Trade Against Retail

Using Simple and Powerful Sentiment Analysis Tools

SentiFX Sentiment Analysis Tool

Why Should You Care?

We all know that 90-95% of Retail lose money over the long term. Doesn't it make sense to be on the opposite side of their trades for every trade you take?

Market Makers take advantage of the heard every day. Market Makers know where retail liquidity is and they take it. You can't beat them, but you can join them with the added edge of Sentiment.

You need Sentiment on your side to amplify your trading profits.

Finally, you can trade with more confidence.

Simple to Learn Signals

What You'll Get

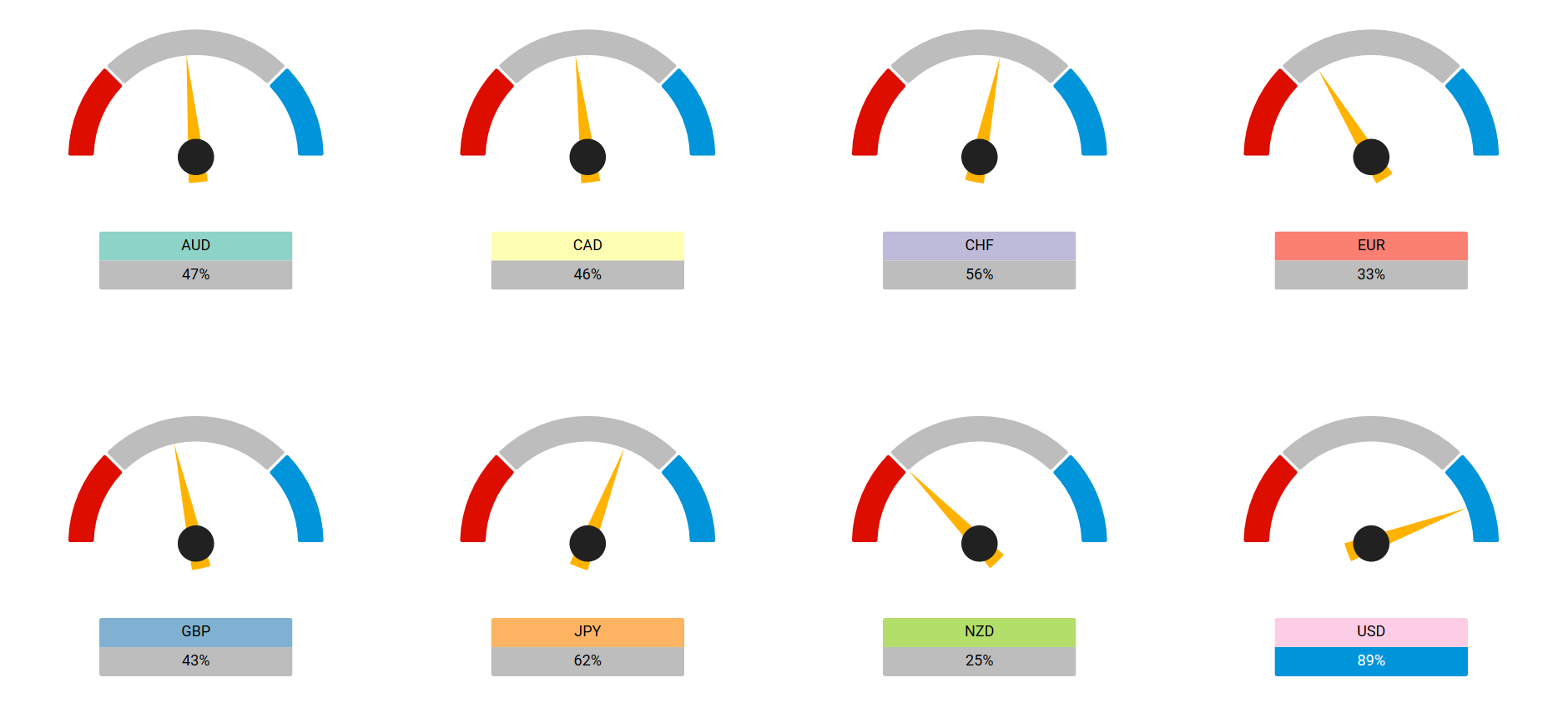

Currency Strength Index

a Quantitative Approach

Sentiment Analysis Tool

Trade with Edge

Seasonality

a Quantitative Approach

Currency Strength Index

The Sentiment Analysis Tool includes currency gauges that measure each currency against all other currencies. The result is a quantitative view of each currencies strength relative to all others.

