The USDJPY Seasonal Trade Part II

USDJPY knocked it out of the ball park – again!

If you didn’t see the first post about the USDJPY Seasonal Trade that I initially missed, check it out HERE

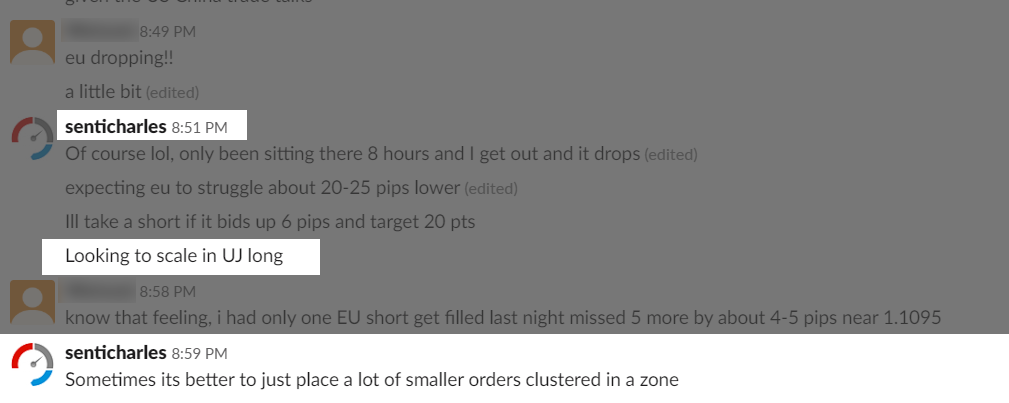

Sure enough, I went to sleep with 6 Limit orders resting…. waiting… at key locations. I was prepared for to take a full stop on all of those limit orders, but I didn’t think that would be the case.

See the thing was, I knew price was likely to drop before moving back up. The question was how far?

We don’t ever know. But the ALL in – ALL out strategies aren’t always our best play with limit orders. It’s actually better to scale-in and scale-out.

