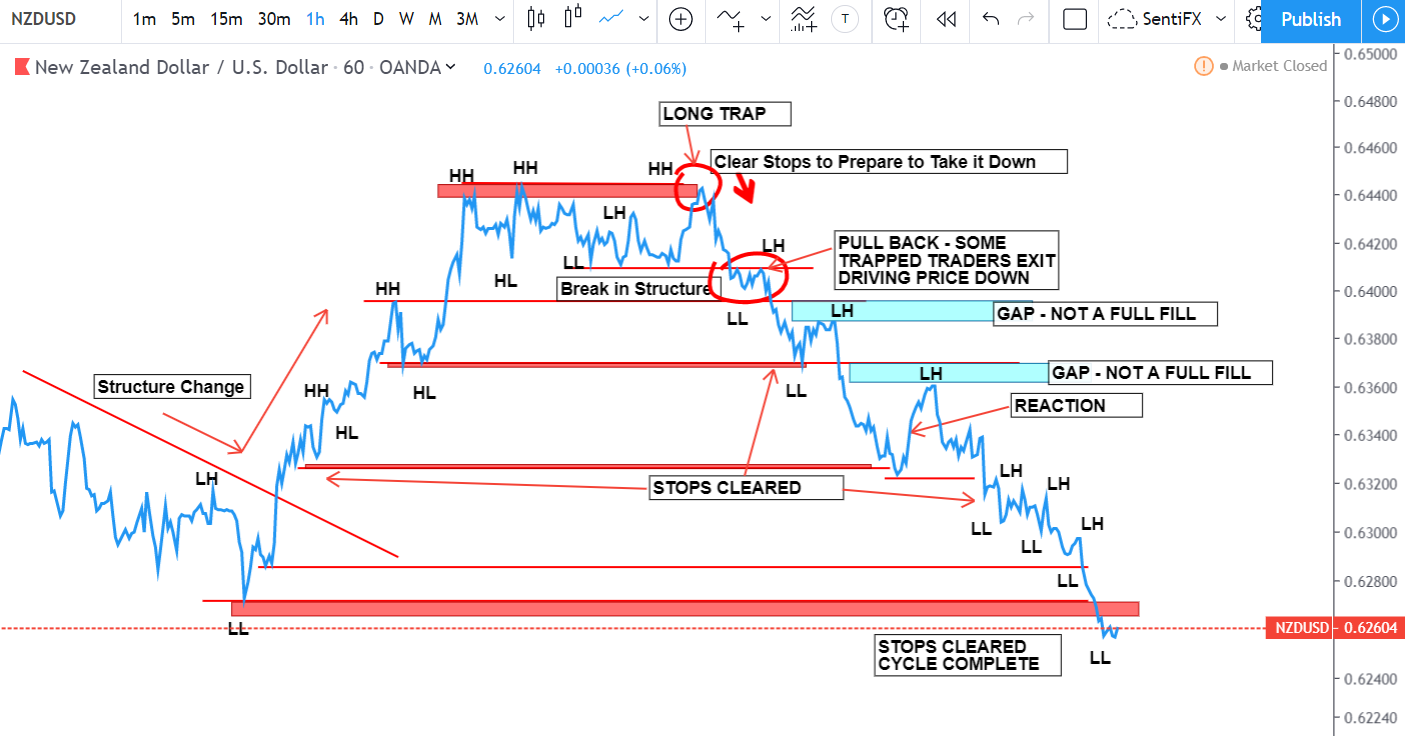

This is an excellent example of a repeatable pattern in the FX market. I would say Textbook because it is perfect – but this happens so often that it is core to the way we think about Market Structure.

Study this Market Structure thoroughly and understand what is going on here. If you understand this – you understand the core of Market Structure.

First you have a mark up (“uptrend”) – by the first Higher High (HH) then a Higher Low (HL). Price continues to drive upward until it reaches a zone where it can no longer continue moving upward.

Market Manipulators purposely create these patterns since they are chock-full of stop liquidity.

The zone at the top where some people call consolidation is really where market makers are unloading their long inventory. They are also starting to accumulate sell side inventory.

As they Sell it down – they Target any Long stops that are resting at the swings. Remember, Buyers need to SELL in the future. Sellers need to BUY in the future.

