Sentiment Analysis Tool

Welcome to the SentiFX Sentiment Analysis Tool instructional guide.

It’s important to understand what you’re seeing on the screen as well as the setups that you want to look out for.

In the FX market – this is the closest we can get to Level 2 type order information. We combine Sentiment Analysis with Market Structure and Order Flow to make trading decisions. We also target Retail Stops where the liquidity likely is.

This is the most powerful tool that you have available to understand how the retail sheep are positioning and changing their positioning over time. Retail traders are liquidity providers and are targeted due to their over leveraging of positions and the markets natural need to seek liquidity to transact.

You can use this Sentiment Analysis information to guide your trading decisions to suit your trading style.

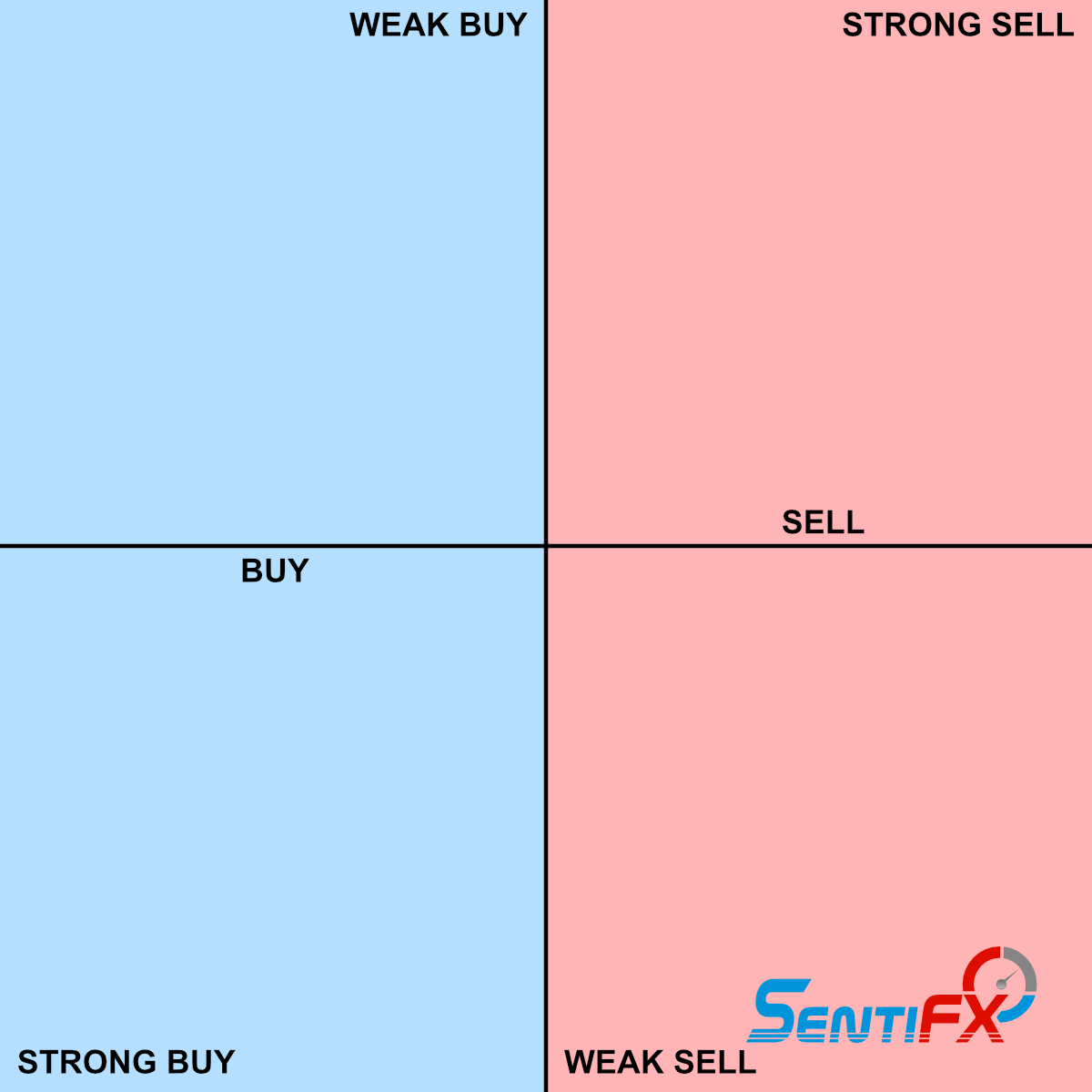

Zones

The first part of understanding the SentiFX Sentiment Analysis Tool is to understand that we want to consider BUYING when the currency bubble is to the left of the vertical Y axis and consider SELLING when the bubble is to the right of the vertical Y axis.

The tool is already setup to be opposite of the sheep so that you don’t have to even think about it.

BUY is to the left. SELL is to the right.

The STRONGEST BUY is at the bottom left corner.

The STRONGEST SELL is at the top right corner.

