Gain Strong Directional Bias

The Fastest Way to Profitability

Sentiment Trading Quick Start Guide

Tired of Losing Money Trading?

Tired of Losing Money Trading?

First, you have to ask - why are you trading in the first place. Are you in a frustrating or boring day job and want financial freedom? Maybe you're just looking for some extra money on the side. You've probably experimented with different ways of trading by now and haven't had much success.

We know that 90-95% of retail traders lose money.

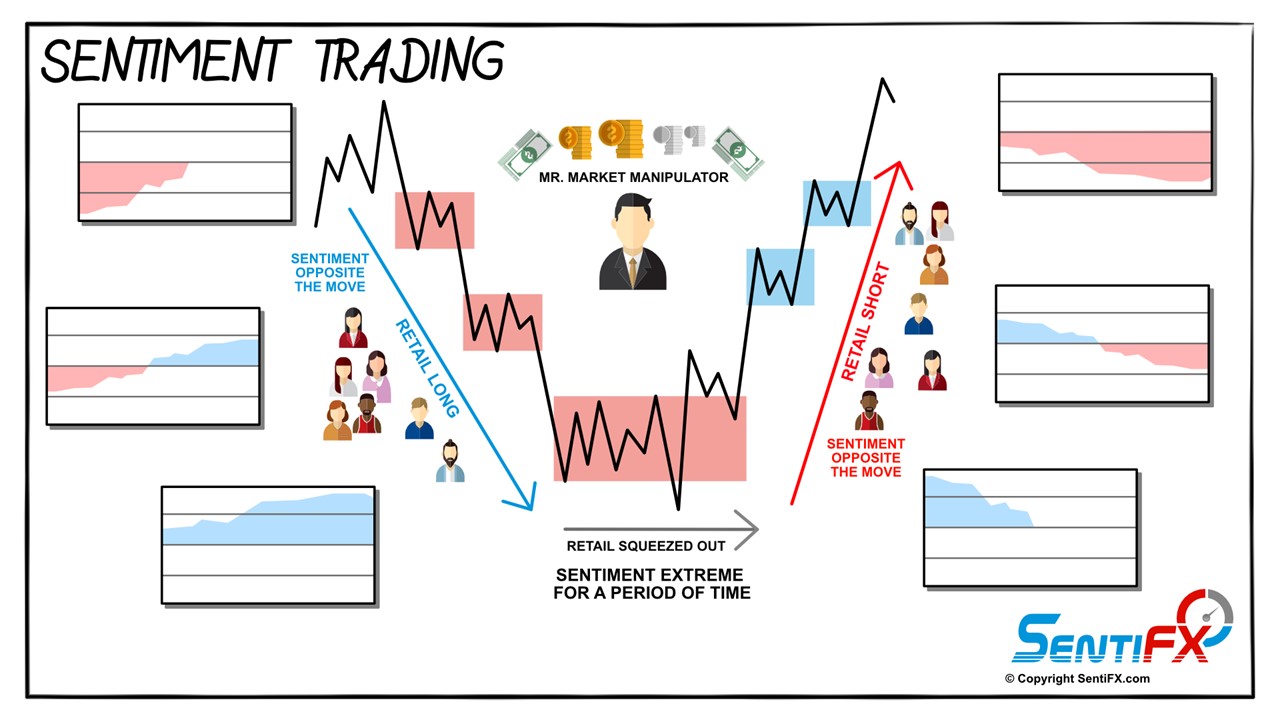

What if I told you that you can trade profitably and consistently by having a directional bias opposite of retail traders and with the direction of Market Makers?

If you want to achieve your trading goals, you need the added edge of Sentiment to help you in your journey.

Now you can win more trades and make more money.

First, you have to ask - why are you trading in the first place. Are you in a frustrating or boring day job and want financial freedom? Maybe you're just looking for some extra money on the side. You've probably experimented with different ways of trading by now and haven't had much success.

We know that 90-95% of retail traders lose money.

What if I told you that you can trade profitably and consistently by having a directional bias opposite of retail traders and with the direction of Market Makers?

If you want to achieve your trading goals, you need the added edge of Sentiment to help you in your journey.

Now you can win more trades and make more money.

