.

But a member – Hepsibah said, “EURUSD shifted across the Y axis to the Buy Zone”

I looked at the Sentiment, replayed it’s movements and then pulled up a chart. Sure enough, Hepsibah picked up on something before it was about to happen.

I took a screen shot of the chart and marked it up and said “If, EURUSD does this – BUY here.”

I said, “This could run for the rest of the week.”

Look what happened next – both Members and myself reloaded over and over for the Kill Shot. Thank you Hepsibah!

Let’s now take a look at how we traded EURUSD to make lots of pips.

How EURUSD was Traded

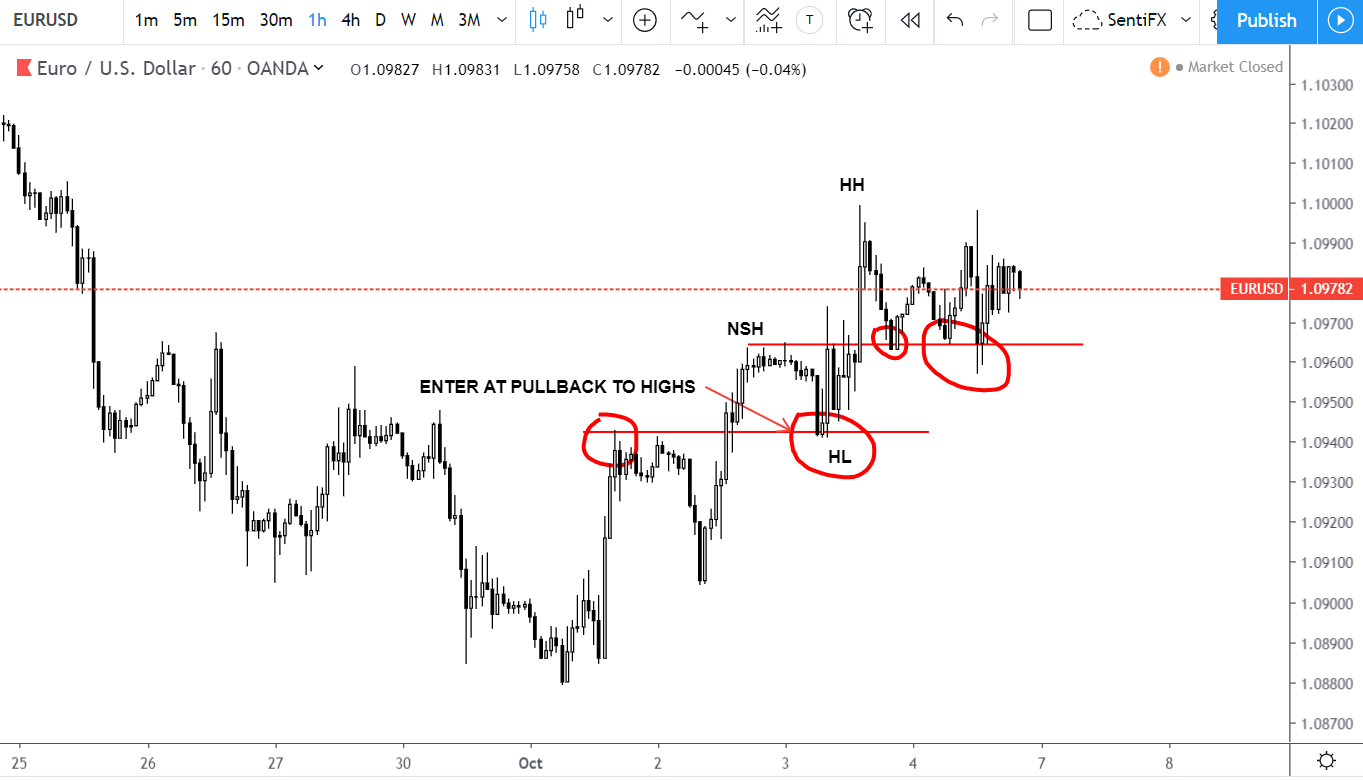

Once we had a clear structural break to the upside – we now had a NSH.

We could now confidently buy at the top of structure (Most recent highs that were broken) and put our stop confidently at the most recent swing low. Why? Because if price breaks that low – then Market Structure would change again. Since we made a NSH, it is unlikely that the most recent swing will be broken right away.