Trade with the flow!

Sentiment Analysis Tool

Finally gain access to the strongest edge in FX - Trade against the retail herd.

Some traders make the mistake thinking they can just check an online site or two and wait for sentiment extremes and take trade opposite of retail. There is more to Sentiment Trading than that. We will teach you.

You'll learn how to apply Sentiment Trading to your current style of trading.

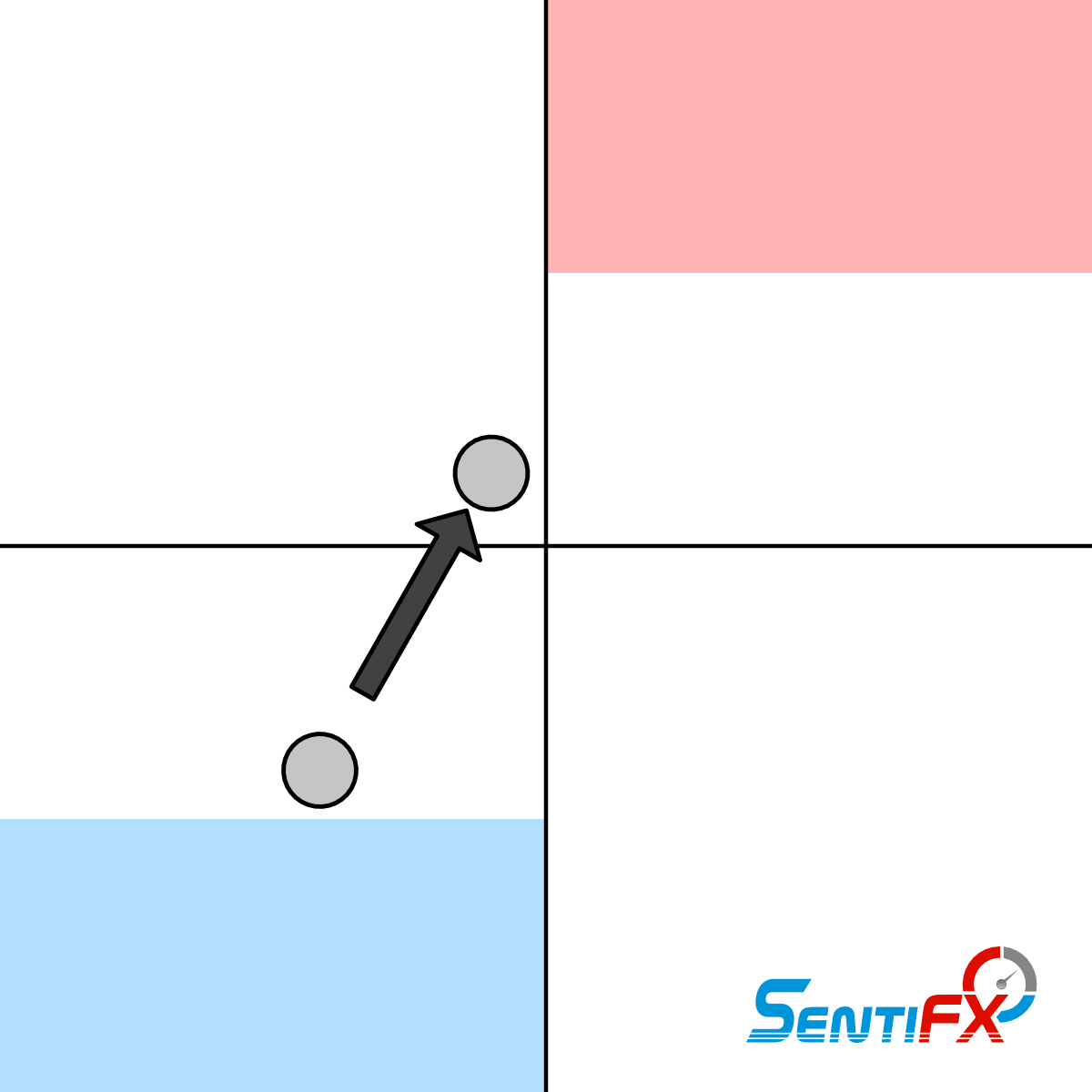

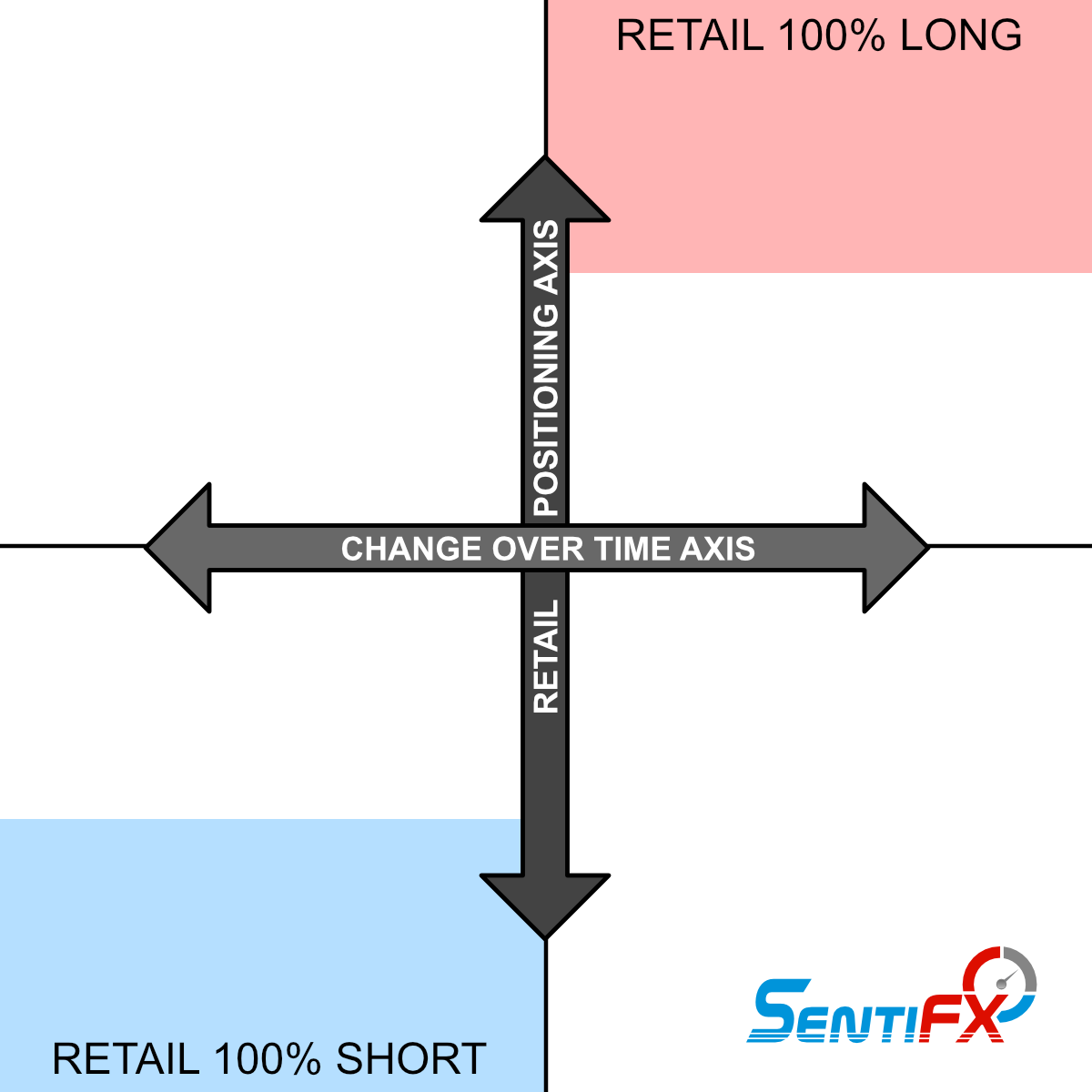

- How has Sentiment changed over time?

- How does a currencies sentiment compare to the rest of cross currencies?

- Has retail positioning shifted/changed? (very important)

The Sentiment Analysis Tool answers those questions and more.

