What is a Liquidity Gap?

First – without getting too much into market mechanics ( I will do so in a future blog post ) – you have to understand a basic concept.

Markets are really trying to find the balance between buyers and sellers. Period.

So if you learn anything here – take this away -> MARKETS WANT BALANCE.

You may hear people say that markets are consolidating – what professionals take this to mean is that price is in balance.

Markets will continue to be in balance unless some sort of news or force causes market participates to reprice new information.

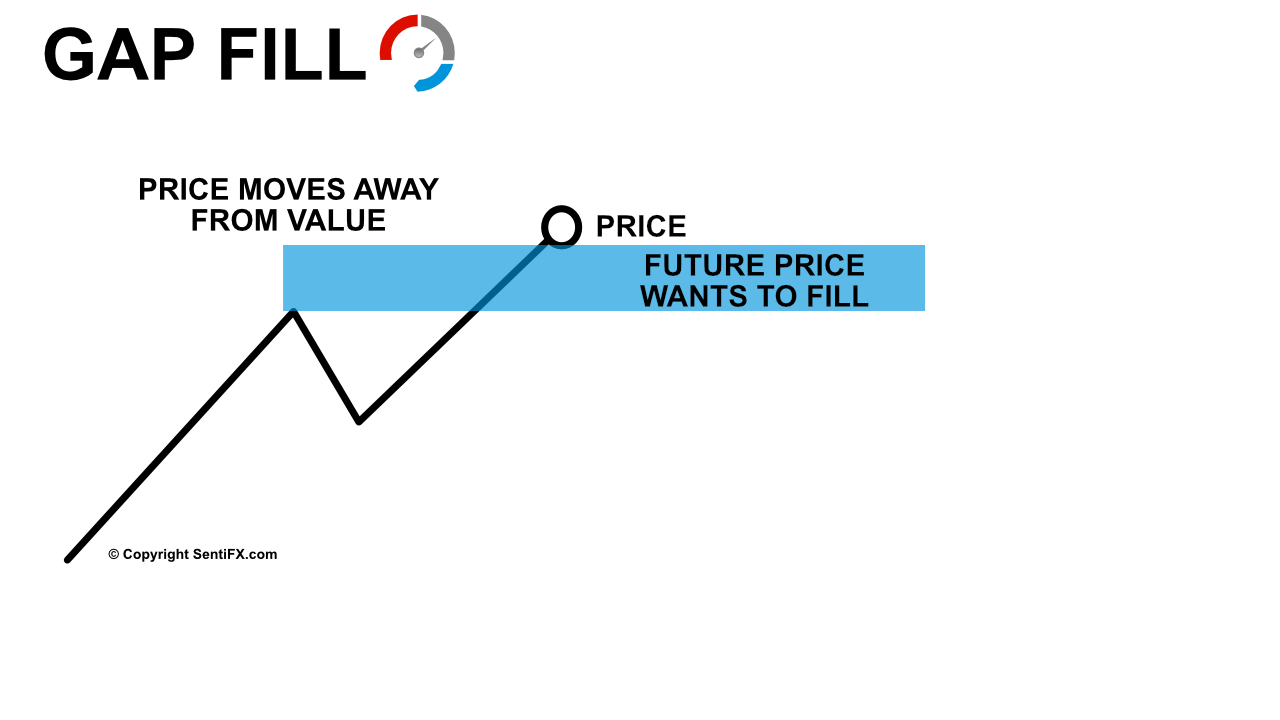