Profit from 6 Sentiment Signals

Profit from 6 Sentiment Signals

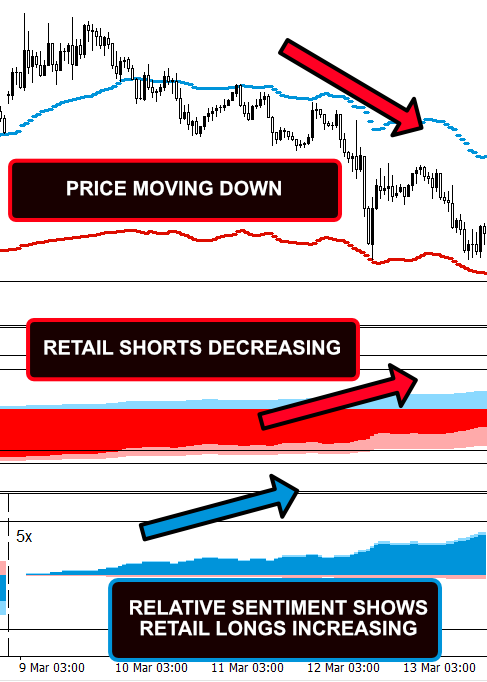

There are 6 signals that we use to profit from the markets week after week with detailed explanations.

If you're serious about making money - you need to have these added to your existing trading method.

Discover the setups and how to take advantage of these moves.

You'll see examples that were pulled directly from the prior week of trading (at the time of the video recording). No cherry picking here. See how these play out every week.

There are 6 signals that we use to profit from the markets week after week with detailed explanations.

If you're serious about making money - you need to have these added to your existing trading method.

Discover the setups and how to take advantage of these moves.

You'll see examples that were pulled directly from the prior week of trading (at the time of the video recording). No cherry picking here. See how these play out every week.