$297 $197

lifetime access - single installment

Sentiment Analysis Tool

Finally gain access to the strongest edge in FX - Trade against the retail herd.

Some traders make the mistake thinking they can just check an online site or two and wait for sentiment extremes and take trade opposite of retail. There is more to Sentiment Trading than that. We will teach you.

You'll learn how to apply Sentiment Trading to your current style of trading.

- How has Sentiment changed over time?

- How does a currencies sentiment compare to the rest of cross currencies?

- Has retail positioning shifted/changed? (very important)

The Sentiment Analysis Tool answers those questions and more.

$297 $197

lifetime access - single installment

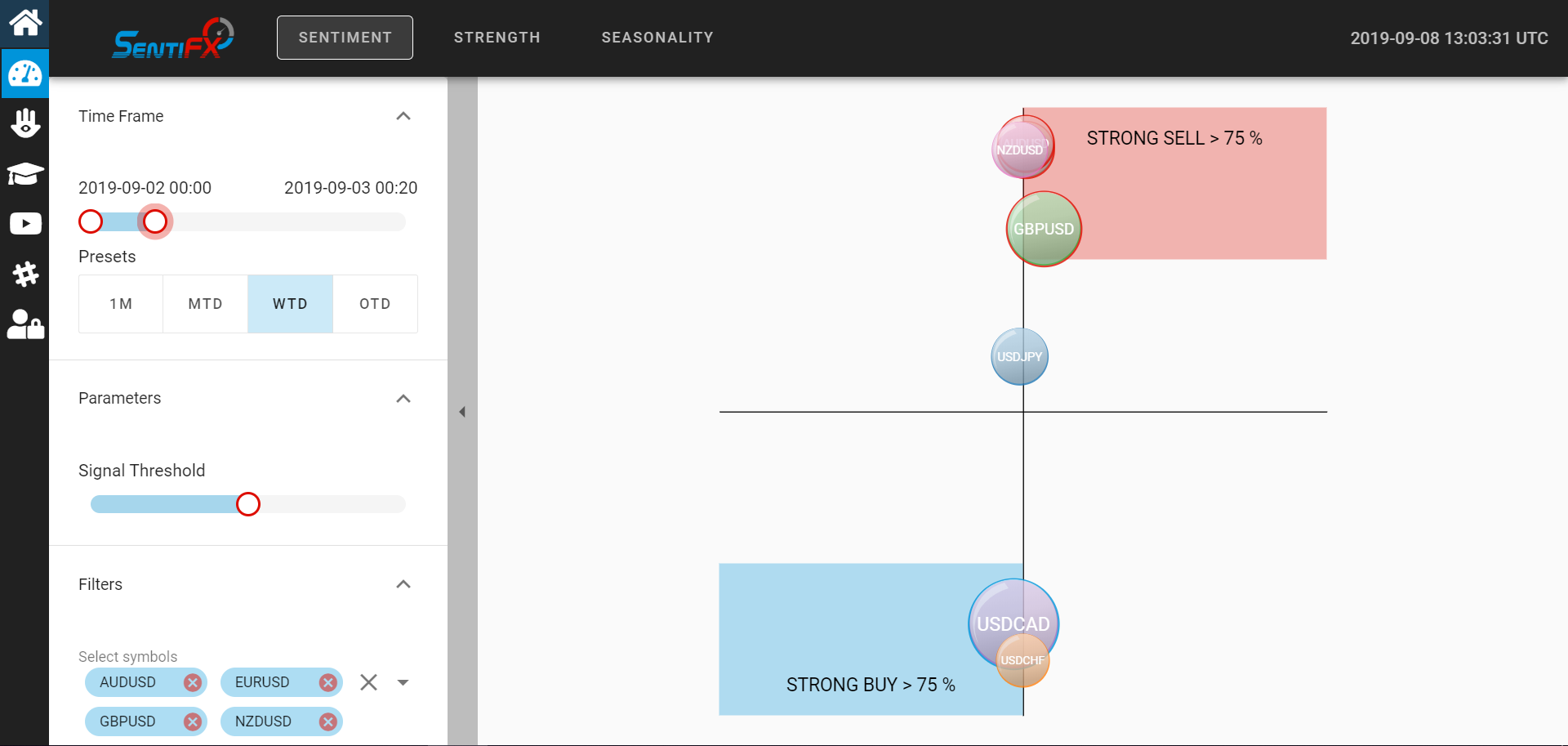

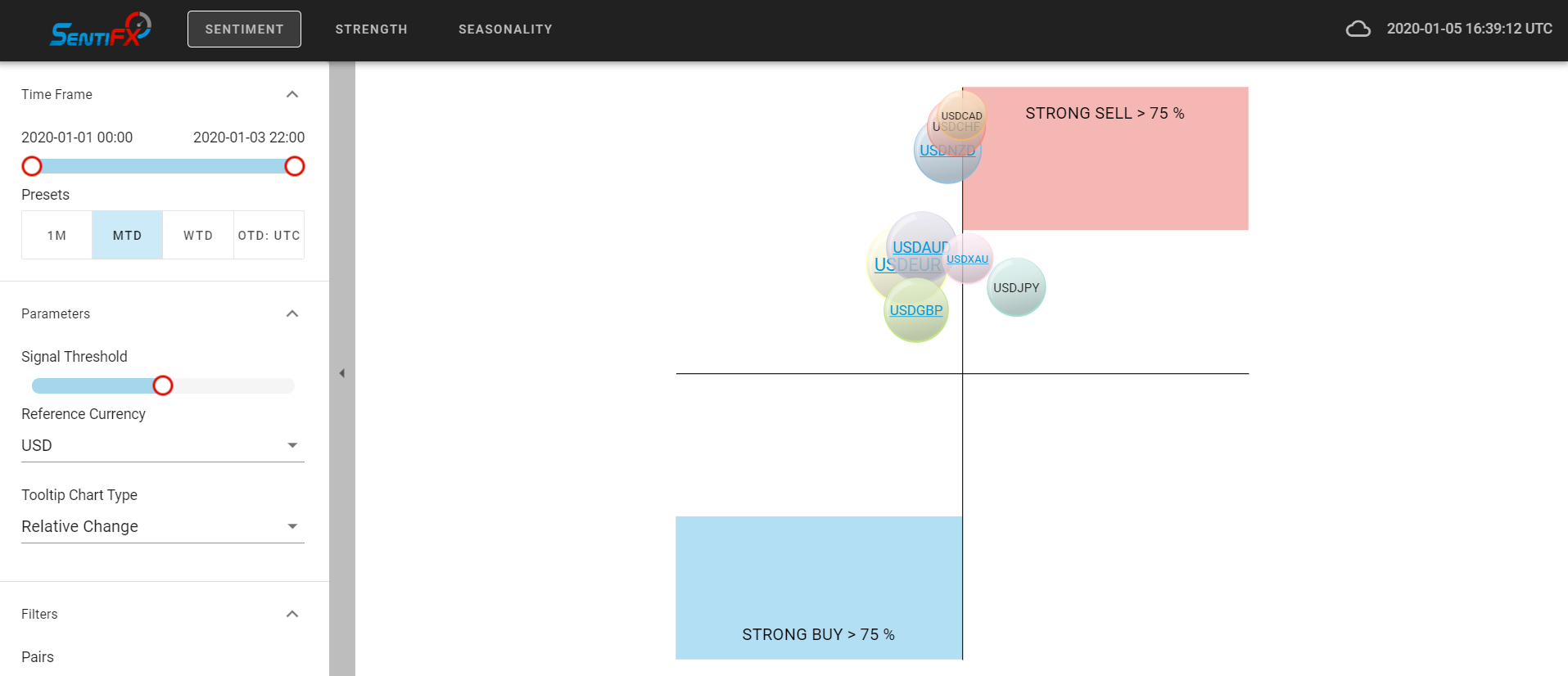

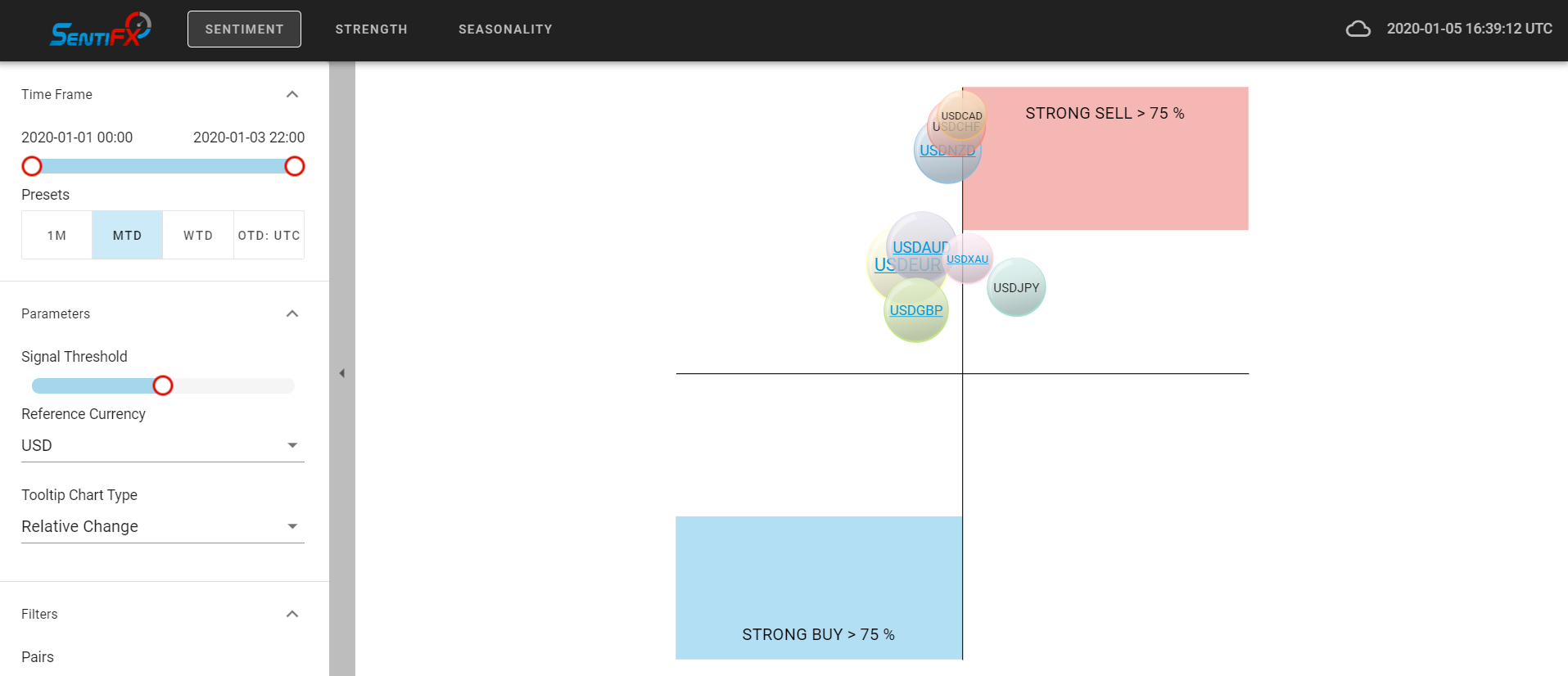

Basket Analysis

Choose a Base Currency to compare against all other currencies (i.e. USD/XXX)

Quickly assess how the Retail sheep are positioned overall for any currency.

Quick Flip

Check on Sentiment vs. the Currency you Choose

With the click of a button you can flip through each currency to see the sentiment of other currencies. This is different than Basket Analysis as the Currencies stay in their proper format.

Instant Replay

Watch Sentiment as You scroll through time

Want to see how Sentiment has changed throughout the Day, Week, or even Month? It's as easy as clicking and dragging.

Instant Alarms

Choose the pairs and events for which you like to receive alarms

Get the alarms delivered immediately to you as they happen, via Email or Slack.

Signals

Clear and easy interpretation

All signals are fully documented and explained in the instructional material. Start using them right away and don't waste any time.

Major Pairs

Check 26 most important pairs

Get all major currency pairs for analysis. Display and compare up to 12 symbols to stay on top of the market.