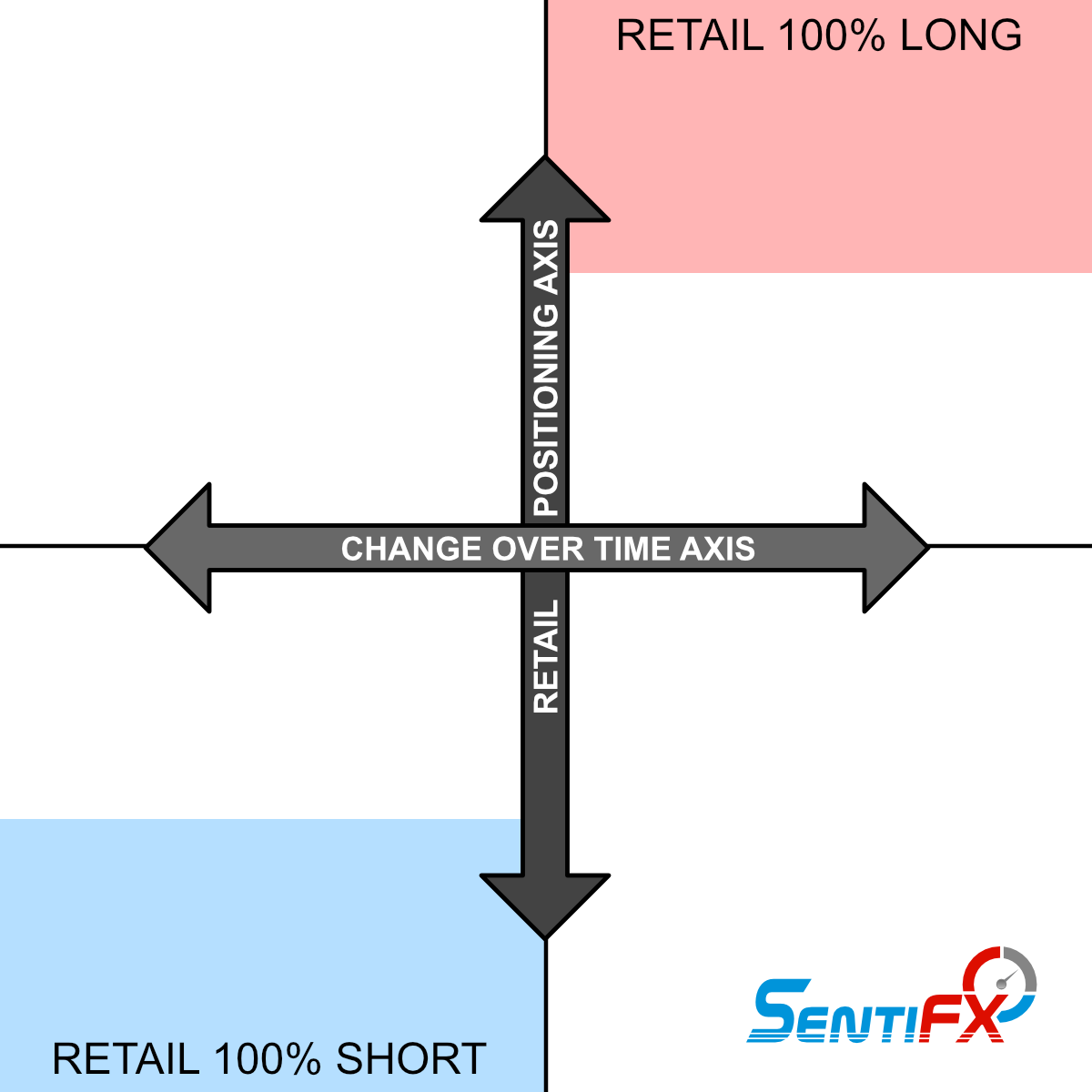

Axis Explained

The Y axis designates retail positioning from 100% Long at the very top and 100% Short at the very bottom.

Again, the chart is already inverted so we DO NOT have to flip our bias to be contrarian to the retail sheep.

When retail are say > 75% Long, we want to consider going Short. When retail is > 75% Short, we want to consider going Long.

The X axis is change over time.

If retail is positioning more short over a period of time, the bubble will move left.

If retail is positioning more long over a period of time, the bubble will move right.

The size of the bubble is based on the relative change in retail positioning. It is calculated in relation to all the pairs you have selected, so selecting different pairs will affect the size of the individual bubbles. Put simply – the bigger the bubble the more attention we want to give it among all pairs we are currently looking at.

Sentiment Setups

Let’s get into the Sentiment Setups. We are going to go over the various setups that you will see time and time again.

Understanding these setups is very important so please spend some time trying to understand them.