So if You’re the Market Manipulator and you have SELL inventory – you need to BUY at a profitable price from someone willing to SELL to you at that price.

Who will be looking to SELL to you? All of the BUYERS stops – that are usually clumped together around swing highs and lows. (Since when retail started going long – they were BUYERS and need to SELL in the future. Their stops are the liquidity MM’s need).

We can’t see where the orders are but we have a great idea. They are at the swing areas.

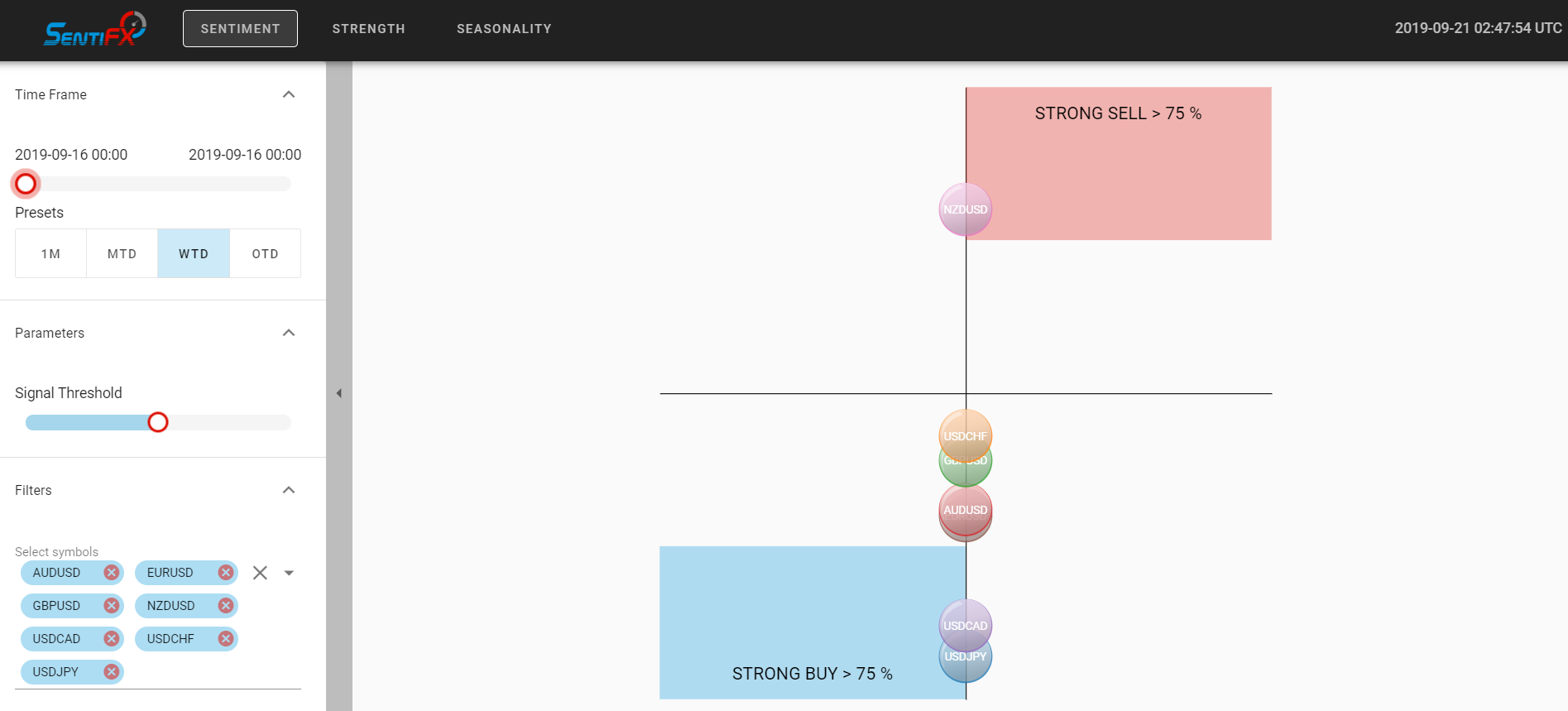

When we can see how retail positioning is changing over time – we know exactly where the MM’s will be targeting.