Learn Sentiment Analysis

+ Market Cycle

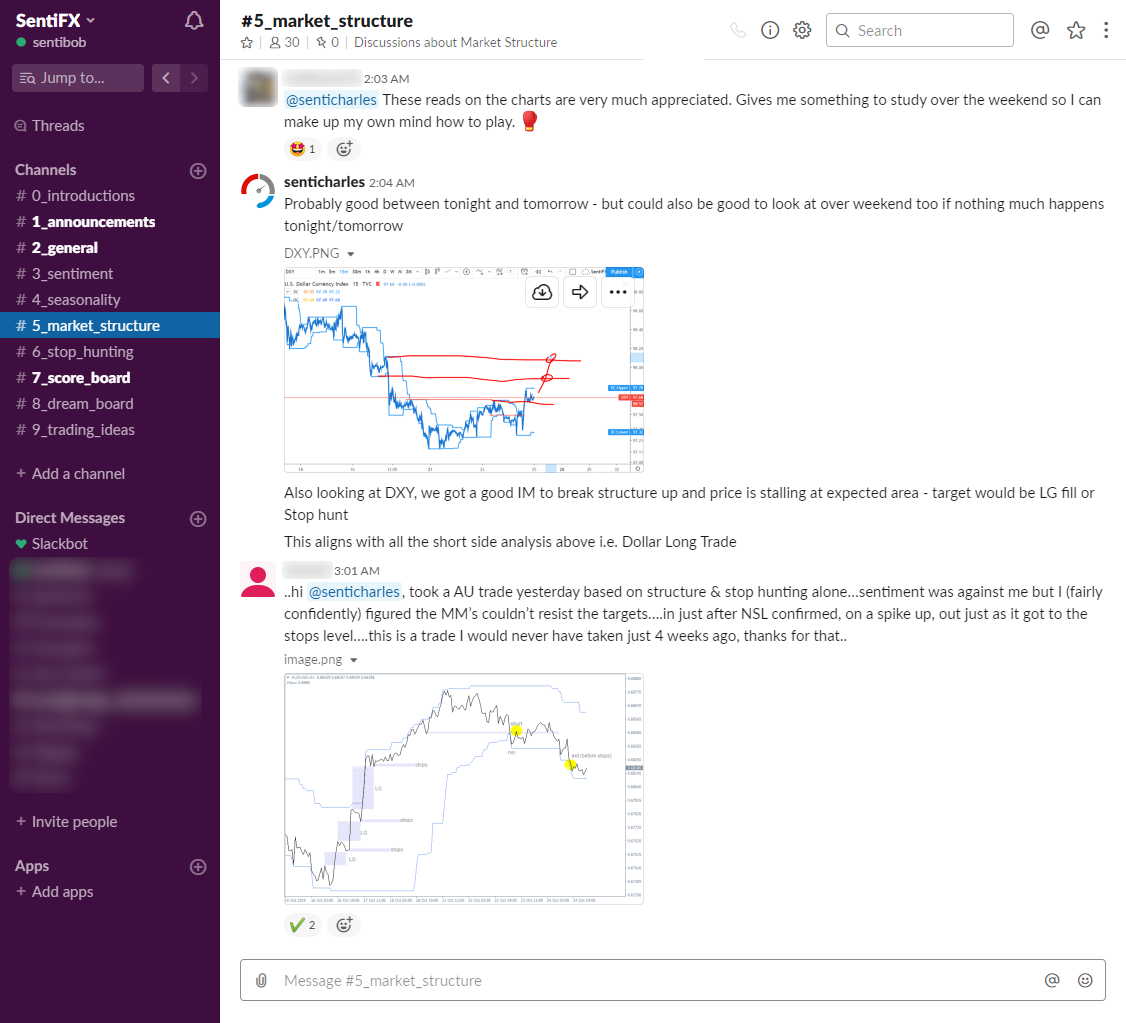

The Strongest Edge in Spot FX is when you combine Sentiment with Market Structure. The Market Cycle is the overall pattern of Market Structure and you'll learn how retail Sentiment positioning fits within that cycle to maximize your trading edge.

Now you can ensure that the probabilities are in favor for your trades.

Learn Sentiment Analysis

+ Market Cycle

The Strongest Edge in Spot FX is when you combine Sentiment with Market Structure.

Market Cycle Down and Retail Sentiment Positioning

The Market Cycle is the overall pattern of Market Structure and you'll learn how retail Sentiment positioning fits within that cycle to maximize your trading edge.

Now you can ensure that the probabilities are in favor for your trades.