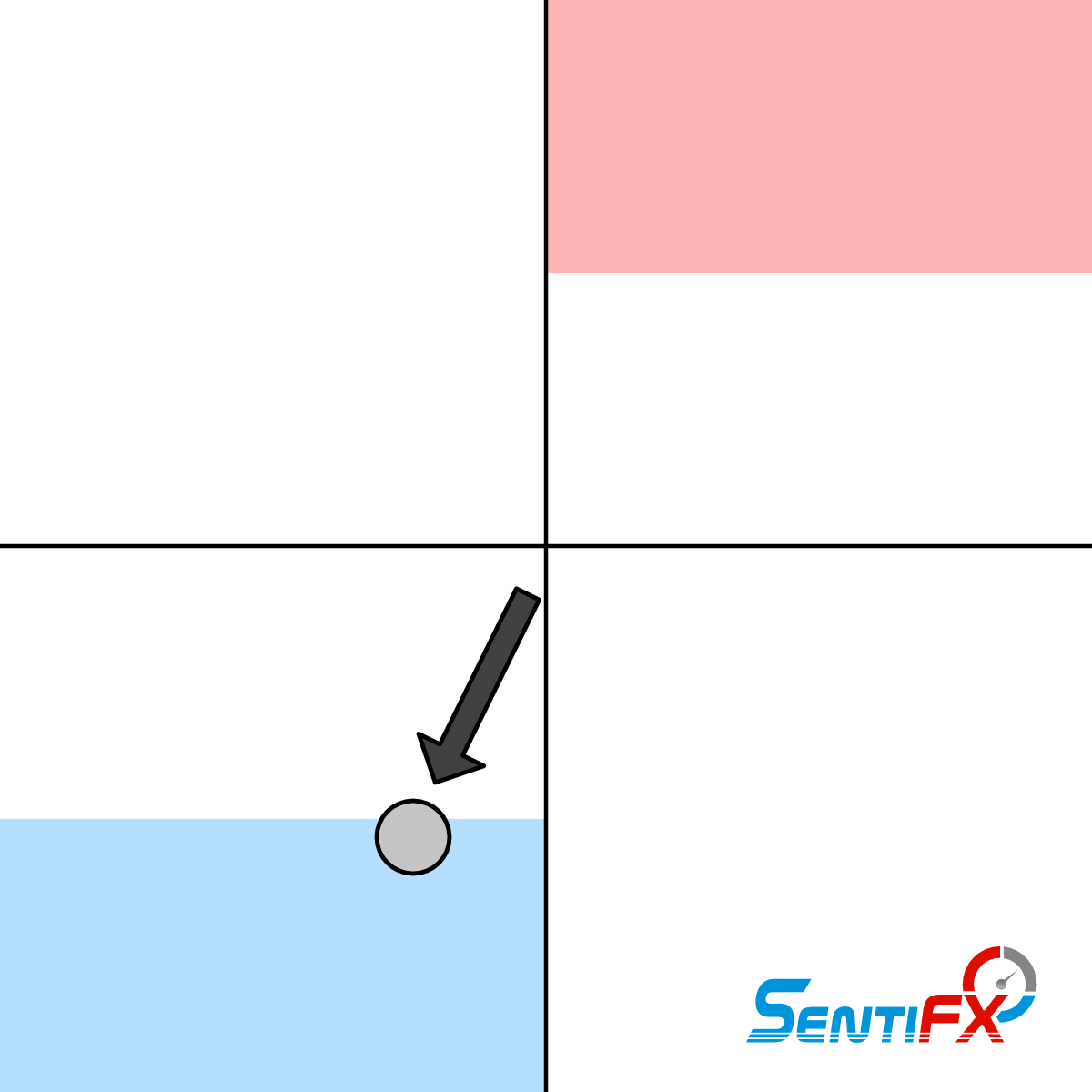

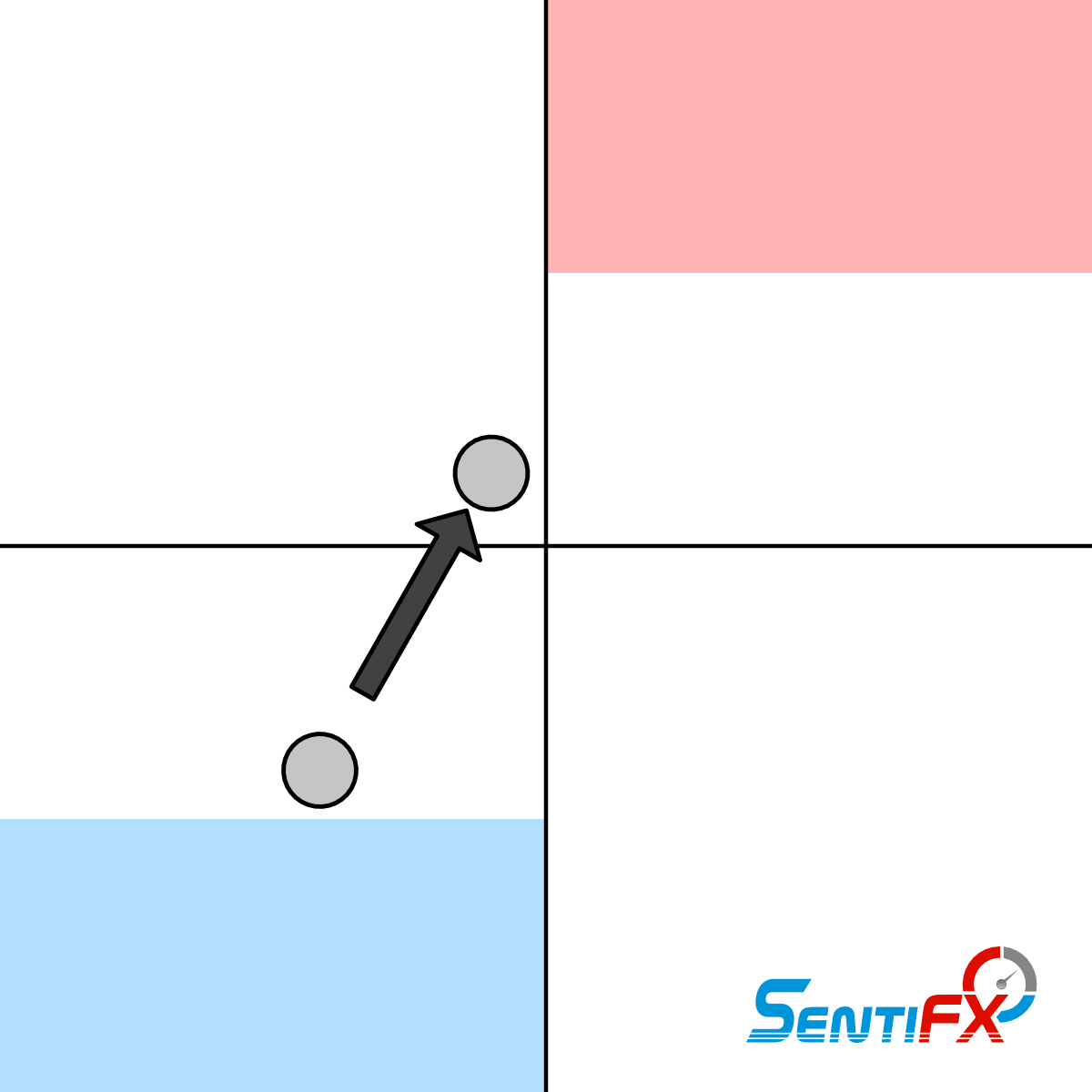

Fresh Entry Setup

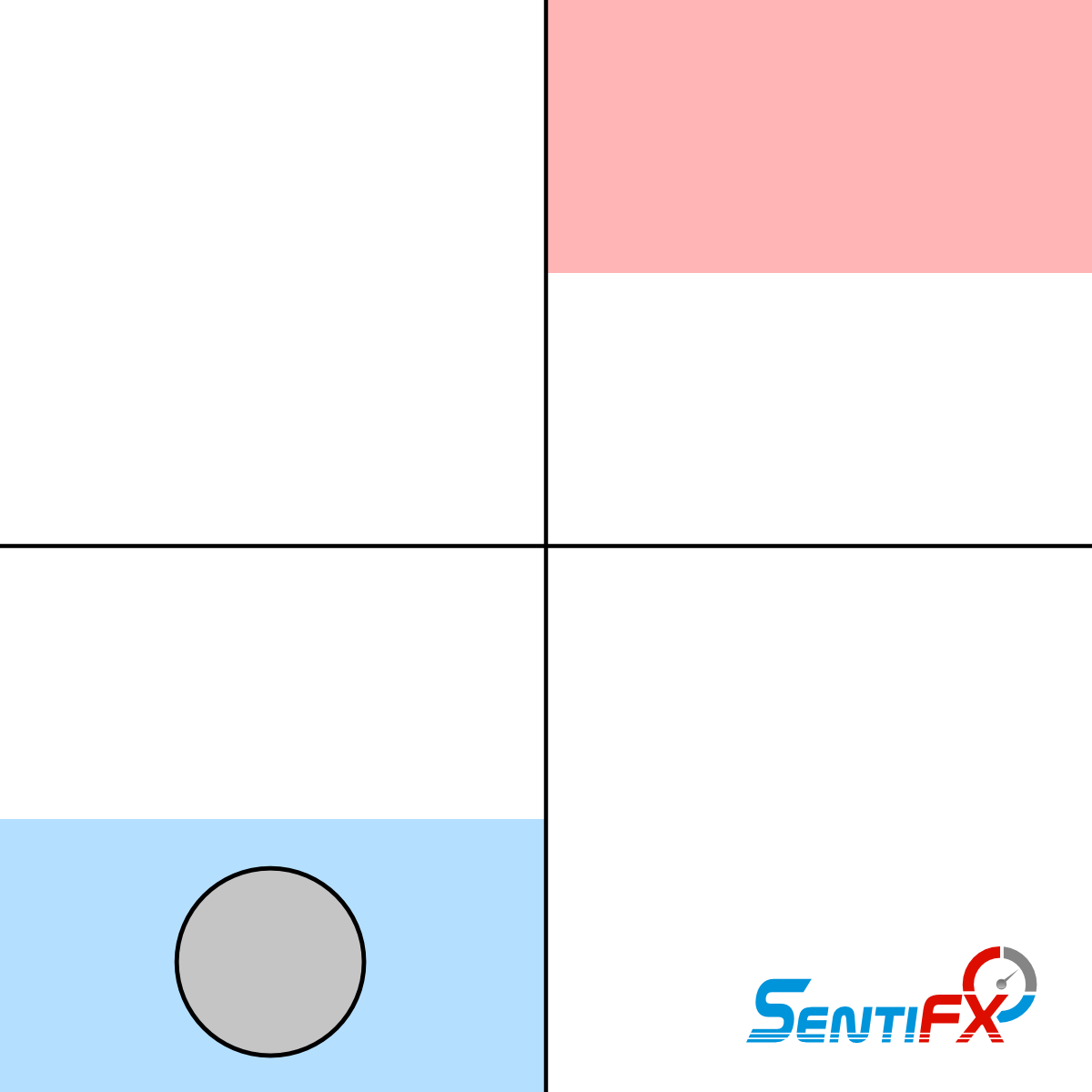

Fresh Entry BUY

SETUP: This occurs when a Bubble freshly enters the colored Strong Zone.

Meaning: Retail is overly positioned on one side of the trade – this creates an imbalance. Markets seek balance.

Action: Look towards Market Structure and Order Flow to take a position opposite of the sheep.