We wanted to be buyers any time price pulled back to the red lines.

Note how price responded each time.

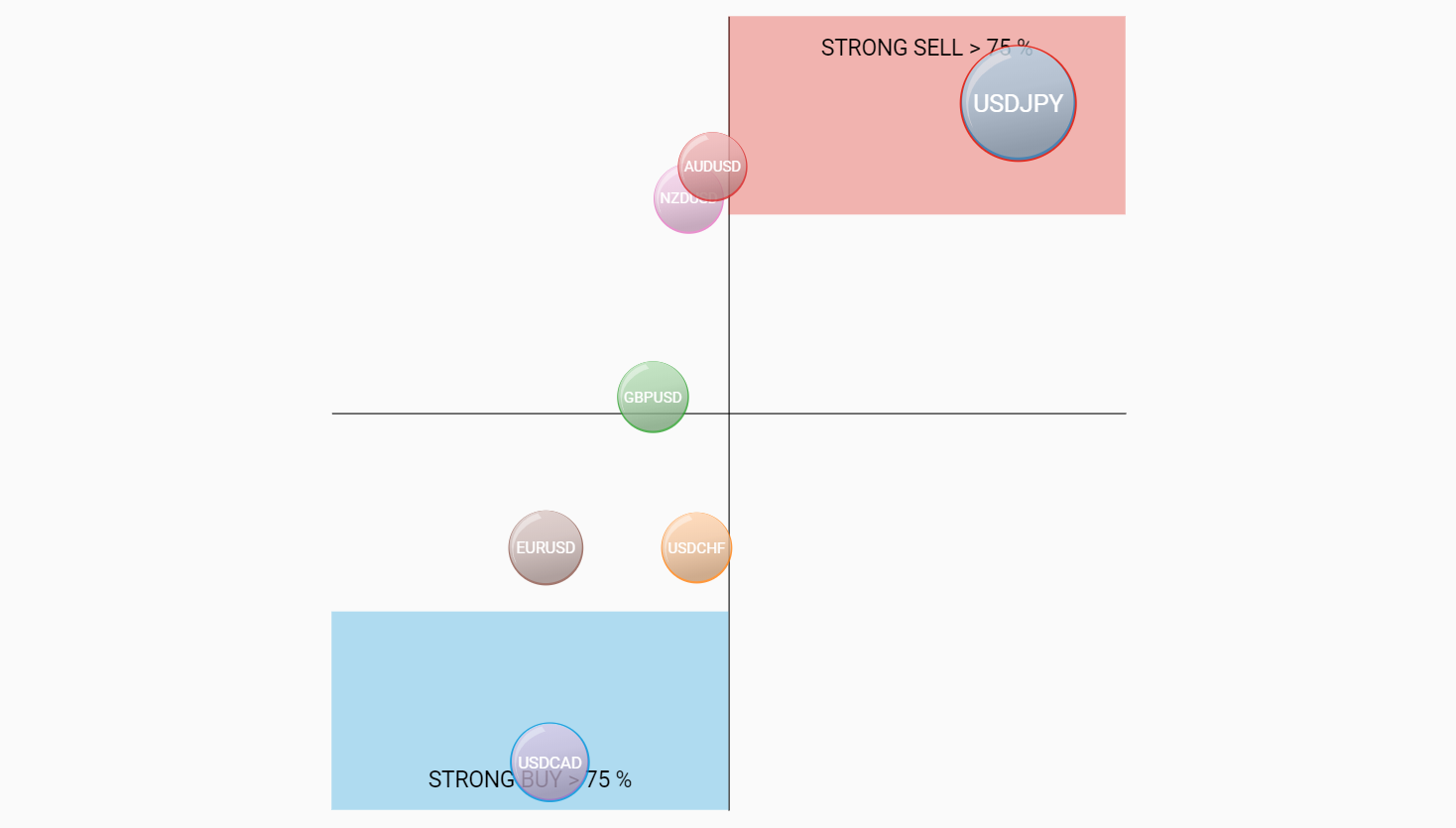

GBPUSD

In last weeks video analysis – we went over a high probability trade for GBPUSD short.

I told members how we could trade it. Selling the stops as it went up, and exact locations to exit. Both Target Smashed!

Those who got on board and held made anywhere from +90 to +130 pips. I only made +90 pips.

Leave A Comment