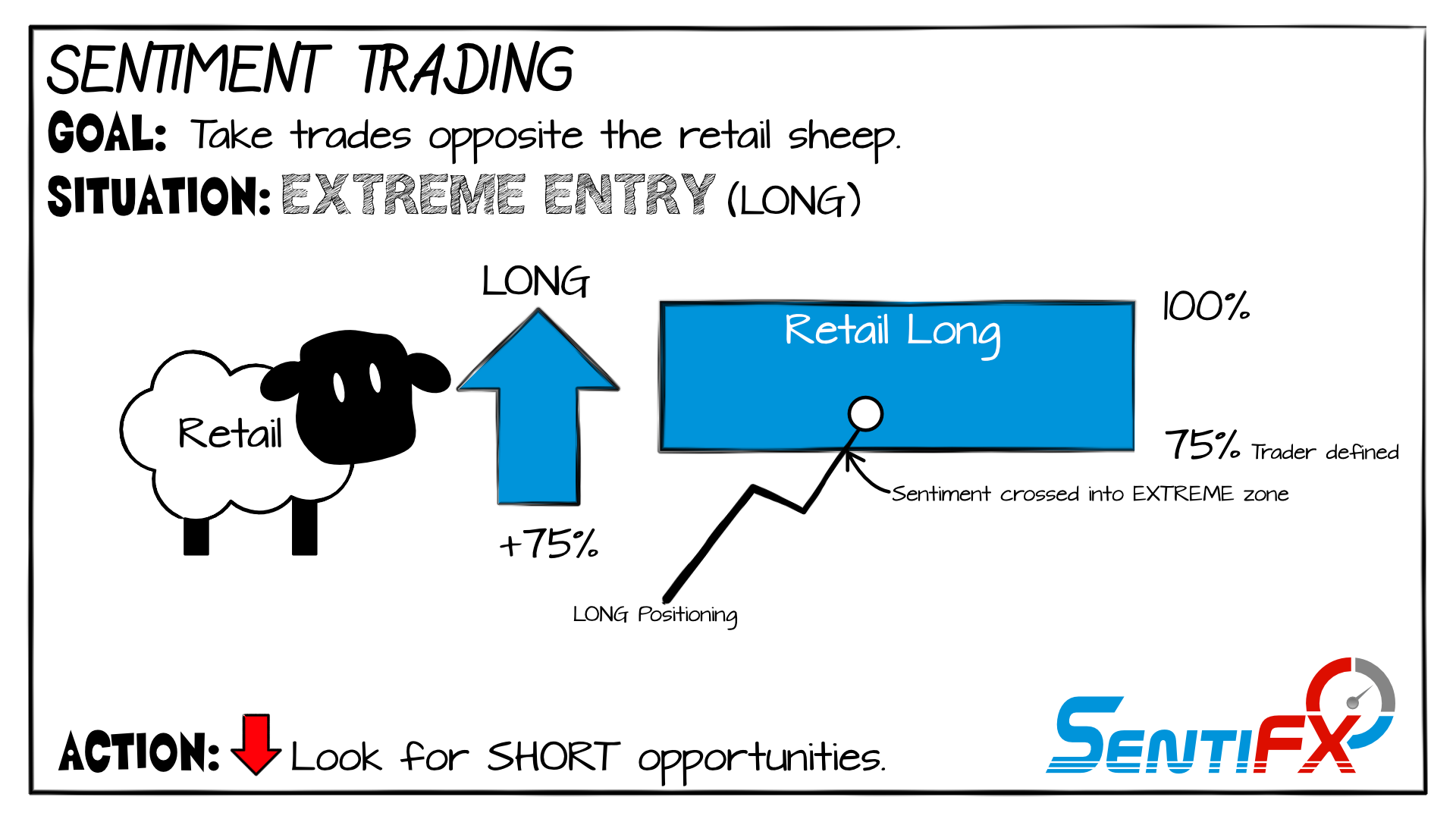

Catch Tops and Bottoms

Catch Tops and Bottoms

Learn How to Spot the earliest signs of a move shift as well as be ready for the risk of reversal when trading against the herd.

Market Makers take this opportunity to run price the opposite the new herd direction and the retail sheep start piling in on the wrong side of the trade again and again.

Learn How to Spot the earliest signs of a move shift as well as be ready for the risk of reversal when trading against the herd.

Market Makers take this opportunity to run price the opposite the new herd direction and the retail sheep start piling in on the wrong side of the trade again and again.

Target the Biggest Edge in FX

By targeting Retail Trader Sentiment Extremes and Changes in Retail Sentiment, you have the highest probability of profiting from your trades.

Trading is a zero sum game. Meaning for every winner there has to be a loser. We know most retail lose over time so doesn't it make sense to always trade opposite?

It's time to join the winning side.

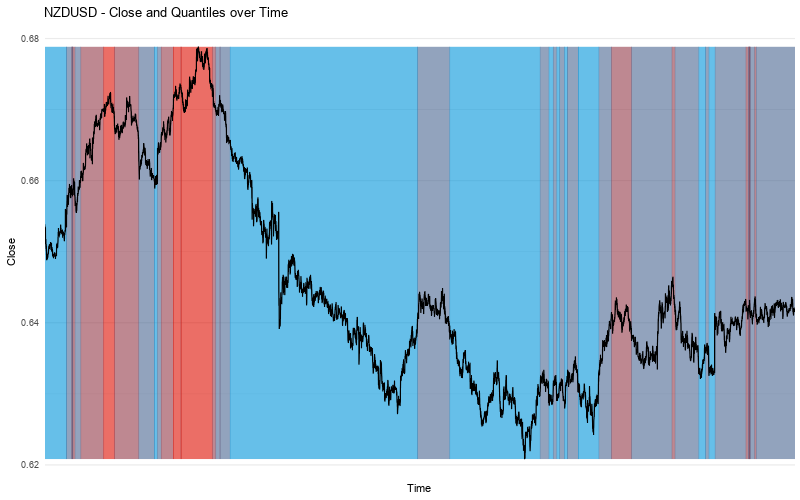

Proven Edge by Quantitative Analysis

We did a deep dive using quantitative analysis to see if Sentiment Trading had edge. The results were in line with what we expected.

The Results? Price moves opposite to the retail herd.

Look at the image to the right - it doesn't take a rocket scientist to see that when retail was Shorting (red background) price moved up and when retail was going Long (blue background) price moved down.