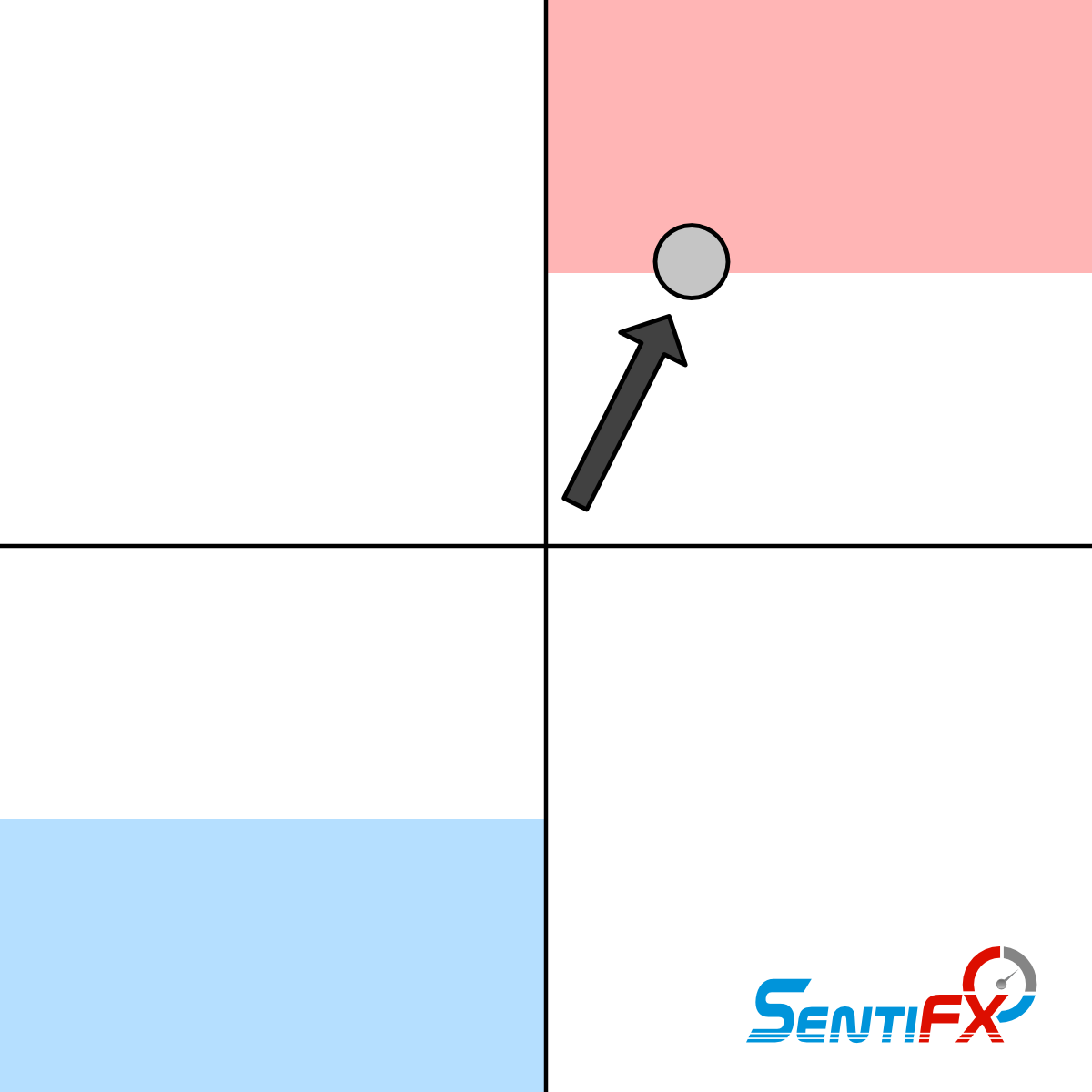

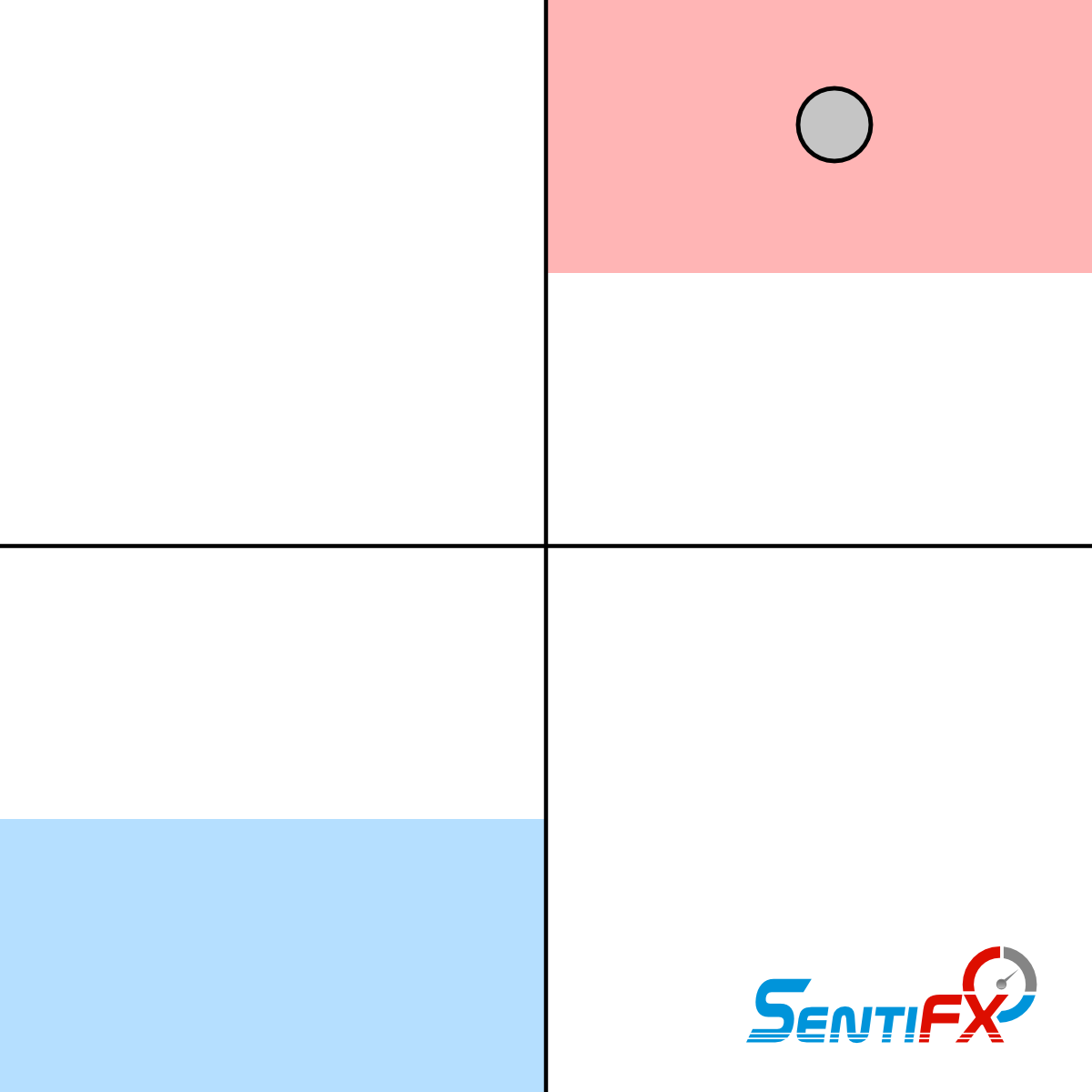

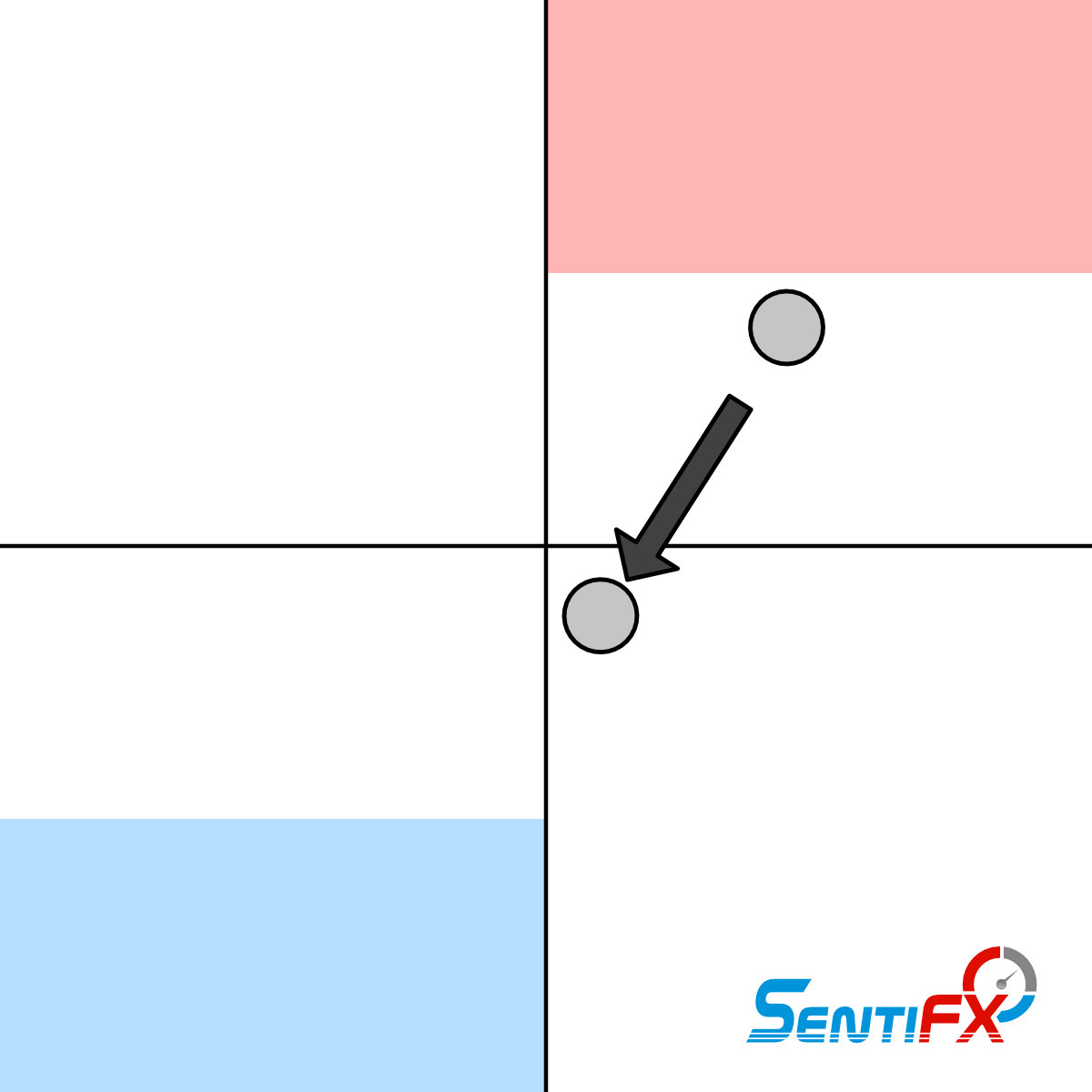

Fresh Entry SELL

SETUP: This occurs when a Bubble freshly enters the colored Strong Zone.

Meaning: Retail is overly positioned on one side of the trade – this creates an imbalance. Markets seek balance.