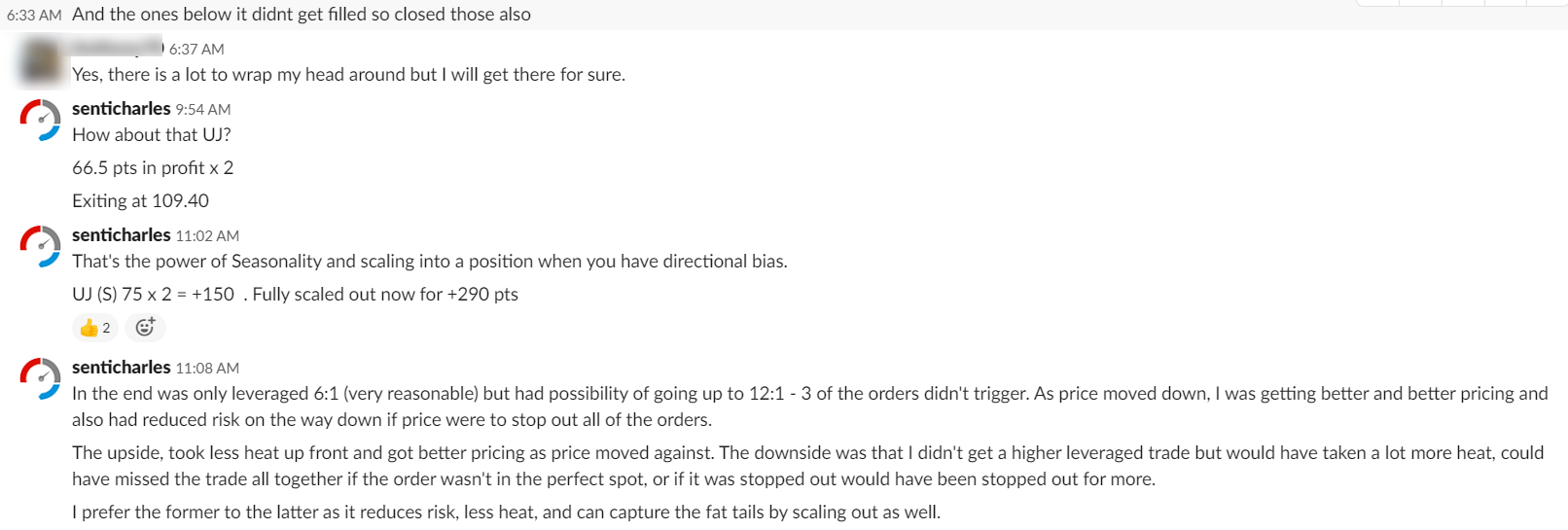

Scaling in let’s us take less heat as our positions are smaller – so we average in on our entries.