This is Sentiment positioning at the start of the week. Previous week NZDUSD was also a strong sell. The MM’s are already eyeing their targets.

From our perspective – NZDUSD starts to become even more and more of a sell.

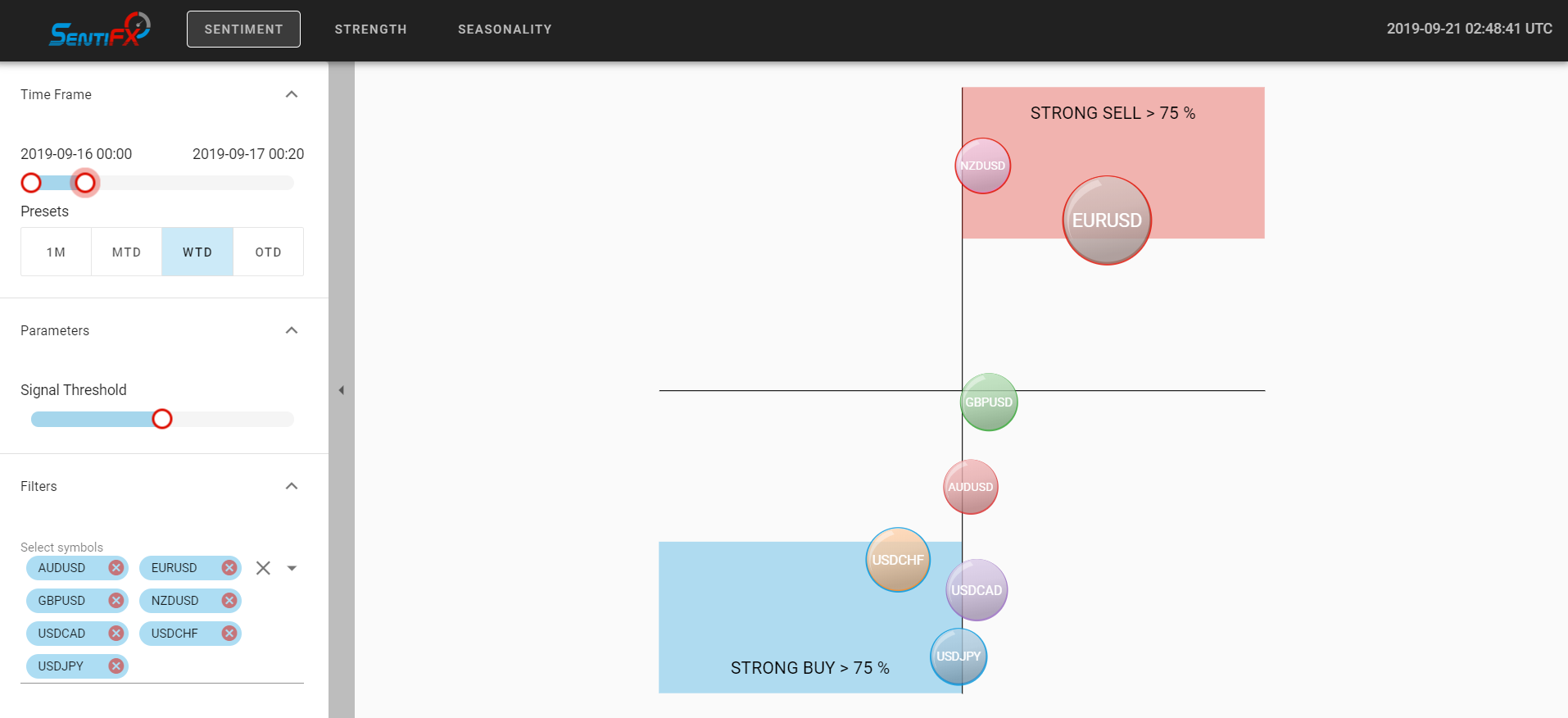

Retail isn’t piling in (based on the bubble size not becoming huge) but it is moving UP and to the RIGHT. This is a good sign for those looking to sell.

The poor sheep that are positioned long are holding on for dear life and their stops are hanging on at the swings.