Action: Look towards Market Structure and Order Flow to take a position opposite of the sheep.

Popping Bubble SELL

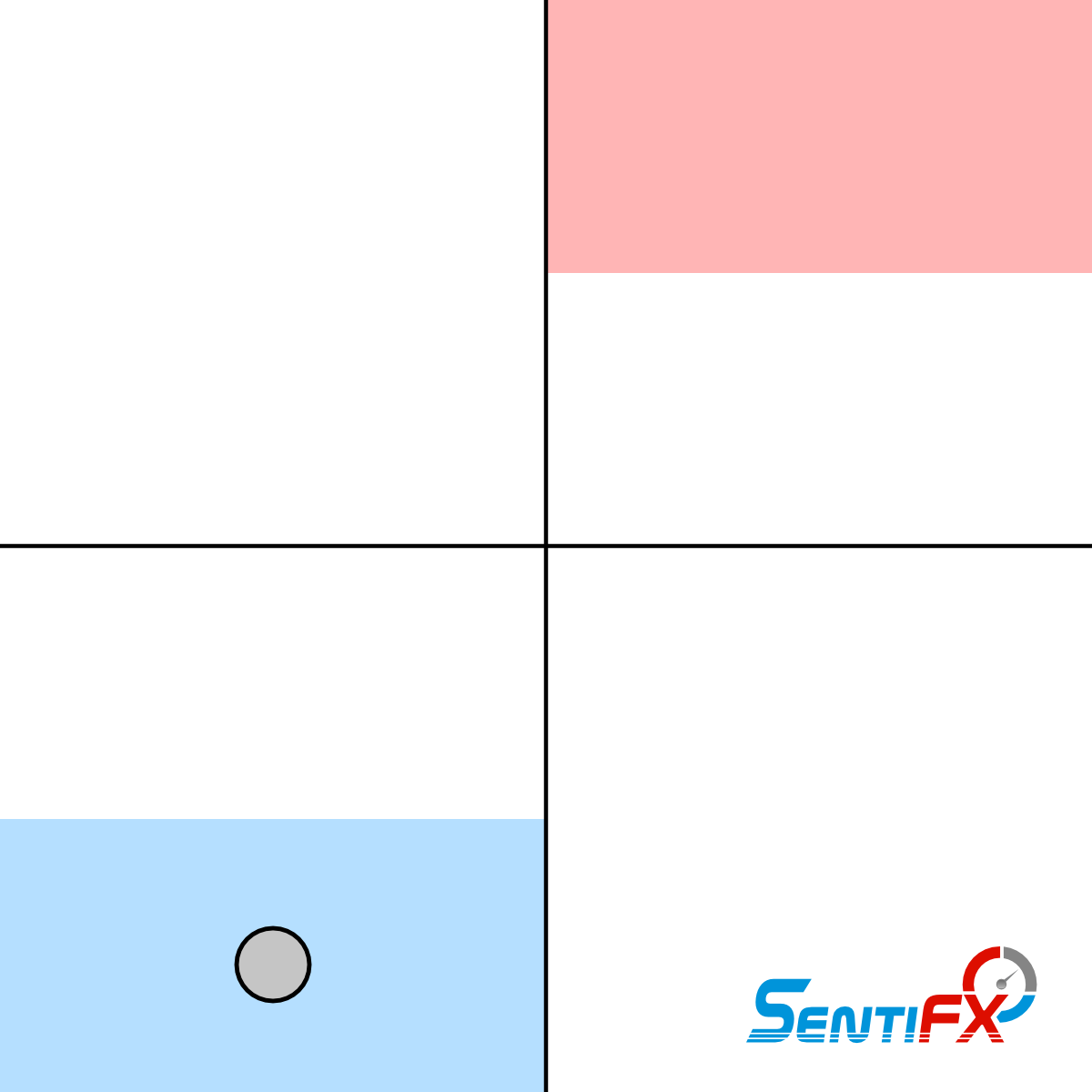

Bubble Popping SELL

SETUP: This occurs when a Bubble is in a colored zone and goes from very large to a normal sized Bubble near the Strong Buy Zone.

Meaning: Retail has likely been stopped out and are no longer overly positioned.