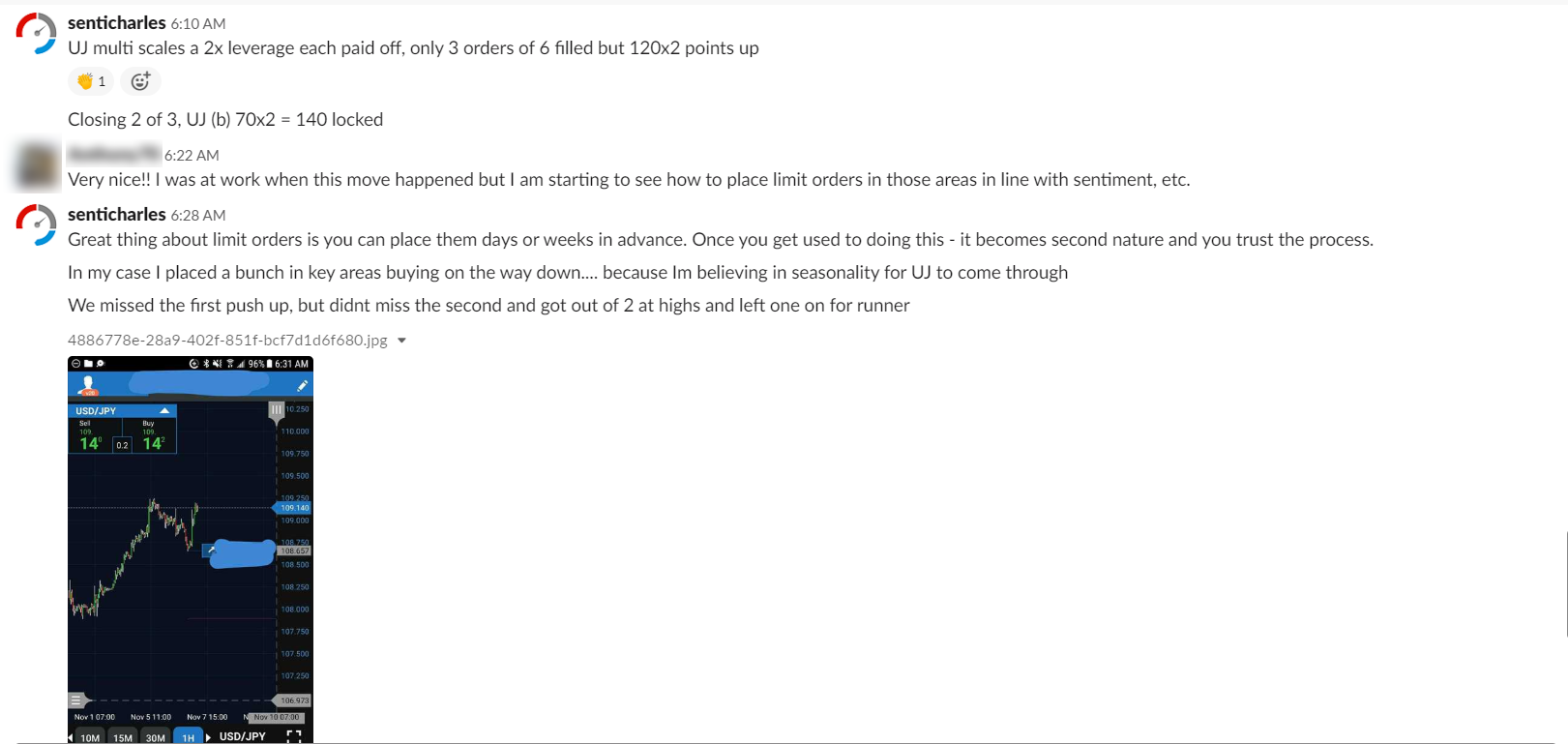

Scaling in also allows us to work a zone instead of trying to pinpoint precise entries and exits (Although we do a great job at knowing where the key levels are – just look at the screenshot from my account). It looks like I bought the low before the move up right? Well that was just 1 of 3 orders, the other 2 I had closed out. But you can see the precision of where turning points likely are and knowing that is very important when working zones.

Needless to say – I woke up to a very profitable position and price sitting near highs and locked in +140 pts.

All in all, I was able to close out at +290 points.

This was an opportunity to get in on the trade that I missed out on originally because I had expectations and those expectations didn’t play out. I missed the first set of stars that said it was a buy in the first place. This could have been an extraordinary week had I landed that trade as well. But it was still an outstanding week – wouldn’t you agree?

Just wanted to share how I was viewing this trade and where I got out.

I wanted to scale in all the way down the move up but wanted to do it at key Market Structure locations.

If you KNEW price was going to move higher, but didn’t know how far down it would go first, where would you place your entry?

Well – if you went all in – all out – then you may not have been filled depending on where you placed your order. If you placed it too high you would have experienced a lot more heat and also limited your profit potential.

By scaling in – you are able to get better pricing as price moves AGAINST you. As long as you’re right about the direction then it’s a good strategy. In this case we had Seasonality on our side, as well as juicy stops waiting above – and we also had Sentiment on our side as retail was trying to short heavily.

By scaling out – I was able to ensure that I locked in profit near prior highs just in case price reverted back to the entry points. I also was able to leave some on the table to capture the fat tails of the normal distribution. That is where true trading profitability comes in and can make or break a trading system.

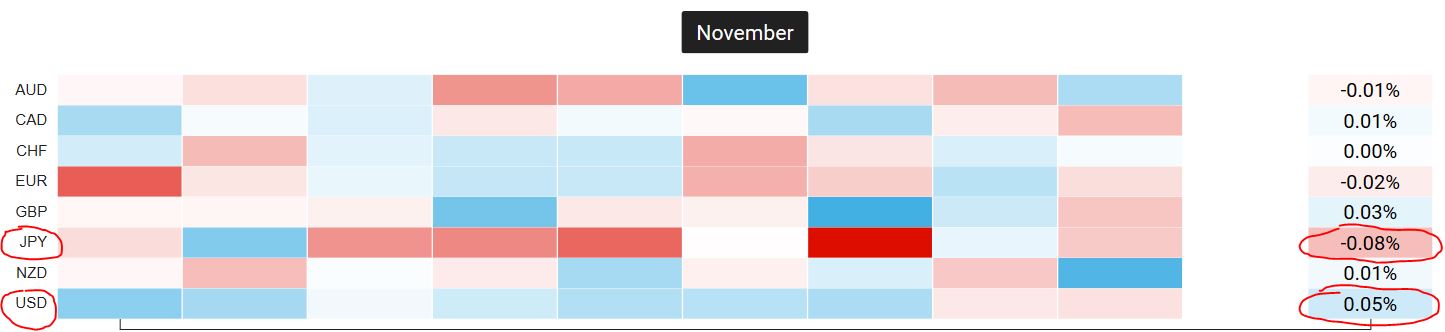

Luckily for us, we have the odds in our favor anytime we take trades where 2 or more factors are aligned – Sentiment / Market Structure / Seasonality / Currency Strength / Fundamentals.

This was an easy trade and I hope you were on the lookout for taking advantage of this move.

Trade well,

Charles

The SentiFX Team

Leave A Comment