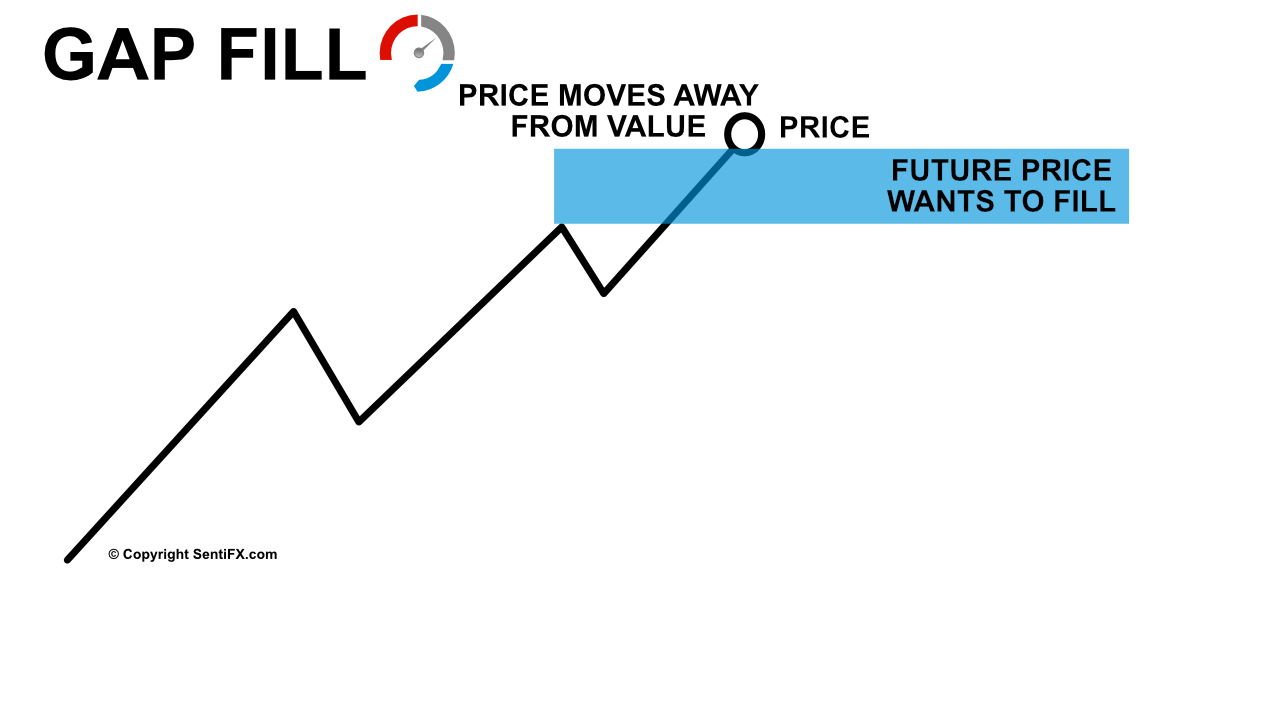

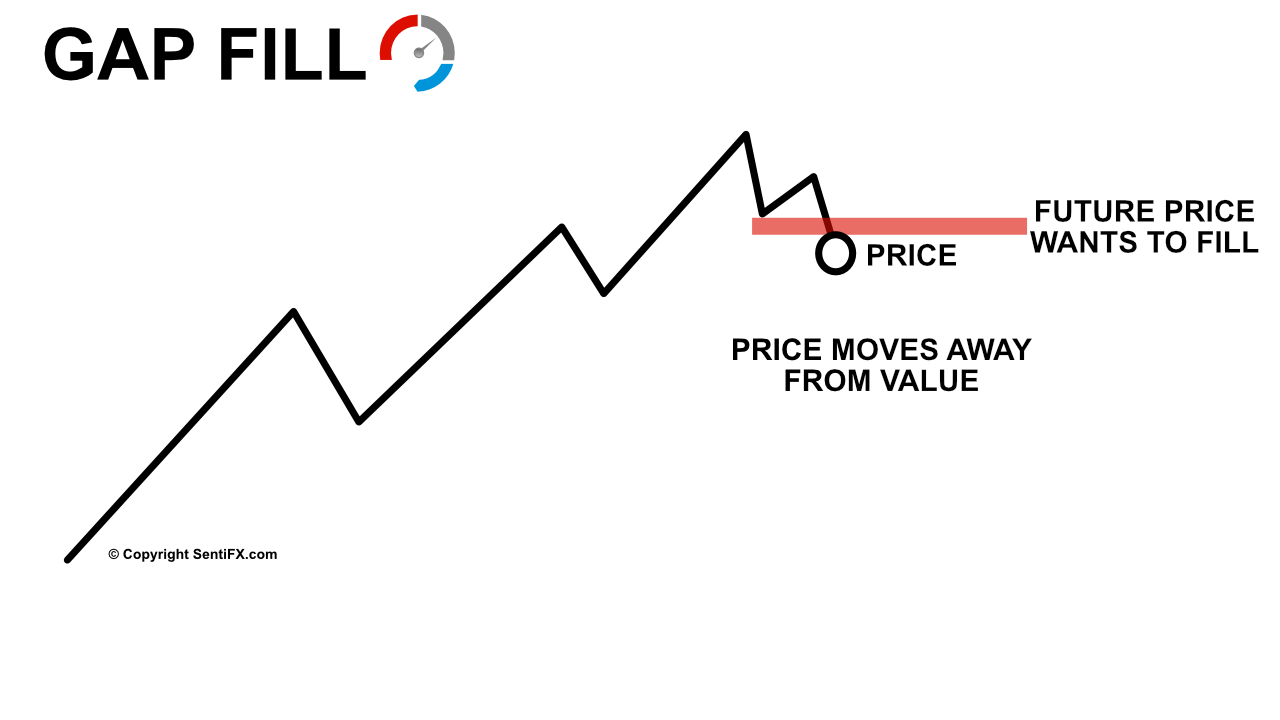

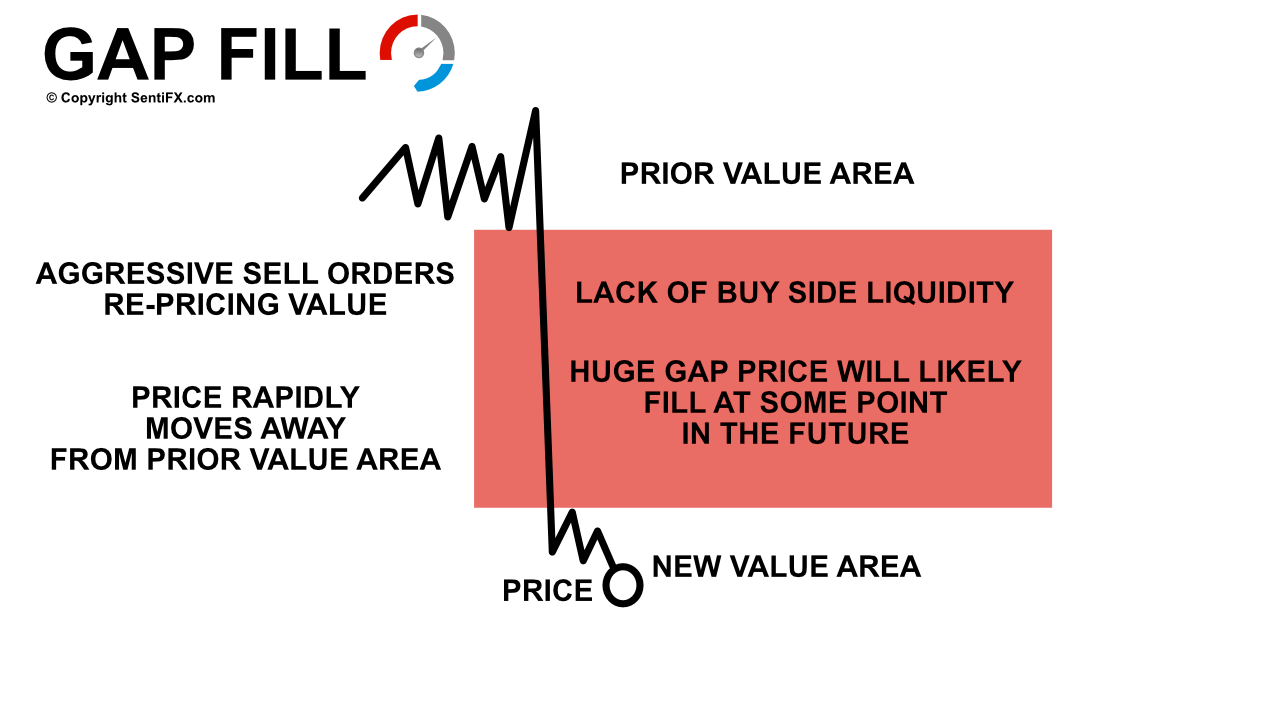

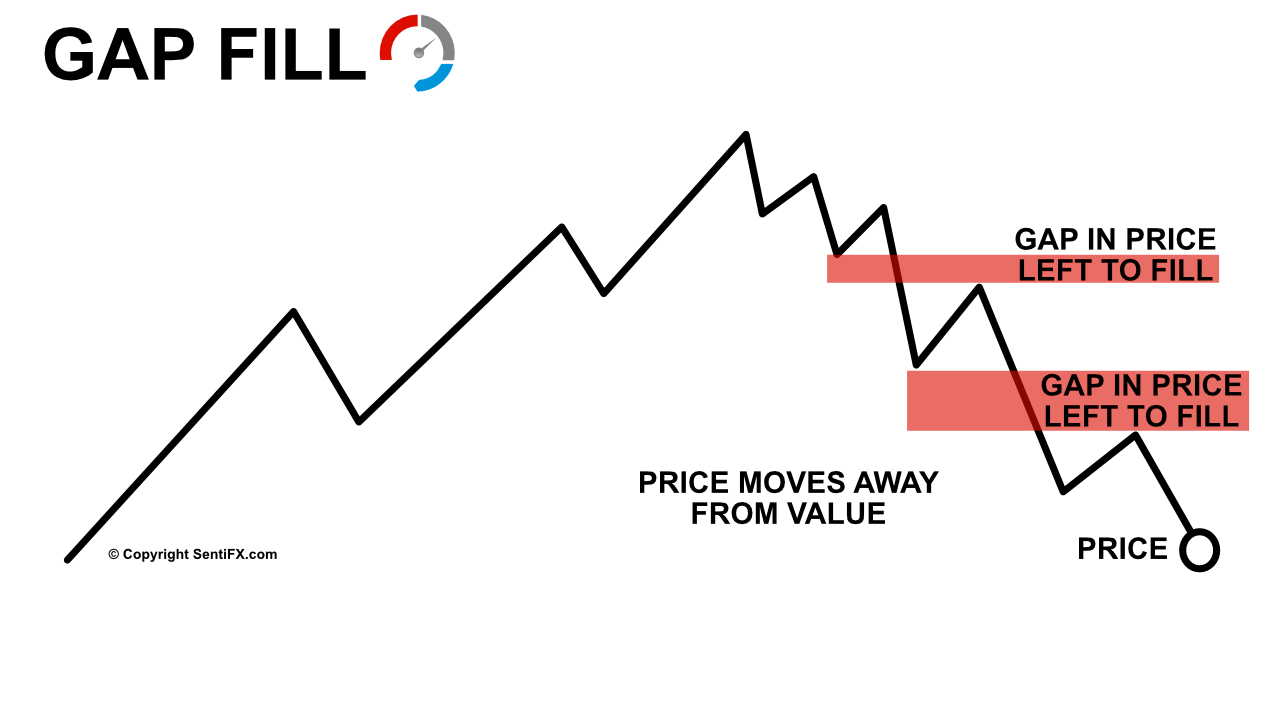

A Liquidity Gap is an area where price is not in balance. We call it an imbalance. On the chart (any time-frame) it is the HUGE – Wide Range Bars.

Milk the Cow?

To understand markets better – Let’s use the example of buying milk.

If the milk was free – well you wouldn’t ever be able to find any because people would line up waiting for the milk truck to arrive and people would take as much as they were allowed to.

If milk is priced too cheap – people will pick up extra gallons of it and freeze it for later use. Sellers will run out of inventory and not be able to keep up with the demand.

If milk is priced too high – people will not buy as much. The milk will likely go bad. The seller may get stuck with some of the inventory.

If the price of milk is OVERLY priced – people will likely find alternatives (almond milk, coconut milk, rice milk – etc) and the seller will very likely take the loss for all of the inventory.

The goal of milk market is to find a relative value where both buyers and sellers can agree on price.

Sellers want the biggest bang for their buck so they test the high ends of the market and Buyers have a limit to how much they are willing to pay for it.

The milk market “value area” is a range of prices that the milk buyers are willing to pay to get it. Anything too high or too low will throw the market out of balance.

This is simple market supply and demand. If any of this isn’t making sense – please read it all again. So important.

How does this relate to Trading?

Markets will remain in balance unless something changes that. This could be interest rate decisions (or anticipation thereof). It could be a nuclear missile attack.