Action: This is where we want to consider looking for opportunities going WITH the original sheep SELL position as they are no longer in and likely will be switching sides. Verify that stops have been taken. Note: There is more risk with this setup but can be highly profitable.

Popping Bubble BUY

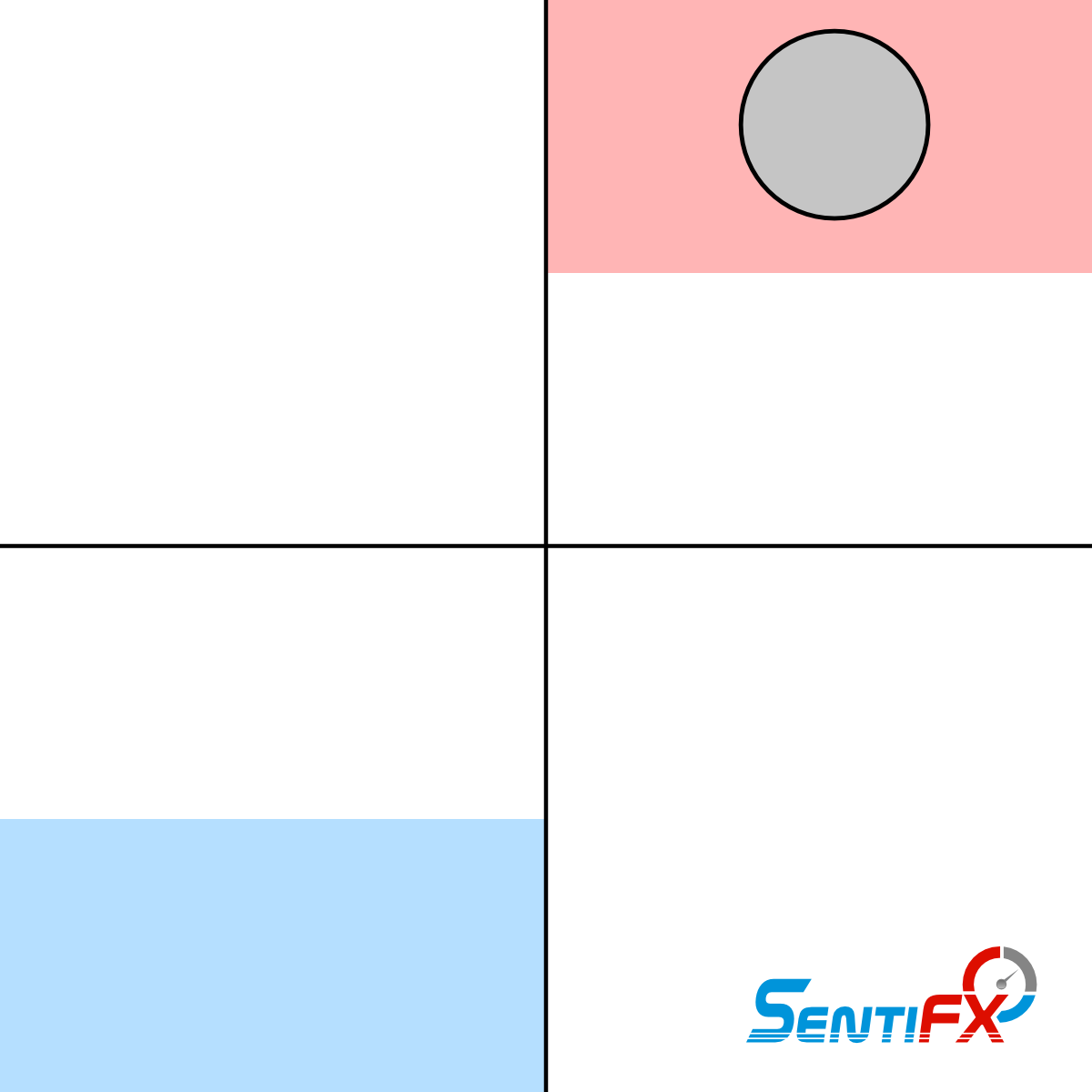

Bubble Popping BUY

SETUP: This occurs when a Bubble is in a colored zone and goes from very large to a normal sized Bubble near the Strong Sell Zone.

Meaning: Retail has likely been stopped out and are no longer overly positioned.

Action: This is where we want to consider looking for opportunities going WITH the original sheep BUY position as they are no longer in and likely will be switching sides. Verify that stops have been taken. Note: There is more risk with this setup but can be highly profitable.

X Axis Crossover

X Axis Crossover SELL

SETUP: This occurs when a Bubble crosses over the X Axis towards the Strong Sell area.

Meaning: Retail positioning is starting to tip the scale in the other direction and creating imbalance. If the bubble is center of the X axis, positioning is balanced. If the bubble is above the X Axis, retail is BUYING. if the bubble is below the X Axis, retail is SELLING.

Action: Look towards Market Structure and Order Flow to take a position in the direction of the color the bubble is headed towards. Note: This trade a little more risk as it is more anticipatory in nature but can be more profitable as you may be getting in at the beginning of the move.

X Axis Crossover BUY

SETUP: This occurs when a Bubble crosses over the X Axis towards the Strong Buy area.

Meaning: Retail positioning is starting to tip the scale in the other direction and creating imbalance. If the bubble is center of the X axis, positioning is balanced. If the bubble is above the X Axis, retail is BUYING. if the bubble is below the X Axis, retail is SELLING.

Action: Look towards Market Structure and Order Flow to take a position in the direction of the color the bubble is headed towards. Note: This trade a little more risk as it is more anticipatory in nature but can be more profitable as you may be getting in at the beginning of the move.

