FOCUS ON CORONA VIRUS

The major focus this past week was the fear surrounding the corona virus. When we get to looking at USDJPY we will see the opportunities that were present in the beginning of the week - with an eye for the change in direction by mid week.

Sentiment

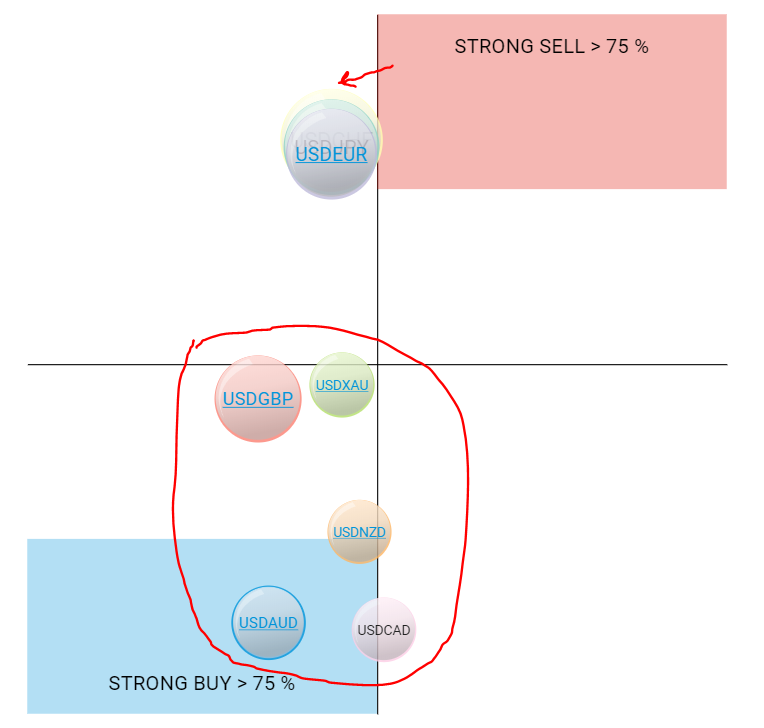

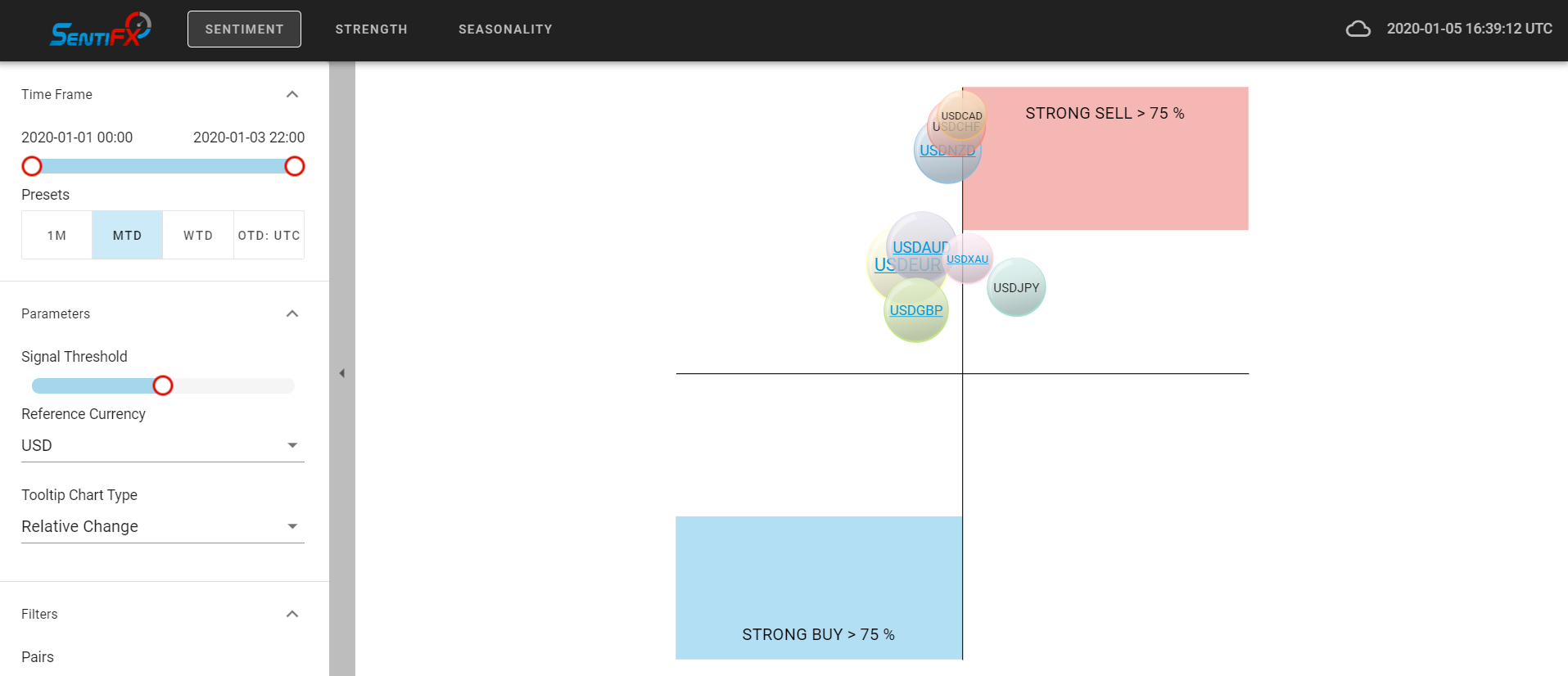

Using Basket Analysis of USD/xxx, we saw the dollar get stronger verses ALL other currencies by 3/12/2020.

Currency Baskets began clustering around the strong buy zone and USDEUR, USDJPY, & USDCHF were in the weak buy. (remember with basket analysis, we are putting all major pairs with USD/xxx) to analyze USD positioning overall).

DXY

The above sentiment analysis corresponded beautifully to the market structure change in DXY.

The sentiment analysis presented itself before the big move upward to clear out stops.