It could be a Apple selling USD to buy Chinese Yuan so that they can buy iPhone components.

Apple may sell 10 Million USD (all at once – via Market Order) to buy the equivalent in Chinese Yuan so that they can buy components from China that are used in their products.

This HUGE Market Order creates a short term market imbalance in the market place.

Price was at a fair value before Apple exchanged currencies – but at the time there wasn’t enough USD Buyers to keep price from moving too far out of balance so it appears that price sold off.

This short term imbalance is quickly arbitraged away by sophisticated Algo’s that use AI, Machine Learning Models, and Behavioral Finance to assess fair value and ensure price doesn’t move too far away from value.

Ok – enough of all the technical talk. But before we get to some charts –

The thing I want you to understand about the market is that aggressive market orders may sometimes clear out buyers or sellers temporarily until the market order is completely filled.

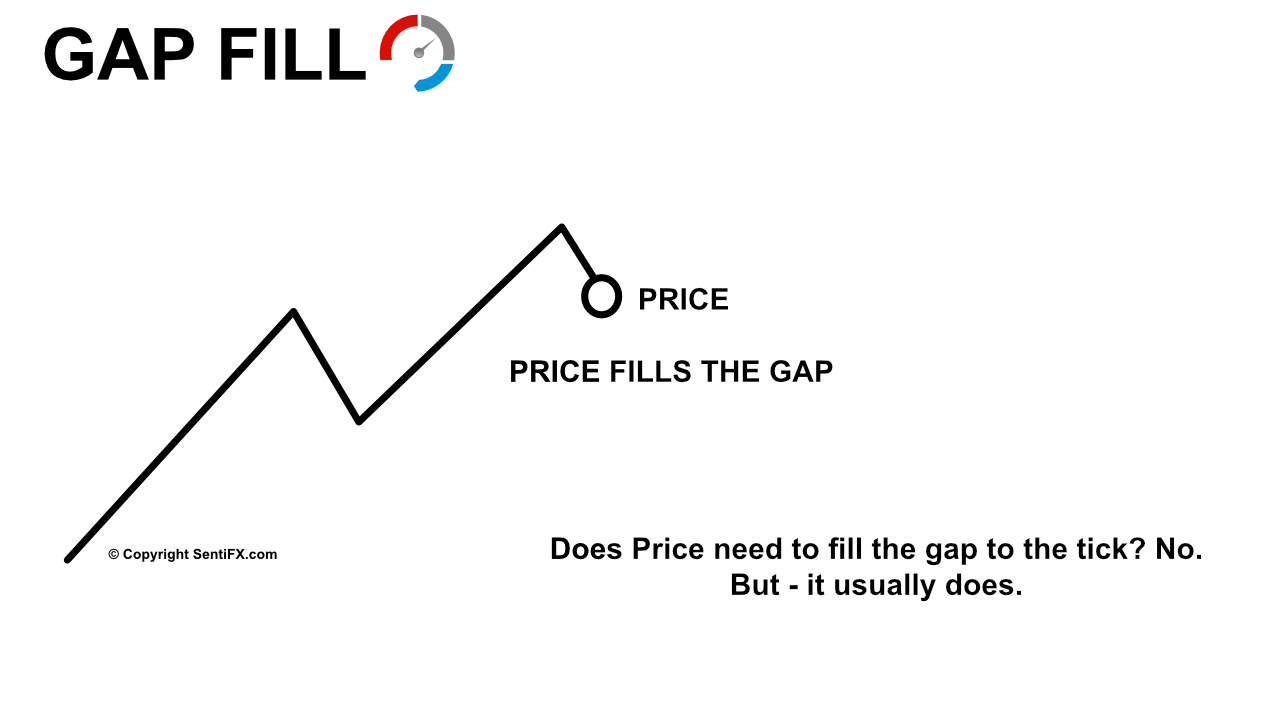

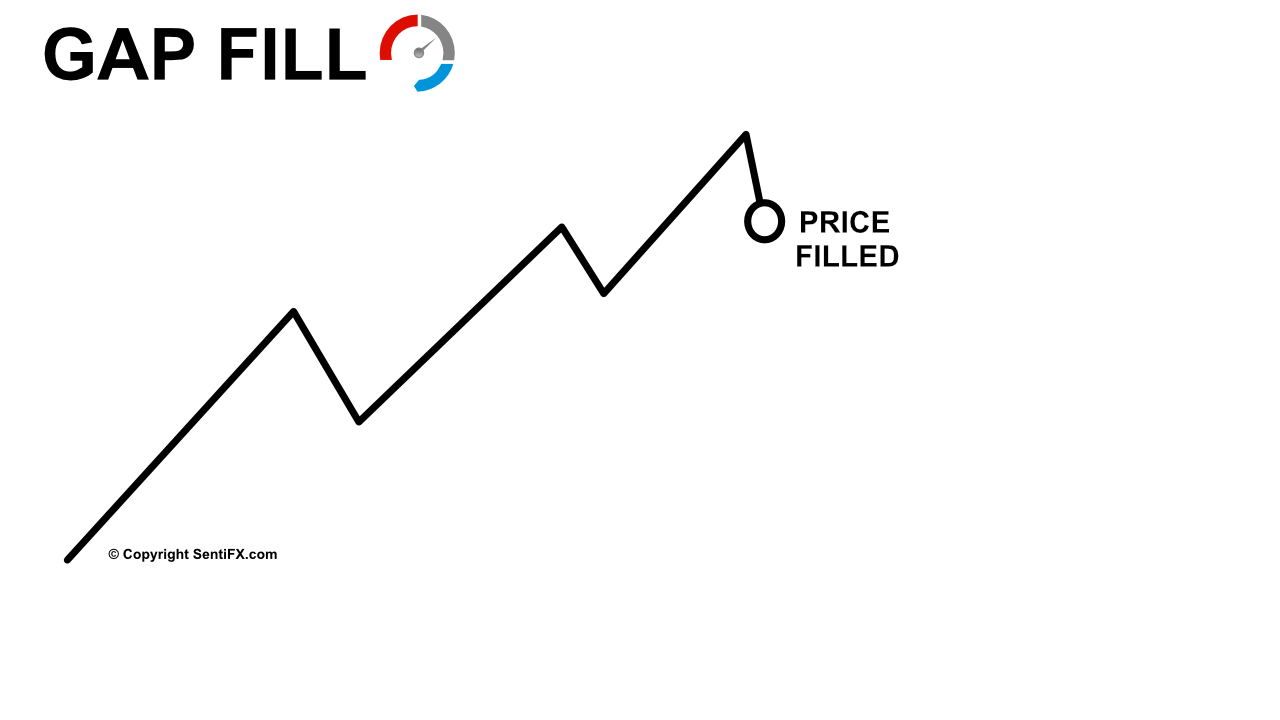

Price will move out to fill the orders then price will LIKELY return at some point in the future ( how long it will take depends on what caused the move in the first place)

News can cause temporary imbalance (Trump Tweet) or it can cause imbalance on a longer timescale (Interest Rate Decision).

With the example on the left – it is likely that a news event (NFP – Interest Rates – Presidential Tweet) caused repricing.

How do you know if the Liquidity Gap is likely to FILL sooner or Later?