Y Axis Crossover

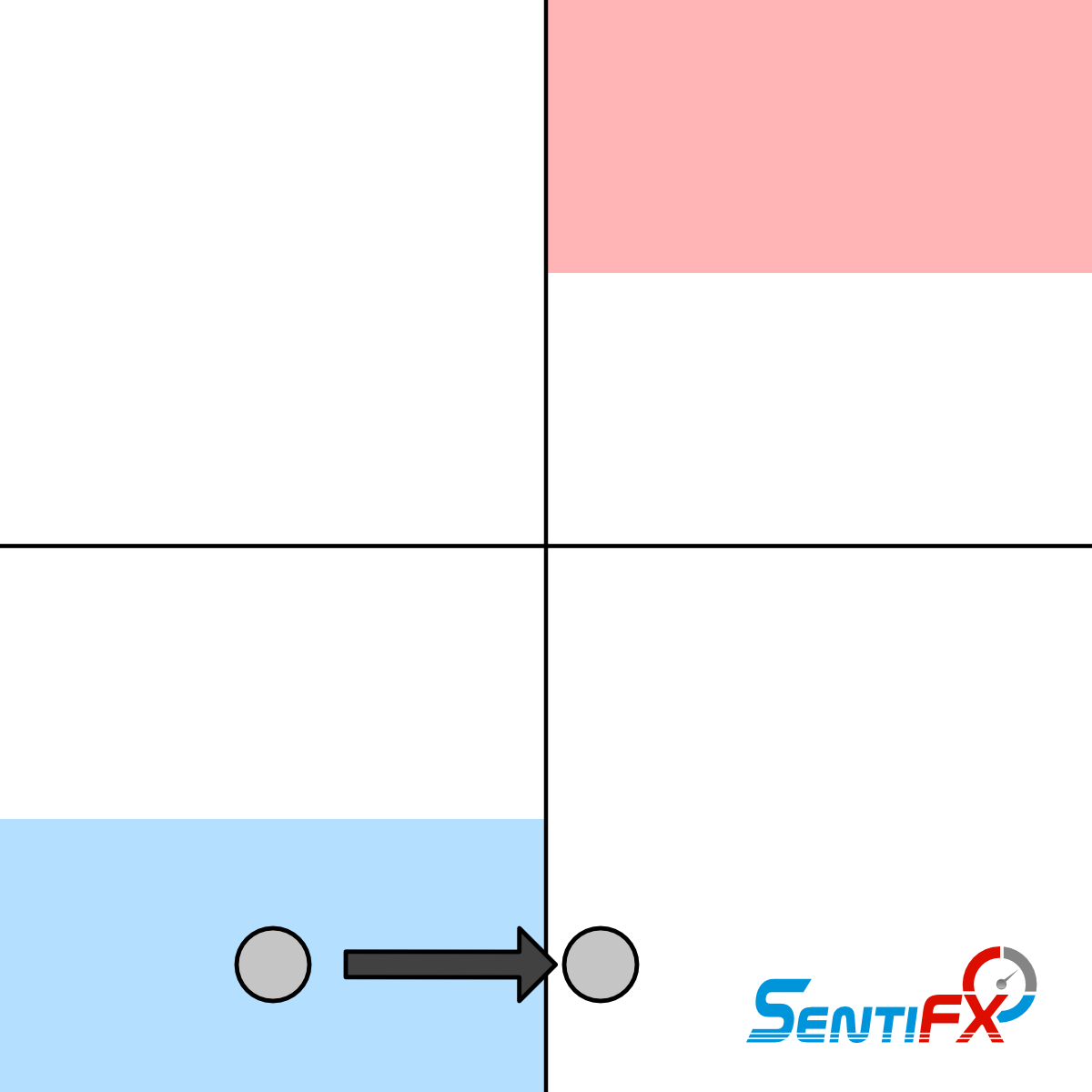

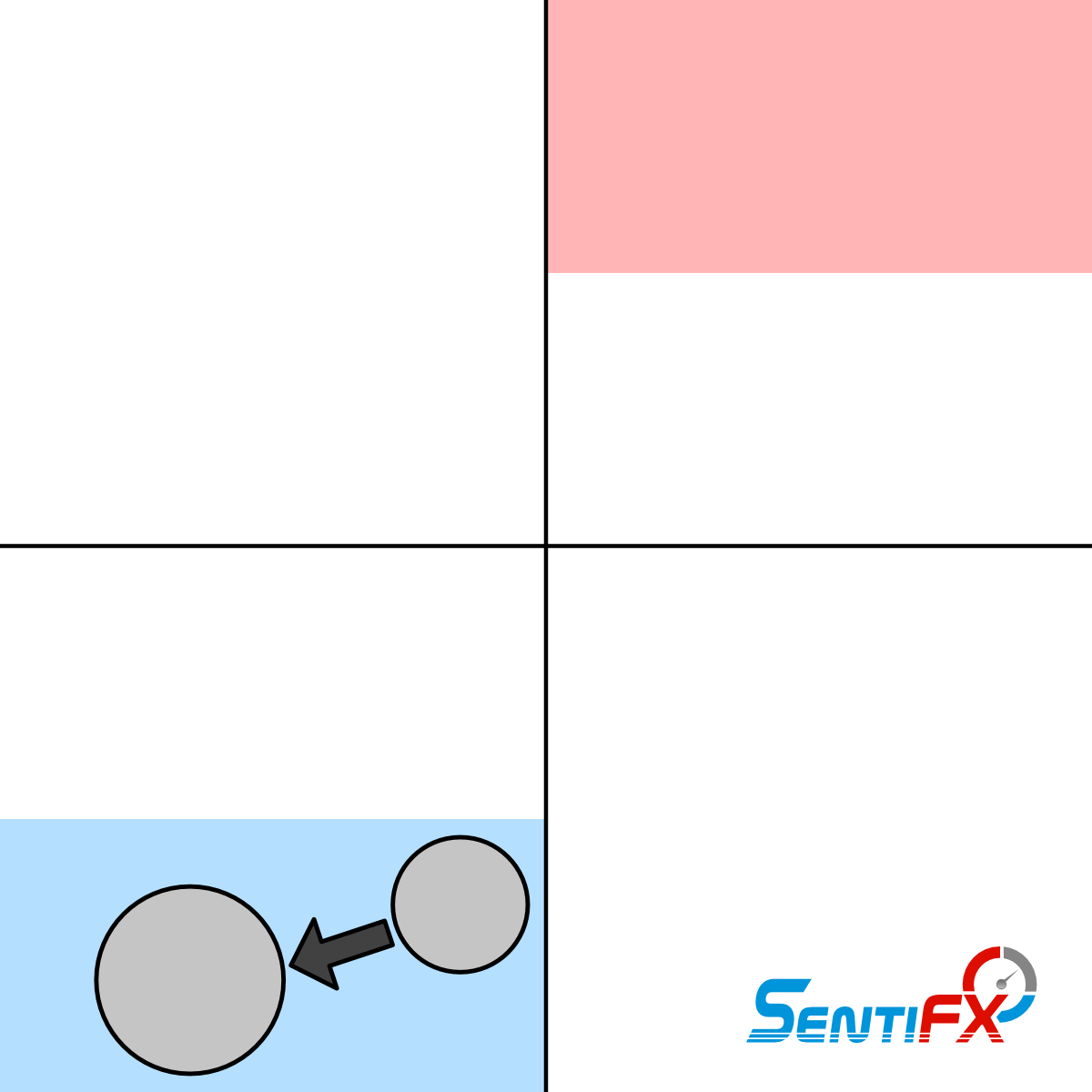

Y Axis Crossover BUY

SETUP: This occurs when a Bubble crosses over the Y Axis.

Meaning: Retail is starting to shift their positioning to the other side.

Action: Look towards Market Structure and Order Flow to take a position OPPOSITE of where the Bubble was before the cross over. Note: This trade has a lot more risk as it is more anticipatory in nature but can be very profitable as you may be getting in at the beginning of the move.