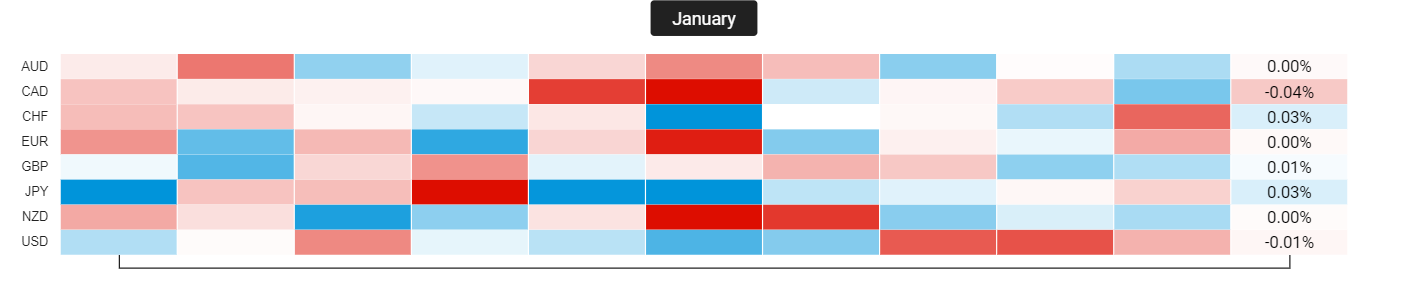

Seasonality

Prepare for each month by getting a quick Quantitative view on the Strongest and Weakest Currency Pairs.

This is added Edge that most Forex Trader's don't even know about.

Proven Edge by Quantitative Analysis

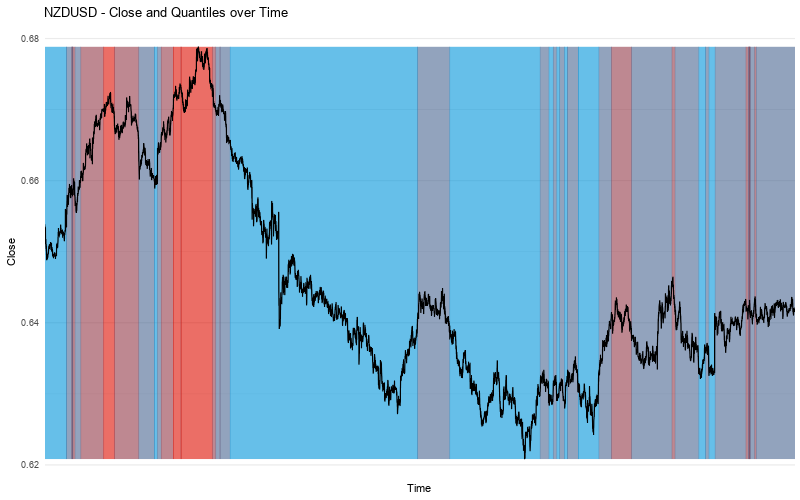

We did a deep dive using quantitative analysis to see if Sentiment Trading had edge. The results were in line with what we expected.

The Results? Price moves opposite to the retail herd.

Look at the image to the right - it doesn't take a rocket scientist to see that when retail was Shorting (red background) price moved up and when retail was going Long (blue background) price moved down.

Proven Edge by Quantitative Analysis

We did a deep dive using quantitative analysis to see if Sentiment Trading had edge. The results were in line with what we expected.

The Results? Price moves opposite to the retail herd.

Quantitative Analysis done using the statistical analysis environment R

Look at the image above - it doesn't take a rocket scientist to see that when retail was Shorting (red background) price moved up and when retail was going Long (blue background) price moved down.

Never Miss a Signal Again!

Alerts Instantly Sent to Your Email & Slack

As an added bonus, you get alerts FREE.

Configure Alerts to work with the pairs that you trade.

Is Retail Over Extended? You get notified.

Is Retail Shifting Sides? You get notified.

Has Order Flow changed direction? You get notified.

Who is Sentiment Trading for?

Traders who believe the Market is Manipulated and want to be on the side of the Market Manipulators.

Traders who know that most retail lose and want to take trades opposite of the retail herd.

Traders who want more confidence taking their trades and holding on longer for bigger profit.

Access a Trading Community

You get more than the Powerful Sentiment Analysis Tools, Indicators, and Education.

You also get access to other Traders who

use the Edge of Sentiment every day on Slack.

Get the Edge You Need

Sentiment Analysis Tool

Lifetime License

$297 $197

lifetime access - single installment