Proven Edge by Quantitative Analysis

We did a deep dive using quantitative analysis to see if Sentiment Trading had edge. The results were in line with what we expected.

The Results? Price moves opposite to the retail herd.

Quantitative Analysis done using the statistical analysis environment R

Look at the image above - it doesn't take a rocket scientist to see that when retail was Shorting (red background) price moved up and when retail was going Long (blue background) price moved down.

Who is Sentiment Trading for?

Traders who believe the Market is Manipulated and want to be on the side of the Market Manipulators.

Traders who know that most retail lose and want to take trades opposite of the retail herd.

Traders who want more confidence taking their trades and holding on longer for bigger profit.

BONUS ROADMAP:

As an added bonus, you'll get the Sentiment Trading Roadmap to help guide your Trading Decisions!

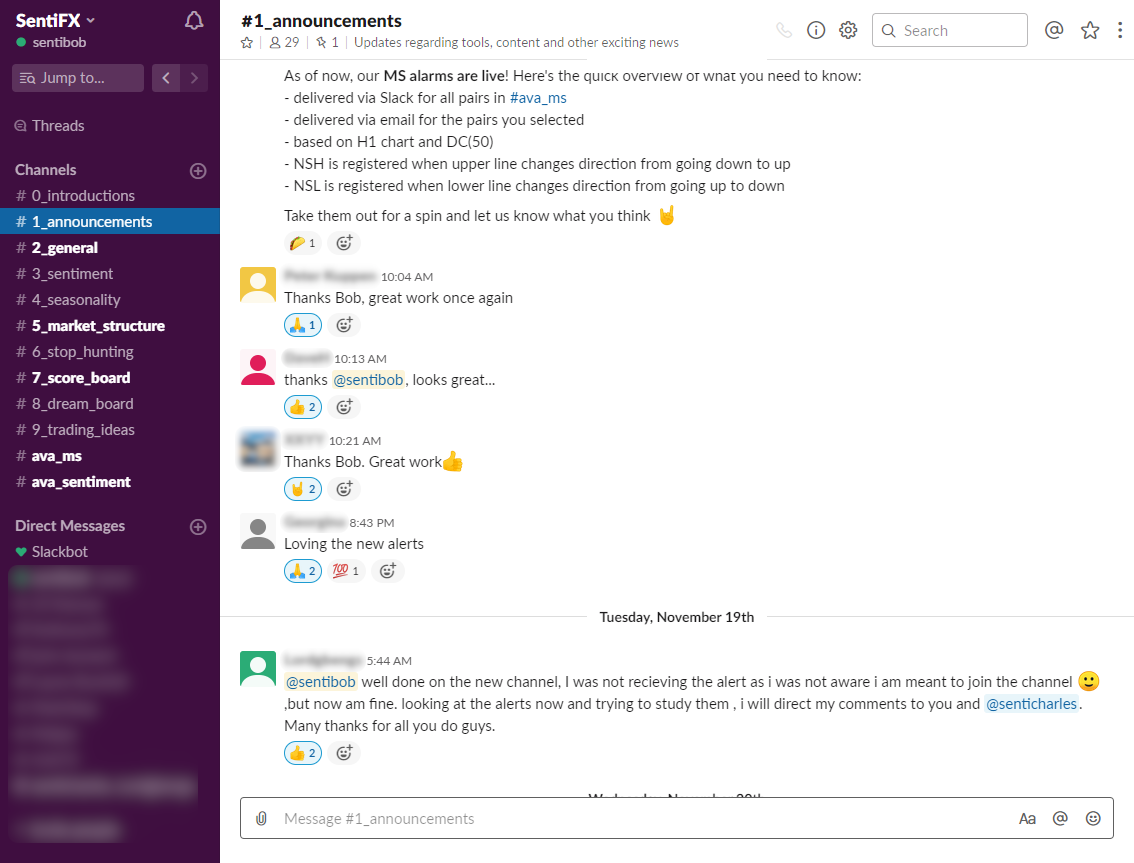

Access a Trading Community

You get more than the Powerful Sentiment Analysis Tools, Indicators, and Education.

You also get access to other Traders who

use the Edge of Sentiment every day on Slack.

Get the Sentiment Trading Quick Start

Sentiment Trading Quick Start

Lifetime Access

$127 $57

lifetime access - single installment