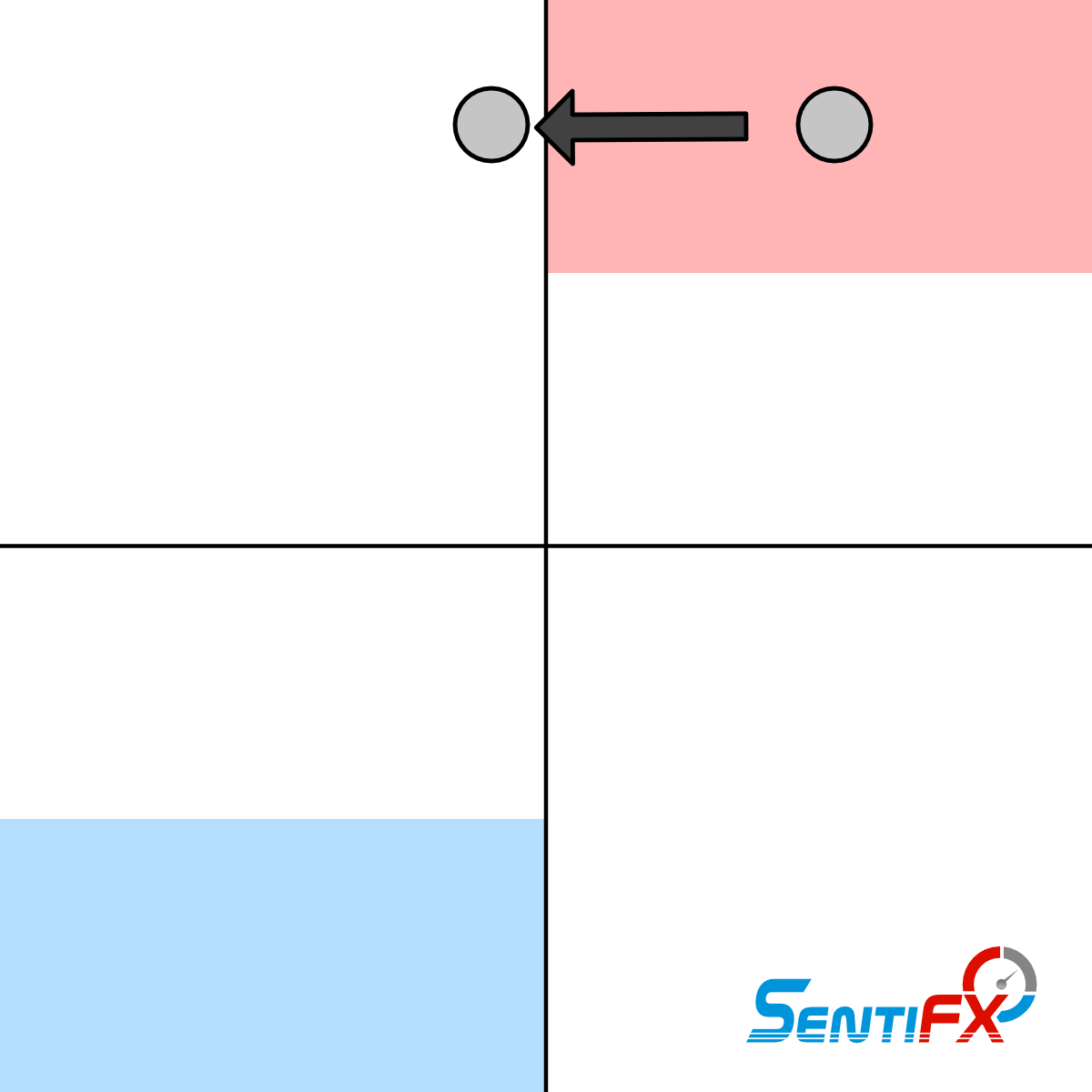

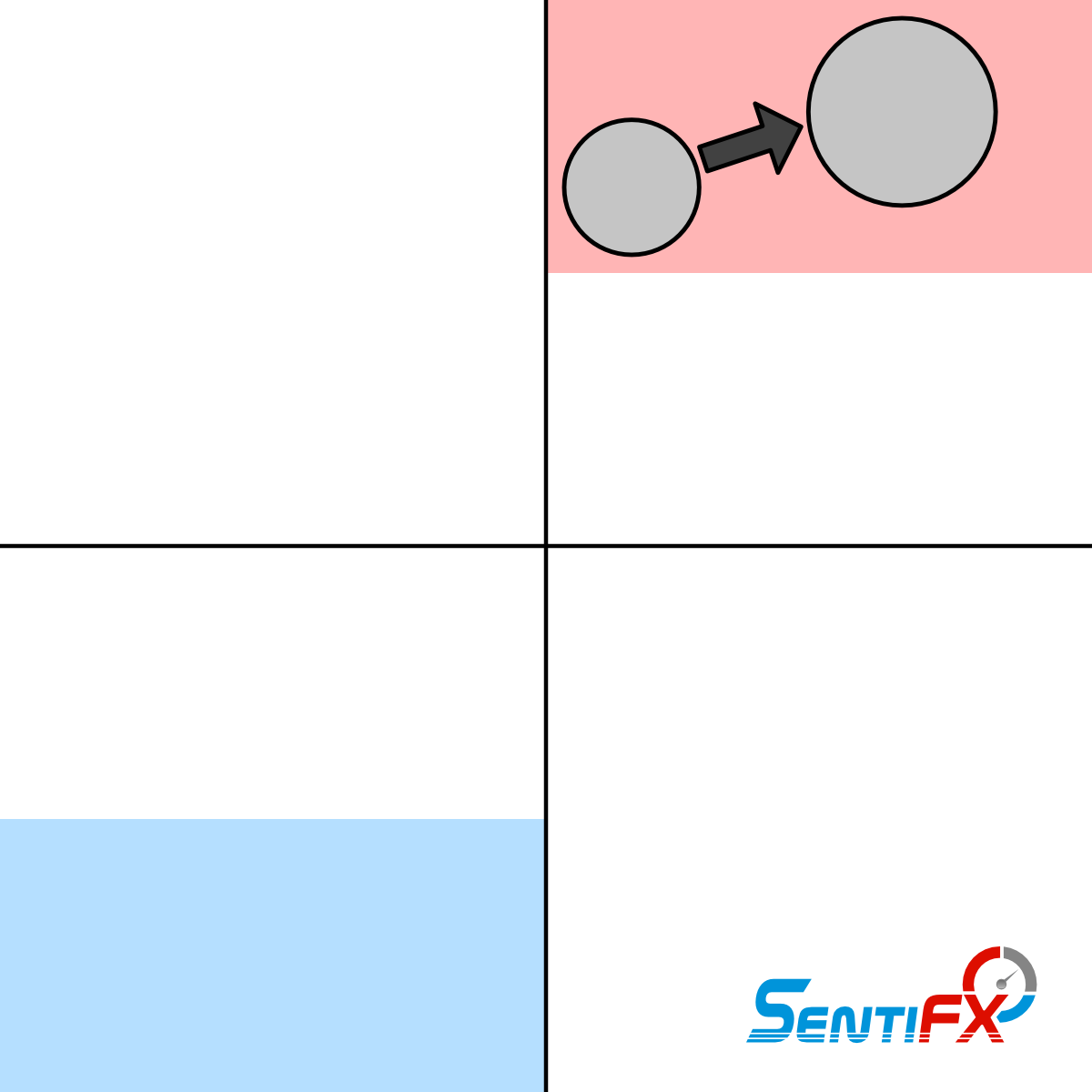

Y Axis Crossover SELL

SETUP: This occurs when a Bubble crosses over the Y Axis.

Meaning: Retail is starting to shift their positioning to the other side.

Action: Look towards Market Structure and Order Flow to take a position OPPOSITE of where the Bubble was before the cross over. Note: This trade has a lot more risk as it is more anticipatory in nature but can be very profitable as you may be getting in at the beginning of the move.

Growing Bubble

Growing Bubble BUY

SETUP: This occurs when a Bubble grows significantly in size.

Meaning: Retail is piling in and creating imbalance. The market seeks balance.

Action: Look at the position of the bubble in relationship to the grid and use Market Structure and Order Flow to guide. If the bubble is in a colored zone, you can be more confident taking a position in the direction of the colored zone targeting retail stops.

Growing Bubble SELL

SETUP: This occurs when a Bubble grows significantly in size.

Meaning: Retail is piling in and creating imbalance. The market seeks balance.

Action: Look at the position of the bubble in relationship to the grid and use Market Structure and Order Flow to guide. If the bubble is in a colored zone, you can be more confident taking a position in the direction of the colored zone targeting retail stops.