USDJPY

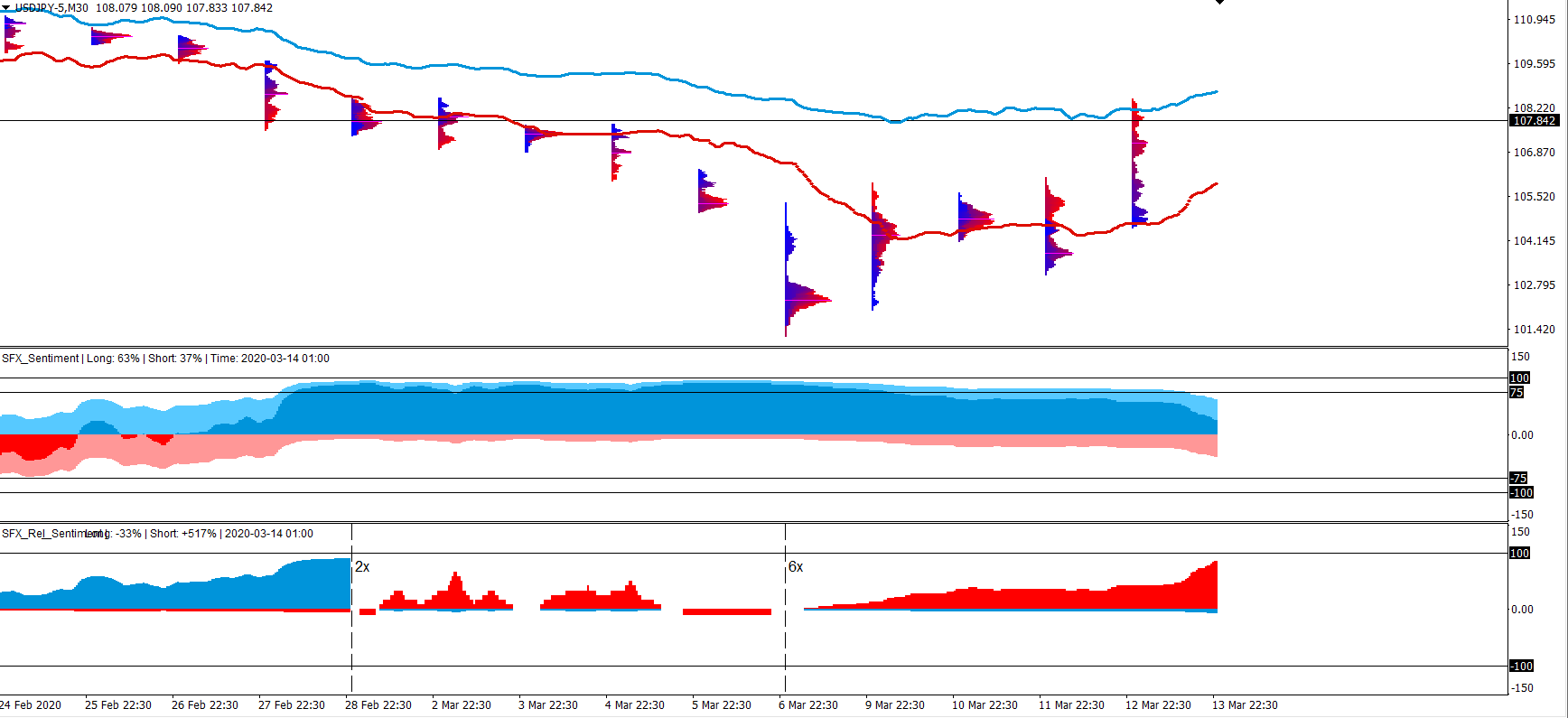

USDJPY was in sight for the open last Sunday. We were expecting price to start moving upward and was waiting for an opportunity to strike.

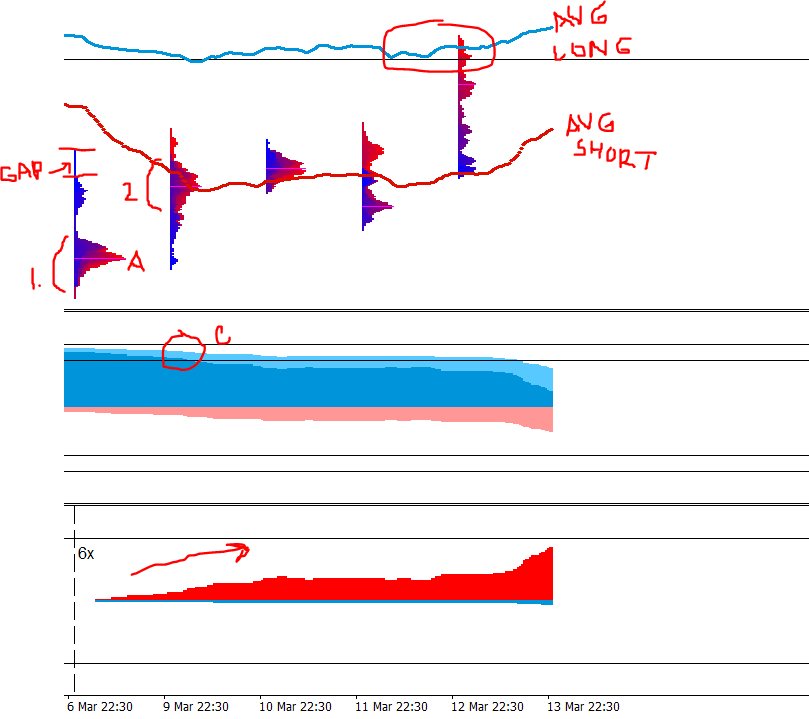

When the market opened gap down (see above 1. to the left) our bias was for the market to continue moving downward.

By the end of the day on Monday, price had found value at A after a 400 PIP move!! Also notice how far away from A that the average short was and the average long. Longs were beyond extreme pain and shorts were in too much profit.

Also notice that retail was starting to go less long (at C.) and starting increasing their short positioning (see bottom graphic).

This means that retail is stopping out and starting to go short. A key indicator that the tide is shifting.

By the close of the day on Tuesday - we had price finding value higher, making more of a P shape.

Combining the P shape profile with retail shorts increasing their positions and longs decreasing their positions - we have a recipe for the market to be ripe for moving upward.

We know that Market Makers (MMs) target retail's over leveraged liquidity.

The Way Ahead

Keep a close eye on the US markets this week. The S&P 500 may be experiencing a dead cat bounce and if that is the case... I will be looking for USDJPY to start moving south again. We will want to see retail starting to position long using the relative sentiment indicator as well as price to start building volume on the lower side.

Where to get edge?

The MT4 Sentiment Indicator and the MT4 Relative Sentiment Indicator provide you with an incredible directional bias that you can use to trade against the retail sheep. Use these week after week to extract money from the Forex market.

The Sentiment Analysis Tool (SAT) combines Sentiment Positioning and Relative Sentiment in an independent platform. The (SAT) also provides the ability to easily perform basket analysis, currency strength analysis, and seasonality analysis to add additional edge to your existing trading style.

Retail Sentiment is the biggest edge in FX. If you aren't using it along with your trading style - you are missing out on having the additional confidence and confirmation to get in the profitable trades and hold them longer.

Trade with Edge, Trade Well -

Charles

Leave A Comment