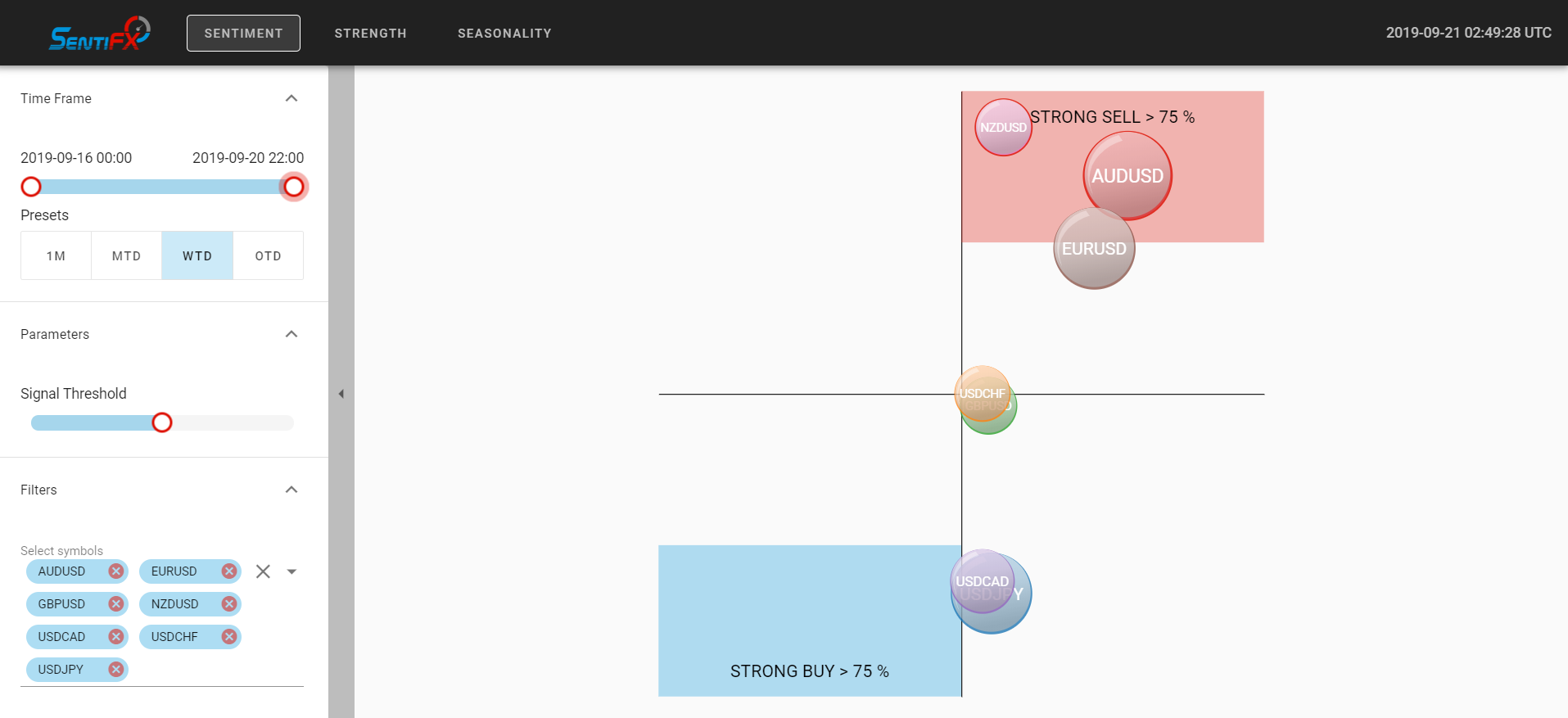

The Longs need to SELL where we want to BUY to exit our short positions.

More retail are getting in Long (as you can see sentiment is moving up for NZDUSD). They aren’t piling in fast like AUDUSD for instance – but they are getting in on the wrong side.

As you analyze the chart above – keep all of this in mind. Retail is positioned Long and steadily increasing those Longs. Their stops are either really close to price which causes double selling – or highly likely at the swing points.

They are getting stopped out all the way down.

P.S. If you’ve been following along – you also know that we had very profitable trades in USDJPY (gap fill) and AUDUSD shorts.

Using the SentiFX Analysis Suite we were able to make some really nice gains.

Leave A Comment