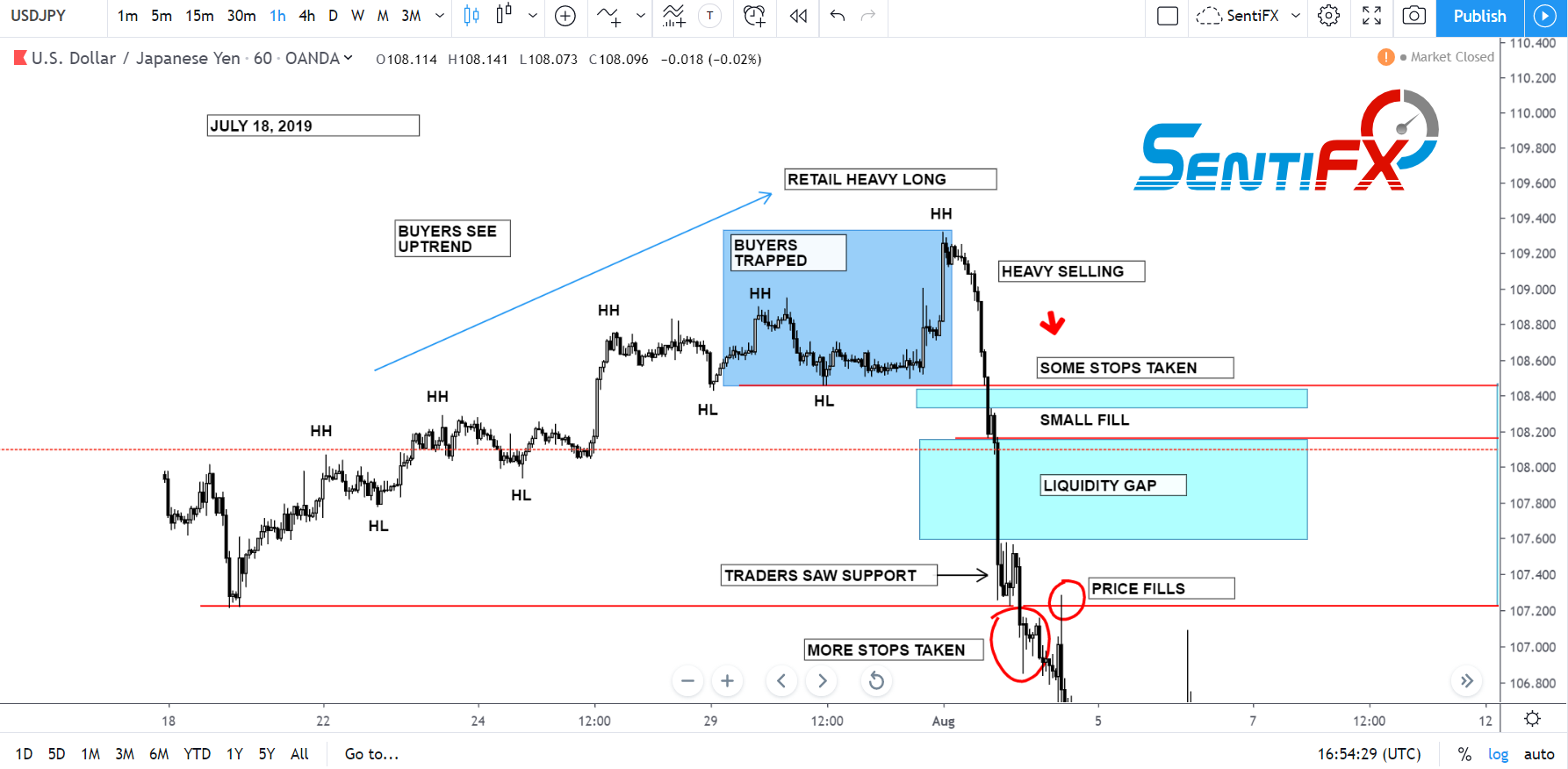

RETAIL SENTIMENT combined with Order Flow around Market Structure.

That is our EDGE that we exploit over and over and over every single week.

We are interested not only in retail positioning – but how it has changed over this time-frame!!! Very important.

(P.S. If you haven’t already – We are offering a limited DEMO of our Sentiment Analysis Tool. If you want to try it out, head to our home page and fill out the form at the bottom)

Great Theory – Show Me some Charts!!

There is a lot of GOLD to be found in the following charts. Read them – try to understand them.

–

VERY IMPORANT: Notice how price filled the “NEAR BREAK EVEN” red lines – TO THE TICK – TWICE!!

Also NOTICE the Sunday Gap – and how price filled the Gap.

If you study these charts and this blog post – you’ll not only learn why this happened but you will have the first secret of Market Structure.

You’ll also see how Retail Sentiment (marked on the charts) guided price order flow.

You can profit by trading just this one concept alone.

It is a repeatable and very high probability trade. You can trade towards the red line – or scalp away from it. Over and over and……

Hi Senti, in 11 years of trading Forex I have noticed some similar patterns but didn’t understand the process and psychology behind these moves, your explanation of why and how things happen has resonated with my observations. Thanks for filling in “the gap” in my understanding and on going education. Cheers Peter.

Glad that it helped “Fill the Gap” :) Thank you Peter.

thank you for very great blog post

Fantastic Post!

You’re very welcome.